- myFICO® Forums

- Types of Credit

- Business Credit

- Just received an invitation to apply for the Chase...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Just received an invitation to apply for the Chase Ink Unlimited business card but I'm over 5/24

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Just received an invitation to apply for the Chase Ink Unlimited business card but I'm over 5/24

It came with an invitation code. The business is technically new because I’m a realtor and I went from having my agent license to broker license, so now I can own my own company (which obviously I do). I already have one personal Chase chard, which is 4 years old. My only other business card is the Amex blue cash (I think that’s what it’s called). My score is in the low 700s. and the business is an S-Corp. Should I open up a business checking account with them before applying? And more importantly, is it even worth applying if I'm over 5/24?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Just received an invitation to apply for the Chase Ink Unlimited business card but I'm over 5/24

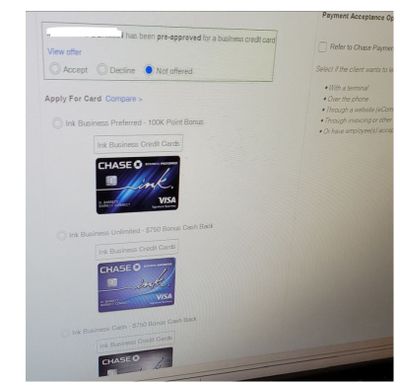

If you go to a branch, have one of the reps check your account to see if they have any targeted offers for you. Those offers generally bypass 5/24.

If there is no offer, you may want to request an appointment with the branch's BRM (Business Relationship Manager). In the past, a BRM could submit a paper application to bypass the automatic rejection by the 5/24 algorithm. I'm not sure if this work around is still in effect or not. Perhaps someone else can chime in here.

FICO8:

VantageScore3:

Inquiries (n/12, n/24):

AAoA: 11 yrs | AoORA: 36 yrs | AoYRA: 12 mos | New Accounts: 0/6, 0/12, 2/24 | Util: 1% | DTI: 1%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Just received an invitation to apply for the Chase Ink Unlimited business card but I'm over 5/24

@NoHardLimits wrote:If you go to a branch, have one of the reps check your account to see if they have any targeted offers for you. Those offers generally bypass 5/24.

If there is no offer, you may want to request an appointment with the branch's BRM (Business Relationship Manager). In the past, a BRM could submit a paper application to bypass the automatic rejection by the 5/24 algorithm. I'm not sure if this work around is still in effect or not. Perhaps someone else can chime in here.

The BRM 'bypass' method is no longer a viable method. These days, it's either a pre-approved offer in-branch, or online when green check mark/black stars with set APR that would bypass the 5/24 restriction. Some mailers (not necessarily the invitations to apply) may work from time to time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Just received an invitation to apply for the Chase Ink Unlimited business card but I'm over 5/24

@Anonymous wrote:It came with an invitation code. The business is technically new because I’m a realtor and I went from having my agent license to broker license, so now I can own my own company (which obviously I do). I already have one personal Chase chard, which is 4 years old. My only other business card is the Amex blue cash (I think that’s what it’s called). My score is in the low 700s. and the business is an S-Corp. Should I open up a business checking account with them before applying? And more importantly, is it even worth applying if I'm over 5/24?

I don't think those types of mailers are especially meaningful. I know someone who gets invites for a Chase Ink card who has never owned a business.

If getting a Chase Ink card is really worth something for you, I do believe your chances would be improved with a Chase business checking account. Once they have you as a business customer, you'll be able to determine online if you're preapproved for an Ink card.

True preapprovals do overrule 5/24. (But I must admit that the only time I was ever preapproved for a Chase Ink card I applied and was turned down, for too many recent accounts ![]() )

)

Since Chase usually has some kind of account opening bonus for business checking, I would look into that first.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Just received an invitation to apply for the Chase Ink Unlimited business card but I'm over 5/24

Update for anyone interested: decided not to apply because another one came in the mail for a family member who has worse credit than I do, meaning the mailer is probably just that, a mailer.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Just received an invitation to apply for the Chase Ink Unlimited business card but I'm over 5/24

@Anonymous wrote:It came with an invitation code. The business is technically new because I’m a realtor and I went from having my agent license to broker license, so now I can own my own company (which obviously I do). I already have one personal Chase chard, which is 4 years old. My only other business card is the Amex blue cash (I think that’s what it’s called). My score is in the low 700s. and the business is an S-Corp. Should I open up a business checking account with them before applying? And more importantly, is it even worth applying if I'm over 5/24?

It may not be a genuine prequalification. I know someone who gets those every few months who's never owned a business.

If it were a prequalified approval, it would override 5/24.

From what I know about Chase, it does help to have a Chase business checking account.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Just received an invitation to apply for the Chase Ink Unlimited business card but I'm over 5/24

not sure if you are still in the market but a few thoughts...I went w a friend to a branch to do the combo at the beginning of this month, open checking and get a card. $ 300 for doing 5 debits, kind of free $. the offers were all there after opening up the account. this same scenario has played out for nearly everyone I know that has opened a biz checking, meaning 8 out of 10 got offers. I wanted the referral so she passed on the card offers. she used the referral link from my CIP and after an address verify she got a CIU with a $32K limit and I picked up the 20k referral. this woman is 54 and has only had credit for 3 years, just bought a car and all scores are mid-700s. the banker did say on our way out that if something hangs up with the app that he would put her in touch with the BRM that covers the branches (santa barbara) and that she would push it thought -because of this and other recent experience I don't agree that BRMs are useless, far from it. anyway, there you have it. they are solid biz cards imo and as I am finding out one can easily double up on all 3 inks, I am getting ready to app for a 2nd CIP and I just got a CIU and the self-referral and sub also worked for me

chase biz checking $ 300 sub. https://tinyurl.com/ybf5lt7w