- myFICO® Forums

- Bouncing Back from Credit Problems

- Bankruptcy

- New Car Loan 10 months from BK7 Filing

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

New Car Loan 10 months from BK7 Filing

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Car Loan 10 months from BK7 Filing

I wanted to share this with everyone there is Life After BK.

FIled BK7 in Dec 2017 due to outrageous medical bills. I let my current vehicle go back because it just made the best sense due to mechanical problems that just seemed to keep coming. We had to get a new one so we bit the bullet and got a 2017 Equinox through Prestige on the day of our discharge in March 2018 we paid for it $25k loan @ 17.95% interest (579.45 for 72 months). We hated to do it but did it we needed it and chalked it up to the price for the BK and intended on refinancing after 1 year knowing we would have to put money down to get the LTV decent. We tried to work with the CU to finance a used car loan and roll the 5k I owed on the current car into it but they laughed at me. Fast forward 10 months and our scores have raised a lot faster than I would ever have imagined. I have 2 unsecured cards and 2 secured cards, 1 high interest personal loan. About 2 months ago I qualified for a refinance through Cap One at 13% but as an individual not jointly. I opted not to do that because I need my wife to gain credit wise from the loan. On October 28th I tried again and we both pre qualified for a refinance at 11.04%. We were happy then I went to CapOne Auto Navigator and we pre qualified for a loan.

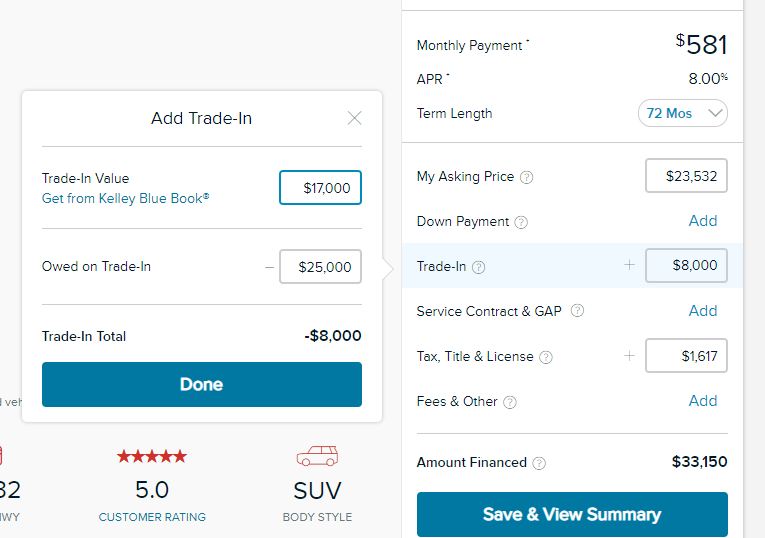

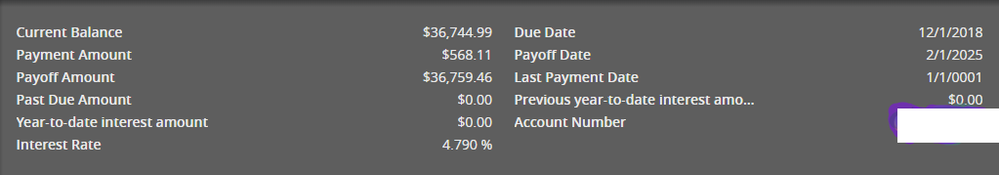

We did some research found a vehicle that we liked and would be able to roll in the negative equity from our current loan. Note that the original loan was for $25,251.12 and 7 months later the pay off was $24,623.37. We knew it was a bit too good to be true but we called the dealership Monday morning and they said they still had the vehicle. We took off of work thinking it would be a long lunch but 1/2 there we got a call saying that the SUV had already been sold. So mostly out of anger we detoured to another Chevy Dealership where we spent 5 hours dealing with multiple sales people. They first showed up vehicles way above our price range and then once we decided on one they wanted us to do in-house financing to the tune of $2500 down. I told them no that we have a pre qualification letter for 0 down @ 8 % then we battled over the trade in value of our 2017 they wanted to give us 14k, when the other dealership said 17k and a ford dealership said if we came down they would give us $16k sight unseen as long as it was in the condition we said, they even drew up a purchase order on a 2018 Edge. During this time both of our phones are going crazy from all the HP alerts being pulled, and the finance guy comes out and asks if we could put $600 down. I said that we could but we won't because we have the pre-qualify letter. He said great and took off for 1 hour. He comes back said I got you financed through a local CU at 4% but we need the $600 down. We went back to sign papers. I was in SHOCK. I was in disbelief I just knew there was a hitch. I asked him how he did it and he said before you got sick you had excellent credit and you shouldn't be punished for that. I was extremely skeptical. We signed the papers and drove home. I was excited but just knew that something was going to happen and we would get a phone call asking us to come back in. 4.79% 10 months after filing ....

Well as of 11/1/2018, the loan funded we were given access to the Amplify CU account and it's all true. God smiled down on us. We got a 2019 Chevy Equinox that had 4 miles on it when we took possession of it. The loan has funded, we were told the pay off check was being expedited and mailed off 11/2/2018 and they should have it Monday 11/5/2018. I am still in shock

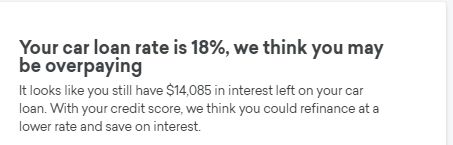

Before I would get these alerts all the time:

But yesterday we now have this:

WOW, I never expected this within the first year of filing!

Our monthly payment is lower, and we have a brand new 2019 Equinox LT LT2!

Don't Give Up Hope There Is Light At The End Of The Tunnel!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New Car Loan 10 months from BK7 Filing

Congrats!!!!!!!!!!!!!!!!!!!!!!!!!!!!! Calls for a Code 3 responce!!!!!!!!! Enjoy the new ride!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New Car Loan 10 months from BK7 Filing

@FireMedic1 wrote:Congrats!!!!!!!!!!!!!!!!!!!!!!!!!!!!! Calls for a Code 3 responce!!!!!!!!! Enjoy the new ride!

Thanks! Christmas came early! And Thank you for your service! My dad was a paramedic and retired as a Fire Chief.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New Car Loan 10 months from BK7 Filing

Congrats. I like the new equinox!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New Car Loan 10 months from BK7 Filing

Major congrats !

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New Car Loan 10 months from BK7 Filing

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content