- myFICO® Forums

- Types of Credit

- Business Credit

- Re: Frustration with EQ Business Reports and lack ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Frustration with EQ Business Reports and lack of protection in reporting for small businesses

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Frustration with EQ Business Reports and lack of protection in reporting for small businesses

I don't want this to be a rant, but it will probably come off as one. I just want the members to be aware of what you are dealing with. It will probably be too long of a post ![]()

I do monitor my business reports, more for fun/education than anything else.

My D&B is an accurate reflection of what I have that reports to D&B

My EX report is an accuract reflection of what I have that reports to EX

My EQ report is an amalgamation of garbage that I have learned not to try and fix, but I wish I could decipher.

Here is an old thread I posted about EQ https://ficoforums.myfico.com/t5/Business-Credit/Equifax-Business-Report-Questions/m-p/4417837

I obtained my written report which had much more detail on it than the online report including other accounts.

I attempted to correct the fact that my parent's personal home phone number was showing up on the report, the phone number for the business that occupied the location before me was showing up on my report (not my business) .

The only account showing up was a 1 year old BoA card that showed Most Severe Status in 24 months Current, but by Payment index indicated 1-30 days past due. This in itself is contradictory. I attempted to dispute this in writing and ask for information as you would on a personal report.

The result was my EQ business report became unavailable for me to monitor any longer and he EFX ID is now "void". I sent some nice professional emails and letters to no avail. When I would get an email response from EQ, it would give me a dead link or email address that bounced back or phone number that ended up in disputes. When I would talk to someone on the phone, it was always routed to the same rep that would tell me I had to dispute in writing.

Fast Forward to EXACTLLY ONE YEAR LATER 2017. My reports were available for monitoring again. EQ had a split business file for me. 3 reports. Basically they split the written report in to 3 reports. One in LLC name, one in my personal name, one in my DBA name. My BoA card that previously reported on monitoring had disappeared. I decided not to fight them and hope it fixed itself. My LLC and my personal had the exact same data reporting.

Eventually my LLC report and the one in my personal name merged with Chase Ink, Amazon Revolving, Fleetcor and AT&T reporting. BoA products do not show anymore.

My DBA still has its own report using the same phone number and EIN as my LLC and one account... Amazon Net 55.

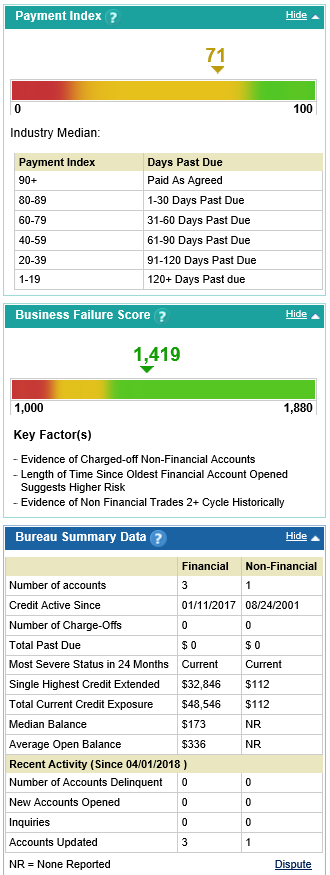

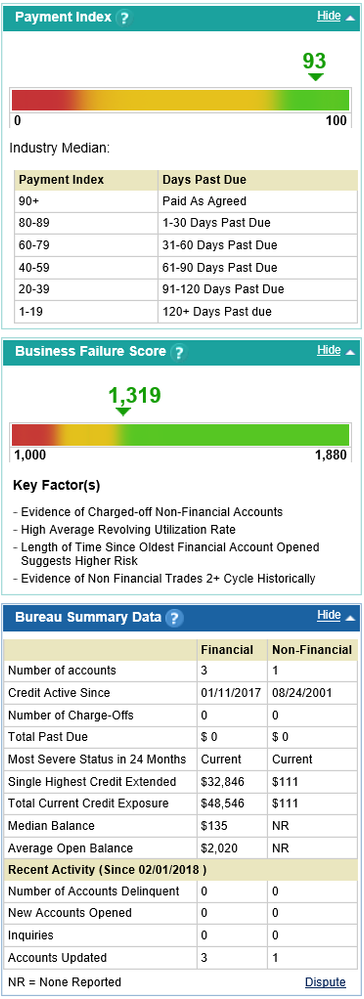

So today I get my update and my payment index has dropped to 1-30 days late. Last month it was on time. I only have 4 accounts reporting. none have ever been late. And the Most Severe Status in 24 months Current I submit the screen shots below for proof. One is last month, one is this month. Note that the most recent activity is listed as 3 months old in each report and both show ZERO for number of accounts deliquent. My average open balance went down? Impossible in the last month. Total Garbage. I am not going to mess with them again. I welcome any insight.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Frustration with EQ Business Reports and lack of protection in reporting for small businesses

You're allowed to rant when it's deserving and I certainly think your situation warrants one. Wish I could add more but that is a mess and unfortunate that you are subject to the incompetence of those at EQ.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Frustration with EQ Business Reports and lack of protection in reporting for small businesses

I never looked at business credit scoring or D&B because they have a history of bad reporting. All I know is we pay everthing on time and never had a problem getting business credit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Frustration with EQ Business Reports and lack of protection in reporting for small businesses

I was thinking about diving into these reports to check for mistakes. Thank you very much for the warning. At least I know one is a big fat lie and not to dive in that dumpster.

Chase Business Ink 20k PenFed Plat Rewards VS 25k NFCU Go Rewards 20k BECU 30k Chase FU 6k GM Biz 21k NFCU Flag 21k Amex BCP 26k Disco IT 18k FNBO Biz 11k Costco Citi Biz 8.1k Amex EDP 2k Gold Delta Skymiles Biz 5k Amazon Prime 10k USBank Cash 12k Amex Biz Plat Rewards NPSL Amex BCB NPSL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Frustration with EQ Business Reports and lack of protection in reporting for small businesses

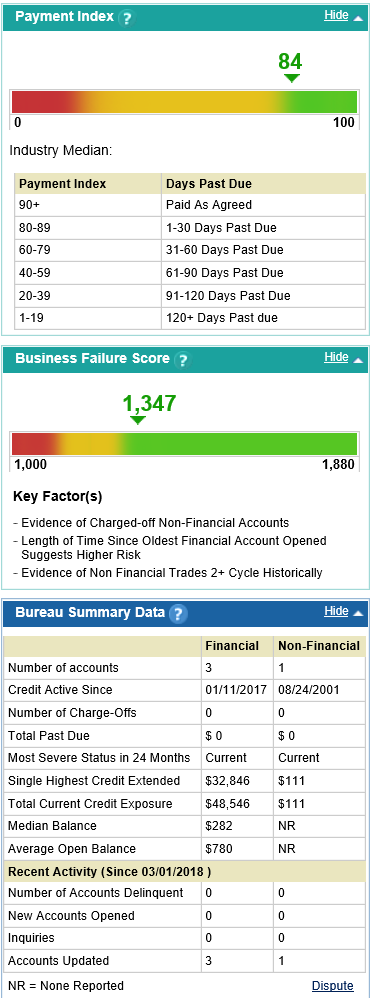

Just posting this to show how weird these reports are. Payment index now dropped to 71, but nothing is or has been deliquent as indicated by the Most Severe Status in 24 Months = Current. Notice the changes in Median Balance and Average Open Balance. Again, these numbers make no sense whatsoever I run an average well over $5K each month

I was feeling froggy. I called the number associated with this report and asked "how can the Payment Index drop if my Most Severe Status in 24 months is Current?" She refused to discuss it with me and provided the number for disputes should I wish to dispute any information on the report. I know not to call that number.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Frustration with EQ Business Reports and lack of protection in reporting for small businesses

Heh, lovely.

I should see if I can go pull my EQ business for the SP just for giggles... established the Ink and later Amex SCP when that pre-approval dropped into my lap but never checked the actual report after some summary showed me the tradeline count = 2.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Frustration with EQ Business Reports and lack of protection in reporting for small businesses

Had a business pull my EQ Business Report for a truck loan. It did have my Chase business Ink on the report, it shows as the business category as "Bank Card", no name. Neither of the Amex business cards were on there. It also had an unknown "Packaging" business on the Net 30 side. At least that didnt show any lates. Everything else seems to be correct.

Strange.

Chase Business Ink 20k PenFed Plat Rewards VS 25k NFCU Go Rewards 20k BECU 30k Chase FU 6k GM Biz 21k NFCU Flag 21k Amex BCP 26k Disco IT 18k FNBO Biz 11k Costco Citi Biz 8.1k Amex EDP 2k Gold Delta Skymiles Biz 5k Amazon Prime 10k USBank Cash 12k Amex Biz Plat Rewards NPSL Amex BCB NPSL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Frustration with EQ Business Reports and lack of protection in reporting for small businesses

Amex doesn't report on your EQ report (it will be on your SBFE through EQ or D&B, but you can't get that)

The packaging is most likely ULINE if you have some starter net 30s

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Frustration with EQ Business Reports and lack of protection in reporting for small businesses

Thanks @Inverse, I didnt know that.

Amex doesn't report on your EQ report (it will be on your SBFE through EQ or D&B, but you can't get that)

Chase Business Ink 20k PenFed Plat Rewards VS 25k NFCU Go Rewards 20k BECU 30k Chase FU 6k GM Biz 21k NFCU Flag 21k Amex BCP 26k Disco IT 18k FNBO Biz 11k Costco Citi Biz 8.1k Amex EDP 2k Gold Delta Skymiles Biz 5k Amazon Prime 10k USBank Cash 12k Amex Biz Plat Rewards NPSL Amex BCB NPSL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Frustration with EQ Business Reports and lack of protection in reporting for small businesses

How are you getting these reports? Don't they charge $99 ever time you run it?