- myFICO® Forums

- Types of Credit

- Business Credit

- Covid 19 PPP and Disaster Relief

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Covid 19 PPP and Disaster Relief

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Covid 19 PPP and Disaster Relief

@mikesonthemend wrote:I reached out to both of my business accounts. BB&T tactfully informed me my relationship with them was not long enough due to "know your customer" regulations. Synovus told me they should be ready to automate apps by Wednesday 4/8/2020 with the caveat that businesses with payrolls would be prioritized.

Time to look for a new bank or credit union.

Why give any business to an institution that doesn't want to serve it's customers ?

*************************************************************************************

Then you are a fool. Be thankful that when God gave you a face, he gave you a fool's face

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Covid 19 PPP and Disaster Relief

I'm not sure why people are angry at banks here. The implementation of a program like this in a week time-frame without having clear guidelines must be a nightmare. I think banks trying to protect themselves is a valid concern. I'm a firm believer every for-profit business has a right to make as much profit as they can. BofA restricting this program to customers it knows well is a smart risk management strategy. I would say this even if I didn't fit the criteria.

I have plenty of liquidity in my small business and am not desperate for this loan. You need to ask yourself if you're desperate for this loan that you can't even wait a week to get the funds why that is? If it's because you're in a hard hit industry, you should be pissed at government for shutting down your businesses and not the banks or the virus.

My firm belief is that the government is the pariah here, first with shutting down the entire hospitality and leisure industry, and second with not streamlining the process not only with these PPP loans, but individual $1,200 checks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Covid 19 PPP and Disaster Relief

So it appers nobody received the money even those who applied beyond 4 days. It also seems that SBA is now rewording their original offer to now say up to 10k when the law, the lawm makers, and SBA clearly said not to exceed 10k.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Covid 19 PPP and Disaster Relief

I don't think people are mad at the banks. I believe that majority of these banks should have the developers and or IT personnel to get these portals created quickly. Most of the banks just had a questionnaire to stall for time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Covid 19 PPP and Disaster Relief

@Anonymous wrote:I don't think people are mad at the banks. I believe that majority of these banks should have the developers and or IT personnel to get these portals created quickly. Most of the banks just had a questionnaire to stall for time.

Why would they stall for time, if not to protect themselves? Banks aren't stupid. They know fully well a borrower whose business lost 80-100% revenue overnight won't be able to pay back this loan. Therefore, they want assurances from the government that they'll be able to recover the up front float (loans). And 95% of these "loans" will turn out to be grants. Banks are making up to five points on each of these loans. They'll give out as much as they can to make that coin, if they're certain they can recoup money from the government. God knows they won't recoup it from the borrowers.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Covid 19 PPP and Disaster Relief

@Anonymous wrote:I don't think people are mad at the banks. I believe that majority of these banks should have the developers and or IT personnel to get these portals created quickly. Most of the banks just had a questionnaire to stall for time.

Really has nothing to do with development or IT. It has to do with the ever-changing guidance coming from Treasury and SBA. The application itself changed 3 times yesterday. Banks need to ensure that they won't be held responsible for borrower misrepresentations. They have to know if they make a loan of $1mm to a business that they won't be left holding the bag on it. I've read every guideline change and the language is ambiguous. In one point it says banks can rely on borrower representations but another it says the bank has to verify the payroll amounts an not rely on borrower representations. For a bank to verify each applicant's payroll averages it is a manual process. Last year the SBA processed $30 billion in loans for the entire year. Now they have to administer $349 billion in loans at once and Treasury is calling the shots. It is supposed to be a streamelined program but Treasury's guidelines don't allow for that.

The whole porogram is a mess right now. I know my banks is working through the weekend to try to go live Monday. We'll see what Monday brings.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Covid 19 PPP and Disaster Relief

In my opinion the program was designed to stall market crash that is why it looked like it was made by "experts" in one week.

Even if business qualifies I wouldn't expect money to be distributed in the next 2 weeks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Covid 19 PPP and Disaster Relief

@Anonymous wrote:In my opinion the program was designed to stall market crash that is why it looked like it was made by "experts" in one week.

Even if business qualifies I wouldn't expect money to be distributed in the next 2 weeks.

Completely agree. This won't be the silver bullet everyone thought.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Covid 19 PPP and Disaster Relief

I applied with SBA on Tuesday and B of A on Sat, just got an email from B of A today that they are working on apps and to get my payroll ready and any docs in the meantime. So whos the better bet? Ive already tried to apply with B of A for loans back in 2019 and got denied.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Covid 19 PPP and Disaster Relief

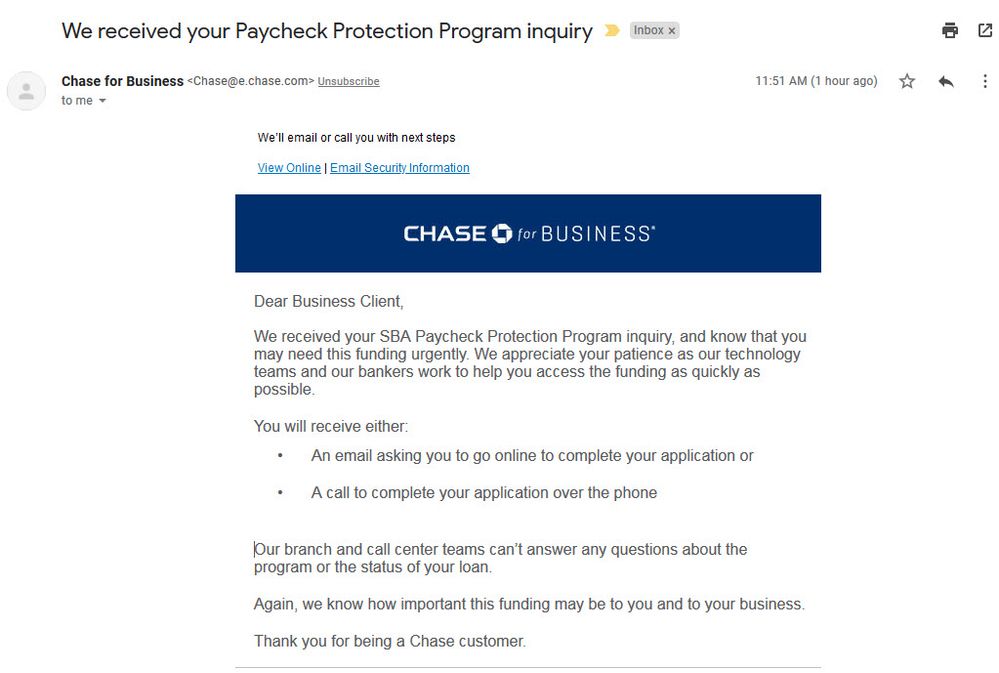

I applied in the first 10 minutes or so that the app page became available at Chase on Friday. However did not get any e-mail confirmation, only a 'success' page as I am sure we all did.

Today I received this e-mail confirmation from Chase.

Personal-

NFCU Platinum 50k | NFCU Flagship 20k | NFCU More Rewards 10k | NFCU NavChek PLOC 15k | PenFed Power Cash 25k | PenFed Gold 15k | PenFed Pathfinder 10k | PenFed OLOC 3K | GTE Financial CU 15k | VyStar CU Cash Back 25k | VyStar CU PLOC 15k | FNBO Evergreen 25k | FNBO 11.85K | BofA Cash Rewards 10.1k | Capital One Venture 13k | Capital One QS 7k | PNC Cash Rewards 15.5k | Citi Costco 8.5k | US Bank Cash+ 10k | Discover 14.8k | Discover 14.1k | Regions Cash 6k | Truist Enjoy Cash 9k | Truist Future 6.5k | Elan Max Cash 7k | Wells Fargo Reflect 20k | Fifth Third 7k | USAA PrefRew 15k | CFNA Tires Plus MC 8k | GM Rewards 3.5k | TD Bank Cash 3.5k | Amex BCP 3K | Lowes Store 30k | Sleep Number Store 13.5k | Home Depot Store 10k | Amazon Store 10k | Care Credit 15k | Walmart Store 6k | JCrew 25k | Jared 18.6k | HSN 4.1K | King Size 4k | Buckle 3.1k

Business-

Amex BBC 25k | Amex BBP 22k | Amex Business Platinum NPSL 30.4kPoT | Citizens Business Everyday 35k | Sams Club Business MC 25K | US Bank Business Plat 24k | Capital One Spark 2% 22k | Marcus GM Business 12.5k | Capital On Tap 2% 10k | Chase Ink 3k | Divvy 7k | PNC BLOC 50K | Citizens BLOC 50K | (Private) BLOC 75K | WEX Business Access Fuel 30k | Sams Bus Store 25k