- myFICO® Forums

- Types of Credit

- Business Credit

- Re: Capital One - Denial Reasons?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Capital One Spark 2% Business Denial

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital One Spark 2% Business Denial

16 months ago and I burnt 3 Capital One cards (2 business and 1 personal) in my Ch7 discharge.

Fast forward to now, Received a Capital One QS Reward card approval 2 days ago with $10K SL. On their website, it states that this QS card requires "excellent" credit. Was super surprised that I got an approval. I also have a credit freeze on all 3 of my credit bureaus. I lifted my Experian freeze temporarily when I applied for this Capital One QS Rewards card.

I figured well since Capital One let me back in with them again on the personal side, then why not try and push my luck to apply for a business credit card, specifically the Spark 2% Cash (another "excellent" credit required), for my business. Applied tonight and was immediately denied. Not really surprised BUT I read on here that for a business credit card application with Capital One, they triple pull or sometimes double pulls on credit bureaus. Do you think my application maybe was denied due to my credit freeze on the other two bureaus? I'm wondering about that now? Cap One said that I'll receive a letter explaining why my application was denied so I'll know for sure then.

I was able to earn an approval on an "excellent" credit profile required personal card just two days ago, that is making me believe that I was denied not for poor credit or a Ch7 on my report, but due to Cap One can't access my file with Equifax or TransUnion.🤷🏻♂️

Plausable?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Spark 2% Business Denial

It's more than plausible that the denial had at least something to do with no access to your TU and EQ reports. As you've stated, CapOne is well known for a triple pull for all of their cards.

Submitting a CapOne app with only your EX report accessible is a recipe for a wasted HP and a guaranteed denial. Oh, and CapOne doesn't recon a denial, so it's not like you can just unfreeze the other two and have them run it again; you'd have to submit a new app all over again. There is no CapOne card worth 4 HPs to me....

Sorry.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Spark 2% Business Denial

I was afraid of that 🤦🏻♂️

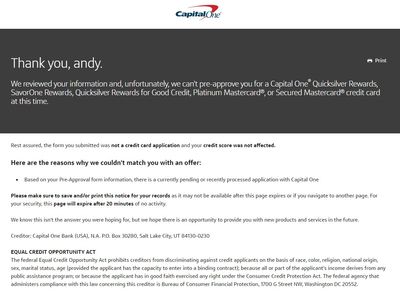

But then....this morning I used their Pre-Approval function and received a denial with an explanation that the reason for not product available to me is because I have an recent application pending or processing already. So maybe my business Spark credit card application was denied due to I have a recent application processing (just 3 days ago I was approved on a personal card)? Wither my business credit card application was denied due to too soon of another application or I forgot to unlock my Equifax and TU, I wasted of a HP on my Experian.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital One - Denial Reasons?

Here's why I'm asking. I was denied for a Capital One business card last night and am trying to figure out why? Was I denied due to:

- Applied too soon

- Capital One can't access my credit files with TU and EQX

- I had a Ch7 DC 16 months ago

To support that my Spark business application was denied because of reason 1) above:

I was approved for a QS with Capital One 3 days ago on the personal side. I like to get a Capital One business card (Spark 2% Cash) with them as well. I did a "tester run" today and for any further preapprovals and received a denial stating "too soon" (see photo).

To support that my Spark business application was denied because of reason 2) above:

Also, is it true that with Capital One for personal applications, they use Experian only (1 credit HP) for determination, but with business applications, they use at least two or all 3 credit bureaus (3 HPs)? I have a security freeze on all 3 of my credit bureaus. (Mod cut) I applied with Capital One for the personal QS 3 days ago and was approved. Last night (2 days later from my QS approval), (Mod cut) and since I had an approval with Capital One on the personal side, I decided to apply for a business card. I received a denial immediately. After that, I read on here that Capital One used all 3 bureaus for their business applications.

Questions with Capital One:

- does anyone know how long must I wait between applications to apply for another new card when I was approved for one 3 days ago?

- does anyone know for fact that Capital One use all 3 bureaus (3 HPs) at one time when applying for their business cards?

Thanks in advance!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One - Denial Reasons?

@ToofDoc wrote:

Also, is it true that with Capital One for personal applications, they use Experian only (1 credit HP) for determination

I'm really surprised you were approved for the QS. It's always been 3 hp's for any of their credit cards (personal or biz) as far as I've known.

Call Cap1 and speak with the New Accts. Biz dept. to see if all you need to do is unlock/unfreeze all 3 cb's.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One - Denial Reasons?

@GApeachy wrote:I'm really surprised you were approved for the QS off of one hp. It's always been 3 hp's for any of their credit cards (personal or biz) as far as I've known.

Call Cap1 and speak with the New Accts. Biz dept. to see if all you need to do is unlock/unfreeze all 3 cb's.

To be honest...I was really shocked when Cap One approved me in the first place with only 16 months after Ch7 DC!

I did call them this AM already, but what do you know, not opened until 9 AM EST.

I plan to call them again to find out why I was denied last night. Maybe it's too soon for another application? I really don't know.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One - Denial Reasons?

@ToofDoc yeah, I mean it could be too soon plus having the bureaus frozen....I'd just double check. You may luck out again. Hey, worth a try, right? GL!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One - Denial Reasons?

6 months between cards. You also got lucky with that approval. Some people have been able to squeak by, but normally all 3 have to be thawed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One - Denial Reasons?

Just talked to the business customer service, waste of time.

She couldn't see the reason for denial and told me to wait for the letter in the mail 7-10 business days to see why. 🤦🏻♂️

She did say waiting 6 months between applications "May be" the reason but she can not confirm or deny. So Brian, you may be right.

I know for fact that I was lucky to get my QS Reward card approved (Mod cut - these types of CRA discussions are not permitted per the myFICO TOS @ToofDoc) with my Ch7 DC only 16 months out. 🤷🏻♂️

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One - Denial Reasons?

Congrats on your CapOne QS approval . . . on the denial -and- reapplication, I would certainly wait at least 3 to 6 months.

Current FICO 8 Score in 06/2021: EQ-796, TU-806, EX-812

Goal FICO 8 Score in 06/2022: EQ-825, TU-850, EX-850