- myFICO® Forums

- Types of Credit

- Business Credit

- Chase now requiring bank accounts before extending...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Chase now requiring bank accounts before extending business credit, for some customers.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Chase now requiring bank accounts before extending business credit, for some customers.

Hello,

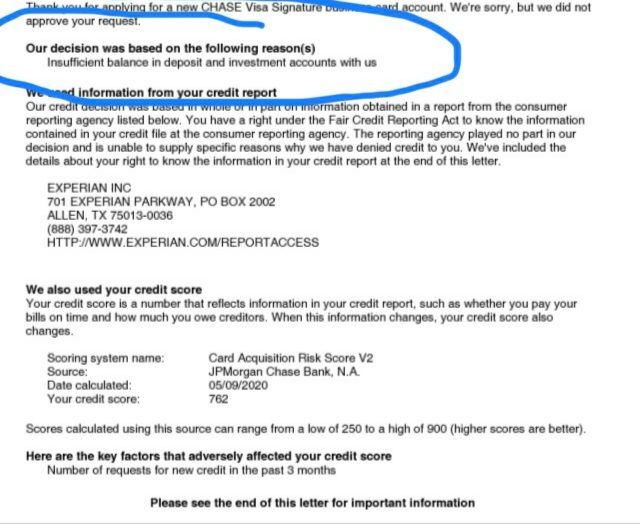

I suggested a Chase Ink Cash application to one of my friends who I felt ticked all the checkboxes as far as requirements. Surprisingly, his application was rejected with reasons "insufficient balance in deposit and investment accounts with us". He even asked to show bank statements from his own accounts but was told that they only "look at balances on accounts with Chase Bank". Outside of this requirement which doesn't appear to be published anywhere online, he wasn't rejected for any other reason. I presume that this is a Covid-19 measure. Does anyone have any experience in meeting Chase Ink requirements in this climate?

Also worthy of note, last check they were using the FICO 2 Bankcard score but they seam to have pulled the Card Aquisition Risk Score v2 instead, this time. Presumably this is a reproduction of the FICO 2 Bankcard score that allows Chase to sidestep paying fees to FICO. I wonder how long this has been in effect because they didn't pull that score when I applied in December, so this may be a money saving step post-Covid-19.

Regards,

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase now requiring bank accounts before extending business credit, for some customers.

I've seen one other instance of this in another thread. So this might me a new trend going forward so that they know exactly what's going in and out, so as to limit risk even more. Most Banks in general want all of your business, hence why they push other products once you open just one account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase now requiring bank accounts before extending business credit, for some customers.

@Anonymous wrote:I've seen one other instance of this in another thread. So this might me a new trend going forward so that they know exactly what's going in and out, so as to limit risk even more. Most Banks in general want all of your business, hence why they push other products once you open just one account.

For thise of us that don't want to transfer all out accounts to chase, they would rather have none of our business then some of it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase now requiring bank accounts before extending business credit, for some customers.

Chase has always been especially cautious about accepting new customers. This applicant actually alreardy had 2 personal cards though so they're kicking up their caution to another level.

It does seam less and less of a "worth it" option but their sign up bonuses are still generous, if you can get in.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase now requiring bank accounts before extending business credit, for some customers.

the applicants details don't show a particularly high score and it says high inqs. having balances on deposit is just another tactic to weed out the low hanging fruit that just want to bang the cards for the subs imo. I would guess they are not going to reverse on their requirements anytime soon and when the bks start flying later in the year I think they will shore up even further. chase values history and coming up short in that dept translates into them drilling further into ones details. shame as the inks are really great cards if they align with someone in the ur orbit. i am afraid this `phase' that we are in is going to get far worse before it gets better

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase now requiring bank accounts before extending business credit, for some customers.

Add to that that right now may not be the best time to be applying for excessive CL's, if any at all. While some of course are still going to have certain expenses even during this time, there are a lot of use that haev been affected. So getting a SUB right now might seem difficult with so much reduced spend. That's not even considereing the cautious appoach the Banks might be taking during a crisis.