- myFICO® Forums

- Types of Credit

- Business Credit

- Re: Help me decide what 2 credit cards to get with...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Help me decide what 2 credit cards to get with the highest possible limits?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help me decide what 2 credit cards to get with the highest possible limits?

@kshurika wrote:

I agree with everyone else that the likelihood of a 130 point jump in your TU approaches 0%. A few weeks ago, I got a 99 point TU jump in the span of about 8 days, but that was from the removal of a federal tax lien that reported only on TU. Last year, though, for reasons I still can't fathom, I got a 74 point boost in one flash on Experian. It enabled me to increase, with one phone call the 1K SL on a Chase FU that had been approved the day before (reconned from a denial) to 6K . So, miracles do happen.

You're obviously a hard worker, So, quite soon you will have cards with good limits. Best of luck with your business.

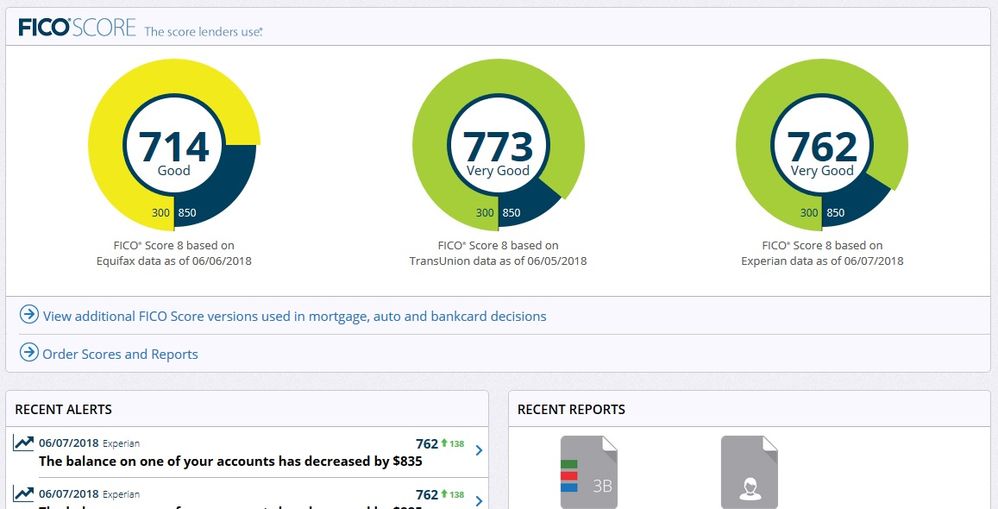

Its didnt jump 130, only 104 BUT Exp jumped 138 points! So never say never my man.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help me decide what 2 credit cards to get with the highest possible limits?

$944,008 Amex BRG

$91,953 Amex SC

$58,351 Discover It

$50,046 BofA CR

$36,146 Amex PRG

$6,774 Cap1 QS

$963 Amex CM

$1,188,241 Yearly Spend

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help me decide what 2 credit cards to get with the highest possible limits?

boatwelder wrote (to me):

"Its didnt jump 130, only 104 BUT Exp jumped 138 points! So never say never my man."

HAH! You beat me to it. I was going to come on and say something to the effect of "See how right I was?!". 😅Well, kudos, my man. For the life of me, though, I can't see the reason for the huge boost in one flash. You seemed to have a pretty good record to begin with. Usually, a 134 point jump comes from the removal of a tax lien (I got 91), or a bankruptcy, or both. There didn't seem to be any of that with you, but, who's complaining? Congratulations!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help me decide what 2 credit cards to get with the highest possible limits?

Ya man I dont even know how it jumped soooo high BUT it is solid proof that if everything remains identical, the simulator is actually pretty close on its UTI estimations. Atleast with a thin easy to calculate file like mine is currently.

And thanks about the tip, i may have gotten one of those. I dont recall, we pulled $30k combined after looking at what you myfico folks were praising. Not going to do much besides use them as a tool to build up into the 800s, 850 would be a nice pride stroker but heck, anything over 825 would be perfectly fine.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help me decide what 2 credit cards to get with the highest possible limits?

@Anonymous wrote:Ya man I dont even know how it jumped soooo high BUT it is solid proof that if everything remains identical, the simulator is actually pretty close on its UTI estimations. Atleast with a thin easy to calculate file like mine is currently.

And thanks about the tip, i may have gotten one of those. I dont recall, we pulled $30k combined after looking at what you myfico folks were praising. Not going to do much besides use them as a tool to build up into the 800s, 850 would be a nice pride stroker but heck, anything over 825 would be perfectly fine.

Glad it's going so well. Do come back and let us know what you apply for and what you get approved for.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help me decide what 2 credit cards to get with the highest possible limits?

@creditbroke wrote:With almost 6 years AAoA, 2 open credit lines, 2 paid off/never late accounts, no negatives, probably a mid 750+ score this time next month, and your telling him "forget about applying for credit?" Seriously? He can probably pull $5k limits on 2 cards in less than a month!

What I actually said is "If you don't need the credit, do it without credit."

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help me decide what 2 credit cards to get with the highest possible limits?

@SouthJamaica wrote:

@Anonymous wrote:Ya man I dont even know how it jumped soooo high BUT it is solid proof that if everything remains identical, the simulator is actually pretty close on its UTI estimations. Atleast with a thin easy to calculate file like mine is currently.

And thanks about the tip, i may have gotten one of those. I dont recall, we pulled $30k combined after looking at what you myfico folks were praising. Not going to do much besides use them as a tool to build up into the 800s, 850 would be a nice pride stroker but heck, anything over 825 would be perfectly fine.

Glad it's going so well. Do come back and let us know what you apply for and what you get approved for.

These are what we applied for, my wife also applied the same just to build a more solid foundation. My scores are higher but she has a longer history ( few lates during nursing school) Goodwill letters will work on them I think.

Discover x2

Paypal x1

Amex x2

Menards x2

Net 30 x1

Cap one either 1 or 2, I dont recall but all was granted but a cap one for myelf (got the 7to10 day message) which is odd since Menards was also Cap one... I did a quick search on 2 Cap one apps simotaniously and I read it was ok, hope I wasnt tired and just mistaken.

Thanks for all your time South, Net 30 I have is all on you man, thank you. Now back to work, 4th time in 2 weeks im pushing on till coffee time! Keep telling myself '8 more weeks, just 8 more weeks and you can buy a fishing license! Ha! Maybe next spring?

Also, I'm forgoing using the cards for anything besides piddly things and pay off monthly. The net 30 will be used at roughly 50% UTI for now, useage and limit will increase as property is where I want it to be and I can focus on making money. Ive also decided to cut a few corners on the rehab (revisit as time allows, possibly days off) and remain cash only. And the inquiries are about all accounted for and not much damage (6 points her, 2 or 3 me) I thought they would be worse.

Question for you South. What can I expect once all cards are reporting? First month =? Second =? etc...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help me decide what 2 credit cards to get with the highest possible limits?

Why have you not applied for anything business?

They don't show up on your credit report so util. doesn't matter much.

American Express is pretty easy especially if you received personal cards.

Bank of America Alaska Airlines Business

Chase Marriott Business

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help me decide what 2 credit cards to get with the highest possible limits?

@Anonymous wrote:

@SouthJamaica wrote:

@Anonymous wrote:Ya man I dont even know how it jumped soooo high BUT it is solid proof that if everything remains identical, the simulator is actually pretty close on its UTI estimations. Atleast with a thin easy to calculate file like mine is currently.

And thanks about the tip, i may have gotten one of those. I dont recall, we pulled $30k combined after looking at what you myfico folks were praising. Not going to do much besides use them as a tool to build up into the 800s, 850 would be a nice pride stroker but heck, anything over 825 would be perfectly fine.

Glad it's going so well. Do come back and let us know what you apply for and what you get approved for.

These are what we applied for, my wife also applied the same just to build a more solid foundation. My scores are higher but she has a longer history ( few lates during nursing school) Goodwill letters will work on them I think.

Discover x2

Paypal x1

Amex x2

Menards x2

Net 30 x1

Cap one either 1 or 2, I dont recall but all was granted but a cap one for myelf (got the 7to10 day message) which is odd since Menards was also Cap one... I did a quick search on 2 Cap one apps simotaniously and I read it was ok, hope I wasnt tired and just mistaken.

Thanks for all your time South, Net 30 I have is all on you man, thank you. Now back to work, 4th time in 2 weeks im pushing on till coffee time! Keep telling myself '8 more weeks, just 8 more weeks and you can buy a fishing license! Ha! Maybe next spring?

Also, I'm forgoing using the cards for anything besides piddly things and pay off monthly. The net 30 will be used at roughly 50% UTI for now, useage and limit will increase as property is where I want it to be and I can focus on making money. Ive also decided to cut a few corners on the rehab (revisit as time allows, possibly days off) and remain cash only. And the inquiries are about all accounted for and not much damage (6 points her, 2 or 3 me) I thought they would be worse.

Question for you South. What can I expect once all cards are reporting? First month =? Second =? etc...

I don't know what to say, it looks like you got personal cards instead of business cards. That's going to create a problem for your bookkeeper and/or accountant. In some cases it could even lead to closure of the accounts. I really think you should avoid using those cards for the business.

As to how it will affect your credit scores I would need a ton of information I don't have to make an informed guesstimate.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687