- myFICO® Forums

- Bouncing Back from Credit Problems

- Bankruptcy

- Re: Worst Case Scenario

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Worst Case Scenario

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Worst Case Scenario

When they set the payment..as "disposable income" do they actually leave you enough to live on.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Worst Case Scenario

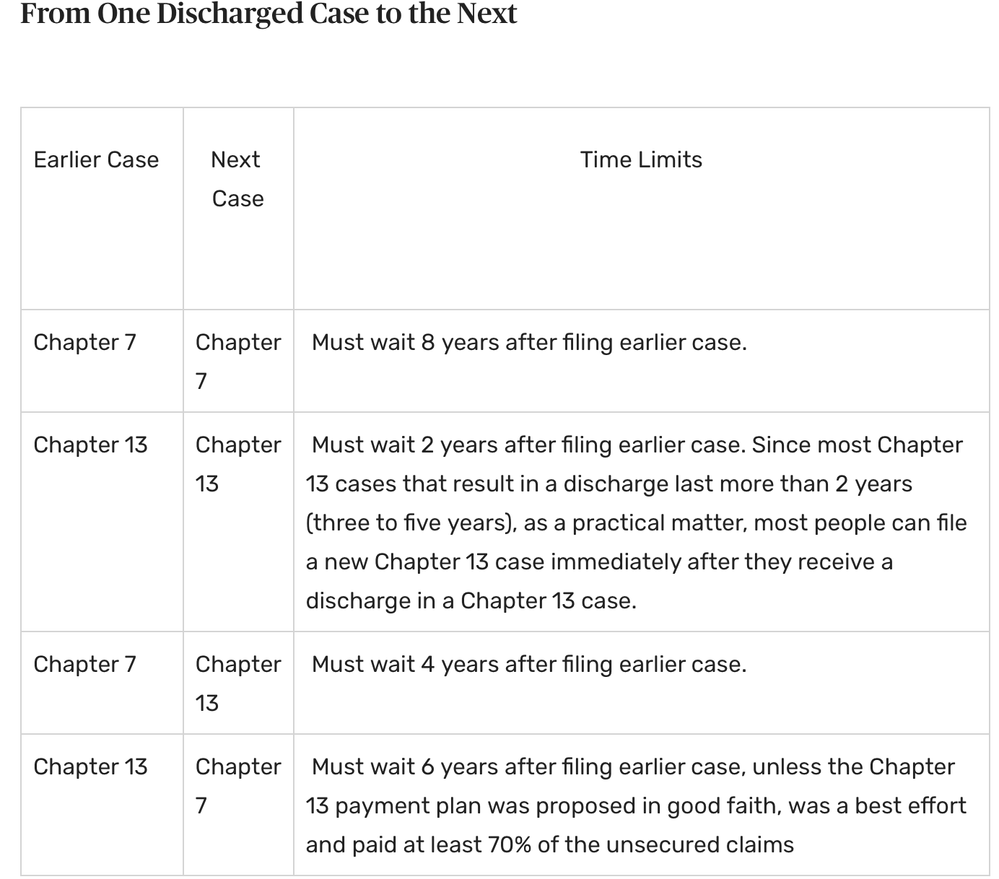

@FireMedic1 is correct. Here's a table that will help. As of right now, your only option is file a BK13, 100% payback. You cant file another BK7 for another 4years from your file date since you're only 4 years out currently (8 yrs total).

Keep in mind that your credit reports will show 2 BK's...... a discharged BK7, AND an in progress BK13. The BK 13 will not show discharged until your debts have been satified, and your case "discharged" by the trustee. You will also at this point not get any credit, and you will have to get any credit or loans approved by the trustee FIRST before you can obtain them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Worst Case Scenario

100% payback on the collateral debts and unsecured. Or just on the collateral debts?

on 100% will that knock out any interest? I guess also during the chapter 13 I could sell off the bikes once the principal reached low enough.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Worst Case Scenario

So I talked to a lawyer finally in person here in the state of Florida.

His advice...give up the bikes. When they sell them if they charge me the difference betwen principle and selling price then add that to the non collateral debt.

Keep my truck and pay the payments as normal and then pay 300-500 a month on the un-secured debts doing 100%payback.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Worst Case Scenario

@Superk88 wrote:So I talked to a lawyer finally in person here in the state of Florida.

His advice...give up the bikes. When they sell them if they charge me the difference betwen principle and selling price then add that to the non collateral debt.

Keep my truck and pay the payments as normal and then pay 300-500 a month on the un-secured debts doing 100%payback.

Your on your way. Congrats!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Worst Case Scenario

@FireMedic1 wrote:

@Superk88 wrote:So I talked to a lawyer finally in person here in the state of Florida.

His advice...give up the bikes. When they sell them if they charge me the difference betwen principle and selling price then add that to the non collateral debt.

Keep my truck and pay the payments as normal and then pay 300-500 a month on the un-secured debts doing 100%payback.

Your on your way. Congrats!

Thanks! I think I am gonna have to go ahead and bight the bullet..I'll actually be able to put away savings, and afford groceries again. I know it's gonna suck being held accountable by a trustee but that's prolly exactly what I need. I've looked at doing everything on my own, but idk if it is pure possible. I would need to work 7 days a week and sell the bikes which may or may not happen.

The biggest thing Is how much more stress do I wanna put on our relationship. At least if I am in Chapter 13 we can move forward with our lives...even waiting about getting married and in a few years we will be ready to buy a house.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Worst Case Scenario

@Superk88 wrote:

@FireMedic1 wrote:

@Superk88 wrote:So I talked to a lawyer finally in person here in the state of Florida.

His advice...give up the bikes. When they sell them if they charge me the difference betwen principle and selling price then add that to the non collateral debt.

Keep my truck and pay the payments as normal and then pay 300-500 a month on the un-secured debts doing 100%payback.

Your on your way. Congrats!

Thanks! I think I am gonna have to go ahead and bight the bullet..I'll actually be able to put away savings, and afford groceries again. I know it's gonna suck being held accountable by a trustee but that's prolly exactly what I need. I've looked at doing everything on my own, but idk if it is pure possible. I would need to work 7 days a week and sell the bikes which may or may not happen.

The biggest thing Is how much more stress do I wanna put on our relationship. At least if I am in Chapter 13 we can move forward with our lives...even waiting about getting married and in a few years we will be ready to buy a house.

In the short term it may suck. Long term down the road you will be rewarded and feel great that you fought hard and accomplished a goal. Bikes and so forth are material things. Yes we like them. But the money that you'll have afterwards to do things like a real dinner date and start saving $ will make your relationship even better. No more stress, and how are we going to pay for it. The biggest percentage from a divorce/break-ups is $$$$$$. Thats going to be a thing of the pass soon. So here's to your rebuild on your relationship, credit, and better times ahead. Good Luck!!!!!!!!!