- myFICO® Forums

- Types of Credit

- Business Credit

- Re: Amex Business Gold Rewards Approved

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Amex Business Gold Rewards Approved

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amex Business Gold Rewards Approved

Ok, well that's 2 cards in 1 week.

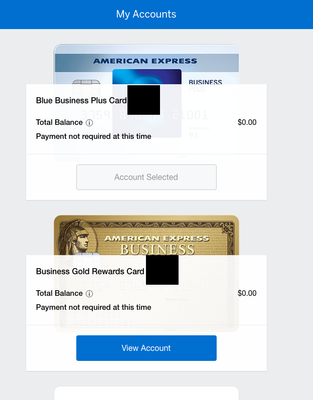

Blue Preferred with $2K limit.

So they approved me and although I didn't need to call in, I did because I didn't notice a credit limit on this card. When I asked her the limit, she said "their is no credit limit on the card, but that does not mean unlimited spending."

Someone mind telling me what the heck this means?

Should I go after a 3rd card with them and if so what do you suggest, or relax for a few payments?

My other questions would be, with a business card do the same rules apply with the 29% utilization per card and 9% overall?

I asked this because they say I can get 50K rewards points if I spend $5K in 3 months.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Business Gold Rewards Approved

@Anonymous wrote:Ok, well that's 2 cards in 1 week.

Blue Preferred with $2K limit.

So they approved me and although I didn't need to call in, I did because I didn't notice a credit limit on this card. When I asked her the limit, she said "their is no credit limit on the card, but that does not mean unlimited spending."

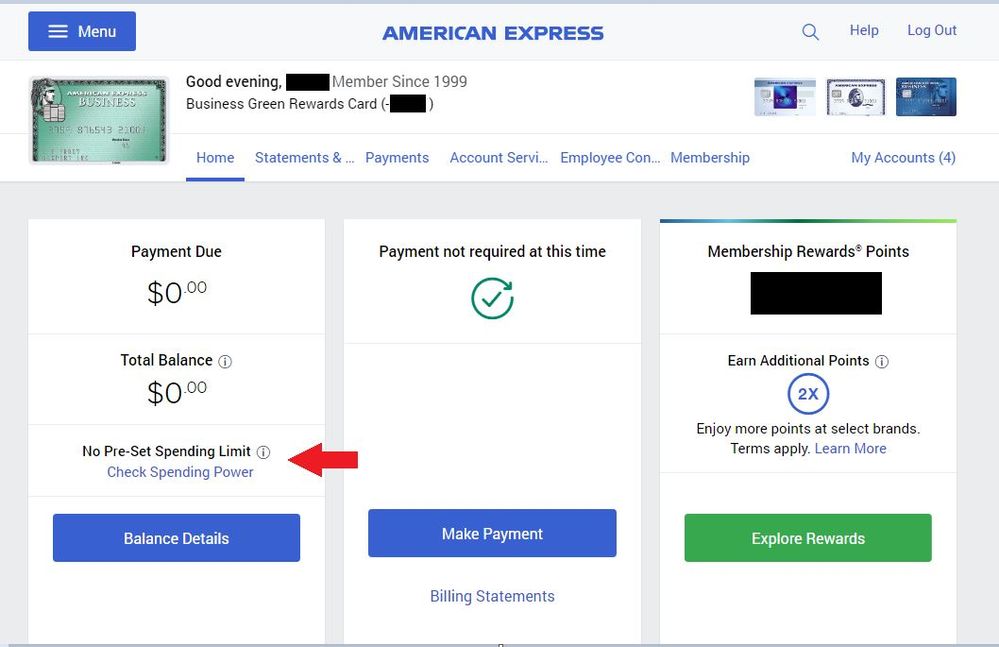

Someone mind telling me what the heck this means? It means that this is a charge card, not a credit card. All charges made with this card must be paid in full by the due date. With charge cards, the lender will determine how much they are willing to let you spend. Amex allows you to check your spending ability on the card through online account management. This amount can increase or decrease throughout the year based on assets, income and spending/payment activity. In the future you may be able to add Pay Over Time (POT) to the account. POT automatically transfers all purchases of $100 or more into POT that allows you to revolve the charges albeit at a very high APR.

Should I go after a 3rd card with them and if so what do you suggest, or relax for a few payments? Up to you. I think three cards in a short amount of time from the same lender can lead to greater scrutiny and can risk your accounts. Having said that, I have not heard of people here going after three Amex's in a short amount of time or any adverse action for doing so. If your "business" truly needs additional credit, it may be best to try another lender like Chase, Citibank or Bank of America.

My other questions would be, with a business card do the same rules apply with the 29% utilization per card and 9% overall? Amex business cards do not report to your personal credit report; therefore, its utilization will not affect your personal credit report. I cannot confirm that the Amex Open cards report to any business credit bureaus and if so, what those rules are for utilization for an optimal credit score. If your "business" does not need additional serious credit, then it doesn't matter. If your business cards become delinquent they will likely be added to your personal credit report.

I asked this because they say I can get 50K rewards points if I spend $5K in 3 months. Just remember that with Amex cards, including business cards, they are one sign up bonus per lifetime. So choose to apply for the cards wisely and look for the best sign up bonuses.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Business Gold Rewards Approved

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Business Gold Rewards Approved

@Anonymous wrote:

i gave my newphew my macbook pro for graduation amd im giving my son my iphone x next week for his birthday, so i will need a new macbook and new iphone. If i use the Amex Gold, will it possibly get denied? Should be about $3,200

When you get your Business Gold and register it for online/mobile account management, you will see the "Check Spending Power" link under the "No Pre-Set Spending Limit" section on the home page. Click that link, enter how much you anticipate spending and they will let you know if that transction may be approved:

Remember that this is a guideline and not a complete guarantee that the transaction(s) will be approved. Purchasing electronics right away with a new account is a huge red flag to most creditors-especially if you live in Southern California. In addition to checking your spending power, it may be a good idea to let Amex know that you will be buying items for your "business" at the Apple Store so that they know it isn't fraudulent purchases. And a reminder, these charges will be due in full when you receive your statement.