- myFICO® Forums

- Bouncing Back from Credit Problems

- Bankruptcy

- Re: What am I doing wrong? Post ch 7 bk

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

What am I doing wrong? Post ch 7 bk

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What am I doing wrong? Post ch 7 bk

In June 2016 I got an auto loan at 21%

I was pre-approved for a game stop cc and I accepted a 250 cl in Nov 2016.

Dec 2016 I got a 300 cl with Cap1

Jan 2017 I got a 300 cl with credit 1

May 2017 I accepted a pre-approval to refinance car at 11%

Jun 2017 I got a 300 cl with fingerhut, but don't use.

I use the cards and come close to paying off each month. I pay auto loan early and extra each month.

My credit score is 491. How do I improve it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What am I doing wrong? Post ch 7 bk

Is that a Fico score?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What am I doing wrong? Post ch 7 bk

Agree with above, is that a FICO? If not, what are your FICO scores? What else is on your reports, any other baddies? Do you have a ton of IIB accounts? You say you use your cards and almost pay them off, when are you making the payment? Are they reporting to the CRA's before your payment?

Sorry for all the questions we just need much more info to try and help. Welcome to myFICO ![]()

801 EQ FICO 06/2022

797 TU FICO 04/2022

793 EX FICO 04/2022

$30k NFCU Platinum | $30.7k NFCU cashRewards Sig | $15k NavChek | $7.1k Cap1 Quicksilver | $10k Amazon Store | $19k Cap1 VentureOne | $16k Barclay Aviator | $5k Chase Freedom | $5k Chase Sapphire Preferred | $9k Costco Visa | $20k AMEX BCE | AMEX Gold | NFCU Platinum #2 $19.3k | Apple $8.5k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What am I doing wrong? Post ch 7 bk

Almost everything came off my report after my bk and there is 1 utility bill that wasn't even mine, that I included, and a couple low balance cards hung around.

I have student loans but those have always been in good standing ... 10 years worth of good standing.

The balances on my cc reporting are after payments. It always shows 150-180 between the cards is being used.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What am I doing wrong? Post ch 7 bk

@Anonymous wrote:

Idk fico. Tu and eq both 491.

Almost everything came off my report after my bk and there is 1 utility bill that wasn't even mine, that I included, and a couple low balance cards hung around.

I have student loans but those have always been in good standing ... 10 years worth of good standing.

The balances on my cc reporting are after payments. It always shows 150-180 between the cards is being used.

From my understanding this should help you (maybe, someone else should chime in).

If you have 3 cards do this.

Have two report 0% and have the other one report 9%. This is supposed to help your score.

Also your Chapter 7 is only a year old. That is still relatively new to your credit report. It will have less of an impact over the coming years as it gets closer to being dropped off.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What am I doing wrong? Post ch 7 bk

@Anonymous wrote:

Idk fico. Tu and eq both 491.

Almost everything came off my report after my bk and there is 1 utility bill that wasn't even mine, that I included, and a couple low balance cards hung around.

I have student loans but those have always been in good standing ... 10 years worth of good standing.

The balances on my cc reporting are after payments. It always shows 150-180 between the cards is being used.

Actually it looks like you are getting your information from Credit Karma. Is there where you obtained your scores? If so, those are not FICO scoresm those are Vantage scores. Vantage scores are nothing like FICO scores and it is probable that your actual FICO scores are higher. Do not use VANTAGE scores for your measure of improvements. I know my Credit Karma scores are at least 100 points lower than my FICO scores. Don't use them. It's depressing. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What am I doing wrong? Post ch 7 bk

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What am I doing wrong? Post ch 7 bk

@Anonymous wrote:

I went ahead and spent $20 for my fico score. It's 587. Wow. Much better. Not as depressing.

^^^ Yes! Much better place to start.

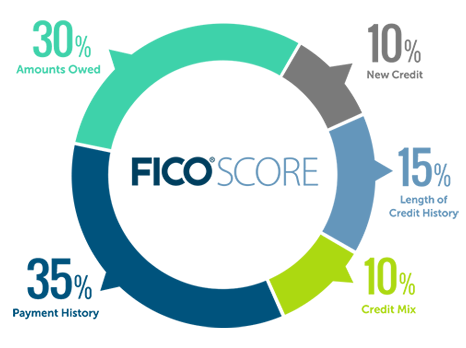

Look at the Rebuilding Your Credit subforum for tips on increasing your score. One of the things that is very important is paying on time each and every month as that is 35% of your score. Plus, another 30% of your score is the utilization of your revovlving credit. Ideally you want to be using less than 9% of one of your credit limits and have the other cards at zero. This will optimize your scores. Here is a graphic to give you an idea of the broad strokes for the score calculations:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What am I doing wrong? Post ch 7 bk

@StartingOver10 wrote:

@Anonymous wrote:

Idk fico. Tu and eq both 491.

Almost everything came off my report after my bk and there is 1 utility bill that wasn't even mine, that I included, and a couple low balance cards hung around.

I have student loans but those have always been in good standing ... 10 years worth of good standing.

The balances on my cc reporting are after payments. It always shows 150-180 between the cards is being used.Actually it looks like you are getting your information from Credit Karma. Is there where you obtained your scores? If so, those are not FICO scoresm those are Vantage scores. Vantage scores are nothing like FICO scores and it is probable that your actual FICO scores are higher. Do not use VANTAGE scores for your measure of improvements. I know my Credit Karma scores are at least 100 points lower than my FICO scores. Don't use them. It's depressing.

Odd, my Vantage Scores are always higher than my FICO scores.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What am I doing wrong? Post ch 7 bk

@Anonymous wrote:

@StartingOver10 wrote:

@Anonymous wrote:

Idk fico. Tu and eq both 491.

Almost everything came off my report after my bk and there is 1 utility bill that wasn't even mine, that I included, and a couple low balance cards hung around.

I have student loans but those have always been in good standing ... 10 years worth of good standing.

The balances on my cc reporting are after payments. It always shows 150-180 between the cards is being used.Actually it looks like you are getting your information from Credit Karma. Is there where you obtained your scores? If so, those are not FICO scoresm those are Vantage scores. Vantage scores are nothing like FICO scores and it is probable that your actual FICO scores are higher. Do not use VANTAGE scores for your measure of improvements. I know my Credit Karma scores are at least 100 points lower than my FICO scores. Don't use them. It's depressing.

Odd, my Vantage Scores are always higher than my FICO scores.

My vantage scores are always lower as well. We will never know ![]()

801 EQ FICO 06/2022

797 TU FICO 04/2022

793 EX FICO 04/2022

$30k NFCU Platinum | $30.7k NFCU cashRewards Sig | $15k NavChek | $7.1k Cap1 Quicksilver | $10k Amazon Store | $19k Cap1 VentureOne | $16k Barclay Aviator | $5k Chase Freedom | $5k Chase Sapphire Preferred | $9k Costco Visa | $20k AMEX BCE | AMEX Gold | NFCU Platinum #2 $19.3k | Apple $8.5k