- myFICO® Forums

- Types of Credit

- Business Credit

- Chase Ink Business Cash Approval

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Chase Ink Business Cash Approval

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Chase Ink Business Cash Approval

On 11/8/22 I dropped down to 4/24 status. It has been my plan to apply for a Chase Ink Cash card upon reaching 4/24. Recently I learned that when you drop below 5/24 it is strongly recommended you wait until the next month to apply to make sure Chase sees this updated info when you apply.

So I was set to wait until next month to apply until an emergency home repair came up. The estimated price for the repair is $4500. A light bulb went off, man that's almost all of the $6000 spend goal for the Chase Ink Cash.

So now I'm wondering if there's anyone that's been approved for a Chase card in the same month they dropped below 5/24? It's been 9 days since I've become 4/24. Trying to make lemonade out of lemons with this unexpected expense, it would be so cool if I could use this big expense as a way to meet the welcome offer spend goal.

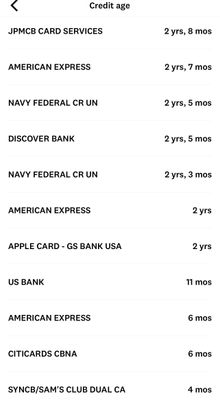

I'm currently: 1/6, 4/12, 4/24. Experian 828, Transunion 770 and Equifax 741. Utilization less than 1%. No recent denials or applications. Only applications have been the cards I was also approved for shown on my screenshot below.

![Capital One Quicksilver | $4000 | July 2013 [AU]](https://ecm.capitalone.com/WCM/card/products/quicksilver-card-art.png)

![Capital One Venture X | $40,000 | September 2023 [AU]](https://ecm.capitalone.com/WCM/card/products/venturex-cg-static-card-1000x630-2.png)

![Chase Amazon Prime | $12,000 | March 2020 [AU]](https://creditcards.chase.com/K-Marketplace/images/cardart/prime_visa.png)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase 5/24 Question Regarding An Emergency Situation

The reason people have said to wait the following month when getting under 5/24 is because Chase is one of those lenders that count the month you applied and for were approved for an account not the exact date itself. If I'm assuming correctly you opened the Apple & AMEX cards November 2020, so to Chase technically you're still 6/24 because to them that's when the cards were open

You can attempt to apply and see if maybe you slip by or in the event of a denial because of your 5/24 status try to recon with them. Seeing as how you're already a cardholder with Chase I'd see about any green/black checkmarks on pre-approvals for better chances

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase 5/24 Question Regarding An Emergency Situation

@simplynoir wrote:The reason people have said to wait the following month when getting under 5/24 is because Chase is one of those lenders that count the month you applied and for were approved for an account not the exact date itself. If I'm assuming correctly you opened the Apple & AMEX cards November 2020, so to Chase technically you're still 6/24 because to them that's when the cards were open

You can attempt to apply and see if maybe you slip by or in the event of a denial because of your 5/24 status try to recon with them. Seeing as how you're already a cardholder with Chase I'd see about any green/black checkmarks on pre-approvals for better chances

@simplynoir THANK YOU soooooo much for this great feedback! Both the perspective you shared and the link you shared have been very beneficial! I think armed with this info I will just wait until December to err on the side of caution. I've been over 5/24 since March 2020 so what's another few weeks?

I think based on the criteria you mentioned of going by the month I was approved for each card, I am in Chase's eyes 6/24. I unfortunately never get any black star or green star offers for credit cards, likely because I'm always over 5/24. Hopefully going forward this changes. It would nice to receive some of those offers. Thank you again for taking the time to share all of this helpful info with me!

![Capital One Quicksilver | $4000 | July 2013 [AU]](https://ecm.capitalone.com/WCM/card/products/quicksilver-card-art.png)

![Capital One Venture X | $40,000 | September 2023 [AU]](https://ecm.capitalone.com/WCM/card/products/venturex-cg-static-card-1000x630-2.png)

![Chase Amazon Prime | $12,000 | March 2020 [AU]](https://creditcards.chase.com/K-Marketplace/images/cardart/prime_visa.png)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase 5/24 Question Regarding An Emergency Situation

@Jordan23ww wrote:On 11/8/22 I dropped down to 4/24 status. It has been my plan to apply for a Chase Ink Cash card upon reaching 4/24. Recently I learned that when you drop below 5/24 it is strongly recommended you wait until the next month to apply to make sure Chase sees this updated info when you apply.

So I was set to wait until next month to apply until an emergency home repair came up. The estimated price for the repair is $4500. A light bulb went off, man that's almost all of the $6000 spend goal for the Chase Ink Cash.

So now I'm wondering if there's anyone that's been approved for a Chase card in the same month they dropped below 5/24? It's been 9 days since I've become 4/24. Trying to make lemonade out of lemons with this unexpected expense, it would be so cool if I could use this big expense as a way to meet the welcome offer spend goal.

I'm currently: 1/6, 4/12, 4/24. Experian 828, Transunion 770 and Equifax 741. Utilization less than 1%. No recent denials or applications. Only applications have been the cards I was also approved for shown on my screenshot below.

Not a response to your question, but I don't recommend using a business card to pay for personal expenses.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase 5/24 Question Regarding An Emergency Situation

Has there been any update on this? I'm very curious about the result should you have applied?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase 5/24 Question Regarding An Emergency Situation

@Mamba22 wrote:Has there been any update on this? I'm very curious about the result should you have applied?

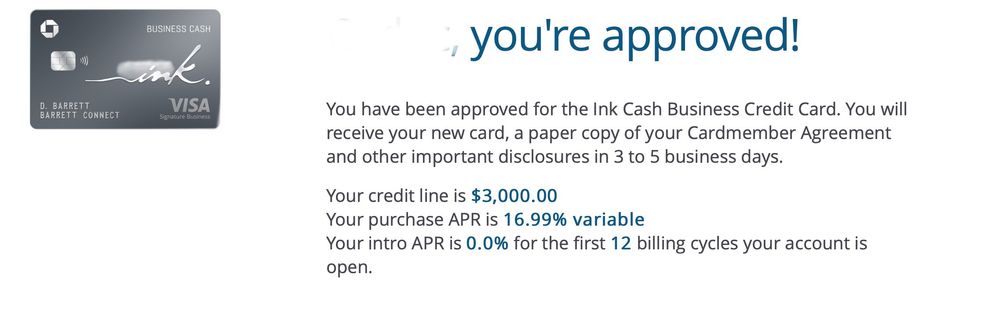

@Mamba22 It's funny you should ask. I was just logging on to come post about my approval. I decided to wait until today to apply even though I hit 4/24 status on earlier last month on 11/8/22. Ended up being worth the wait, I got instantly approved. I was dreading thoughts of having to go through the whole reconsideration process should that have happened, thankfully it did not.

![Capital One Quicksilver | $4000 | July 2013 [AU]](https://ecm.capitalone.com/WCM/card/products/quicksilver-card-art.png)

![Capital One Venture X | $40,000 | September 2023 [AU]](https://ecm.capitalone.com/WCM/card/products/venturex-cg-static-card-1000x630-2.png)

![Chase Amazon Prime | $12,000 | March 2020 [AU]](https://creditcards.chase.com/K-Marketplace/images/cardart/prime_visa.png)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Chase Ink Business Cash Approval

Today I was FINALLY approved for the Chase Ink Business Cash! It was an instant approval also thankfully! Been over 5/24 since 3/2/2020 so to finally be under 5/24 again, be eligible for Chase cards and remain 4/24 is a huge win!

-Hit 4/24 on 11/8/22 but waited until 12/1/22 to apply after being told Chase usually counts your 5/24 status at the time of application with whatever it was the beginning of the month that you end up applying.

-Pulled Fico 8's for: Experian 828 and Equifax 741

-Personal Cards Status: 1/6, 4/12, 4/24

-Chase Relationship: Chase Freedom 2 yrs 9 months, Authorized User on DW's Amazon Prime 2 yes 8 months. No other banking with Chase.

![Capital One Quicksilver | $4000 | July 2013 [AU]](https://ecm.capitalone.com/WCM/card/products/quicksilver-card-art.png)

![Capital One Venture X | $40,000 | September 2023 [AU]](https://ecm.capitalone.com/WCM/card/products/venturex-cg-static-card-1000x630-2.png)

![Chase Amazon Prime | $12,000 | March 2020 [AU]](https://creditcards.chase.com/K-Marketplace/images/cardart/prime_visa.png)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Ink Business Cash Approval

Congrats on your INK Approval!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Ink Business Cash Approval

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Ink Business Cash Approval

@Jordan23ww wrote:Today I was FINALLY approved for the Chase Ink Business Cash! It was an instant approval also thankfully! Been over 5/24 since 3/2/2020 so to finally be under 5/24 again, be eligible for Chase cards and remain 4/24 is a huge win!

-Hit 4/24 on 11/8/22 but waited until 12/1/22 to apply after being told Chase usually counts your 5/24 status at the time of application with whatever it was the beginning of the month that you end up applying.

-Pulled Fico 8's for: Experian 828 and Equifax 741-Personal Cards Status: 0/6, 4/12, 4/24

-Chase Relationship: Chase Freedom 2 yrs 9 months, Authorized User on DW's Amazon Prime 2 yes 8 months. No other banking with Chase.

Congratulations. That's the elusive card on my one-card wishlist.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687