- myFICO® Forums

- Bouncing Back from Credit Problems

- Bankruptcy

- Rebuilding after Ch. 7

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Rebuilding after Ch. 7

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rebuilding after Ch. 7

I'm beginning the process of rebuilding post-ch7, and am going to do my best to document my path and progress here. My BK was discharged a little over 2 weeks ago. I've been doing a lot of reading over the last couple of weeks (or months, I suppose), and used Soulmaster's 24 months to 700 blueprint as the basis for my plans moving forward.

I pulled all 3 reports this morning to make sure that everything is reporting correctly. My FICO 8 scores were EX: 551, EQ: 589, TU: 528. I'm planning to go through all 3 reports with a fine-tooth comb in the coming days and make sure there aren't any errors, but for now it looks like everything is reporting correctly.

I opened NFCU savings/checking yesterday and plan to open an nRewards Secured CC, as well as an SSL soon. I also plan to open a Discover IT Secured.

As I read the forums trying to figure out what my best option for a 3rd card would be, I found several people posting that Cap1 was prequalifying and approving unsecured Platinum and QS1 cards. I didn't have any plans to apply for unsecured credit but I figured I would check the pre-qualification page and go from there. As it turned out, Cap1 showed that I was pre-qualified for the Platinum, QS1, and their secured card. Having read that it's best to go with the Platinum card (because it's easier to product change down the road), I decided to pull the trigger and was pleasantly surprised that they approved me on the spot for a Platinum card with a $1000 SL. For reference, I did not burn Cap1 in my BK.

Things seem to be off to a good start. I'm excited about my plan to rebuild, and looking forward to this journey. I'll do my best to post updates here, and please feel free to ask questions if there's anything I can clarify or help with along the way.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding after Ch. 7

Congratulations on your approval! Give it 3 or so months after having the card then check for upgrade to QuickSilver. Do not select the QuickSilver One with the annual fee. You picked the correct card for the upgrade. Capital One check for upgrade link

Once in with NFCU and obtaining the nRewards, you may be eligible to graduate to unsecured around ~7 months. For your reading pleasure. Navy Federal Thread for CLI and Additional Cards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding after Ch. 7

@AllZero wrote:Congratulations on your approval! Give it 3 or so months after having the card then check for upgrade to QuickSilver. Do not select the QuickSilver One with the annual fee. You picked the correct card for the upgrade. Capital One check for upgrade link

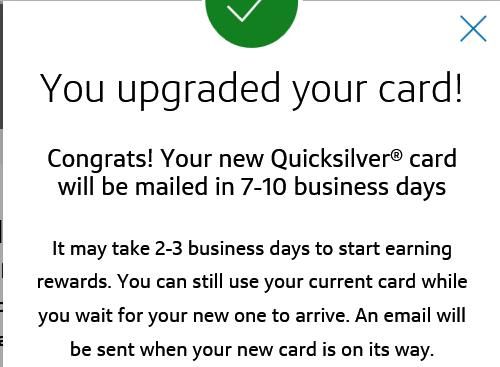

Thanks @AllZero - Link worked like a charm and upgraded my 3 month old Platinum PC that was offered to the Quicksilver No AF.

Also requested CLI and accepted $100 making it $1100 now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding after Ch. 7

@CreditMagic7. Congratulations on your CLI and product upgrade!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding after Ch. 7

@AllZero is one of many on here we all should bow down to. You know your stuff! Keep it up!

Closed - PenFed $35,000 - Cap1 World Elite MC $11,200

Total CL - $115500

CH7 BK Filed 8/1/17 Discharged 11/7/17

Scores as of 2/18/21:

Inquiries Last 12 Months:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding after Ch. 7

@DebtStinks. Thank you. I was very ignorant to all of this before finding myFICO forums. Just trying to share the wealth of knowledge that I learned here.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding after Ch. 7

@AllZero wrote:@CreditMagic7. Congratulations on your CLI and product upgrade!

Thanks @AllZero and like others i highly commend your diligence and attention to details from your generous advice. Your aware of that but deserves repeating.

These are uncharted and very new waters for this member. First ever BK and a blow to what was for 10 years a strong profile with above average lines suddenly swept away in entirety with the exception a single account that survived at $15K. A Credit Union.

I am still in process of DISPUTE with the big 3 in ensuring 0 Bal and <included in bankruptcy> notations which will likely consume another month or so of just doing the work the Big 3 should already have accurately reported but is disregarded accurate reportings.

Question: Once those accounts in error are correctly amended to accurate reporting does that eliminate the derogs of "accounts not paying as agreed" and leaving the single PR Derog of BK alone? I have 100% perfect payment for 125 months straight before & after the BK DC.

Your knowlege of correct reportings reflecting after a BK is a important aspect for members to move ahead to a better rebuild and we are grateful for your help.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding after Ch. 7

@CreditMagic7 Thank you for the kind words. I greatly appreciate it.

I do recall reading of your great success in the past. I know you will be able to achieve greatness again. You have done well so far in a short amount of time.

While I may be able to offer some wisdom learned from these forums, I do not know it all. I wish I was able to answer all these questions, but have to defer it to more knowledgeable members. Perhaps, post a new message in this sub forum? Hopefully, more experienced members can give advice? I do not know how it is supposed to report.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding after Ch. 7

@CreditMagic7 Yes, it should eliminate the derog of "not paying as agreed" however, as you may already know, it will still be a derogatory account until the 7 year credit reporting SOL passes and/or the account is removed, etc. From my understanding, it's 7 years vs the 10-years even though your accounts never had late payments because once it's IIB, it's considered a derogatory account and therefore the 7 year rule applies.

Best of luck!

Closed - PenFed $35,000 - Cap1 World Elite MC $11,200

Total CL - $115500

CH7 BK Filed 8/1/17 Discharged 11/7/17

Scores as of 2/18/21:

Inquiries Last 12 Months:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding after Ch. 7

I am starting with the same items Discover secure, Capital one Platinum and NFCU soon ...after Chaper 7. Congrats on Capital one!!!