- myFICO® Forums

- Types of Credit

- Business Credit

- US Bank Business Card Approvals

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

US Bank Business Card Approvals

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

US Bank Business Card Approvals

After reading some of the posts here in the Business section, I have some idea about the scores and approvals for the US Bank Business Card. Looks like most of the people who got approved for US Bank Business cards received $3000 in Credit Limit. Am I close on this conculsion or did some people get higher limits right at the approval. I am looking for approvals for last 6 months since March 2020 after Pandemic till now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Business Card Approvals

@Red1Blue wrote:After reading some of the posts here in the Business section, I have some idea about the scores and approvals for the US Bank Business Card. Looks like most of the people who got approved for US Bank Business cards received $3000 in Credit Limit. Am I close on this conculsion or did some people get higher limits right at the approval. I am looking for approvals for last 6 months since March 2020 after Pandemic till now.

@Anonymous was approved for $10K in May 2020

@GApeachy husband was approved for $5K in September 2020

@FICOEmpire was approved for $5K right at the beginning of stay-at-home orders

@imaximous was approved for $3K in April 2020

@BearsCubsOtters (me) was approved for $3K in September 2020

Someone else, I want to say Janus, was approved before (?) the pandemic with $1,600.

@mchang124 was approved in February 2020 with a SL of $3,000 and in September 2020, he received a SP CLI to $6,000.

US Bank is clearly not as generous as Chase and Amex but its good that they are still lending.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Business Card Approvals

@BearsCubsOtters wrote:

Nice job! @BearsCubsOtters I like the list you provided, thank you!

Sure US Bank is not as generous as Amex in the SL department but I think they are doing well offering us a product at a lower apr. That right there can be a game changer. I have and dh has plenty of cl with Amex. I'm at $41k biz and he is at $27k biz...not including personal. That's all great but when the apr is high, it's not so great afterall. I wouldn't mind floating and having some flexibility but not at those %'s. So having a low/lower apr fills the bill.

@mchang124 receiving a $3k cli after 6 months on "light spend" as per mchang DOES make US Bank a little more generous if looking at the overall picture down the road perhaps.

Also, a little fyi, US Bank will be backing State Farm credit products in 2021. I have been a life long customer with State Farm, dh and myself together for over 35 yrs. This could be good in terms of future personal and biz products.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Business Card Approvals

@BearsCubsOtters wrote:

@Red1Blue wrote:After reading some of the posts here in the Business section, I have some idea about the scores and approvals for the US Bank Business Card. Looks like most of the people who got approved for US Bank Business cards received $3000 in Credit Limit. Am I close on this conculsion or did some people get higher limits right at the approval. I am looking for approvals for last 6 months since March 2020 after Pandemic till now.

@Anonymous was approved for $10K in May 2020

@GApeachy husband was approved for $5K in September 2020

@FICOEmpire was approved for $5K right at the beginning of stay-at-home orders

@imaximous was approved for $3K in April 2020

@BearsCubsOtters (me) was approved for $3K in September 2020

Someone else, I want to say Janus, was approved before (?) the pandemic with $1,600.

@mchang124 was approved in February 2020 with a SL of $3,000 and in September 2020, he received a SP CLI to $6,000.

US Bank is clearly not as generous as Chase and Amex but its good that they are still lending.

I was also approved for $3k SCL about a month ago..

*************************************************************************************

Then you are a fool. Be thankful that when God gave you a face, he gave you a fool's face

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Business Card Approvals

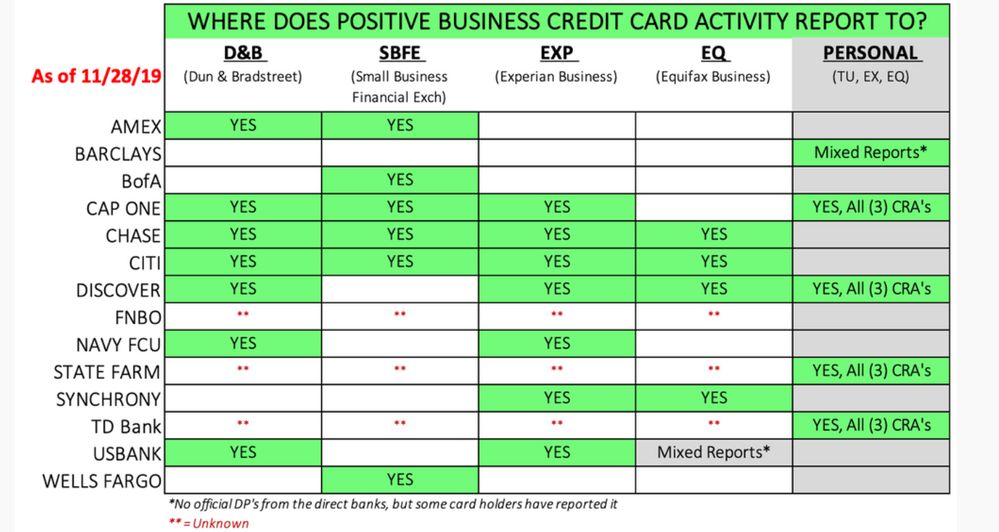

I am kind of curious does US Bank when they are approving Business Credit Cards do they look at the Business Credit from D&B or Exp Biz or any other Biz Reports or do they just look at the Personal Credit Report and Approve their Business Credit Cards ? Any ideas?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Business Card Approvals

ths is a chart i had gotten from one of the facebook groups i'm apart of. I hope this helps. most small business cards still require a PG

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Business Card Approvals

@BearsCubsOtters wrote:

@Red1Blue wrote:After reading some of the posts here in the Business section, I have some idea about the scores and approvals for the US Bank Business Card. Looks like most of the people who got approved for US Bank Business cards received $3000 in Credit Limit. Am I close on this conculsion or did some people get higher limits right at the approval. I am looking for approvals for last 6 months since March 2020 after Pandemic till now.

@Anonymous was approved for $10K in May 2020

@GApeachy husband was approved for $5K in September 2020

@FICOEmpire was approved for $5K right at the beginning of stay-at-home orders

@imaximous was approved for $3K in April 2020

@BearsCubsOtters (me) was approved for $3K in September 2020

Someone else, I want to say Janus, was approved before (?) the pandemic with $1,600.

@mchang124 was approved in February 2020 with a SL of $3,000 and in September 2020, he received a SP CLI to $6,000.

US Bank is clearly not as generous as Chase and Amex but its good that they are still lending.

Yes. My auto approval was for $3k. However, I called UW and requested a higher SL. They asked how much and let me know that anything over $50k would require docs. So, I said $30k because that seemed plenty.

After review, I got approved for the $30k.

My understanding is that USB auto-approvals aren't that generous for the most part. But, once an underwriter manually reviews your file, you could qualify for a much higher limit. You just gotta be willing to take an additional pull or provide docs if needed.

This card went from $3k to $30k with a phone call right after auto- approval.

My Altitude Reserve started at $5k and now sits at $40k. I'll be requesting a CLI soon because I do use this card heavily and need to cycle my limit often.

USB has been great and never have issues with charges or declines for large purchases.

$20-30k purchases go through just like $5.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Business Card Approvals

@imaximous wrote:

After review, I got approved for the $30k.

My understanding is that USB auto-approvals aren't that generous for the most part. But, once an underwriter manually reviews your file, you could qualify for a much higher limit. You just gotta be willing to take an additional pull or provide docs if needed.This card went from $3k to $30k with a phone call right after auto- approval. My Altitude Reserve started at $5k and now sits at $40k. I'll be requesting a CLI soon because I do use this card heavily and need to cycle my limit often. USB has been great and never have issues with charges or declines for large purchases.

$20-30k purchases go through just like $5.

Hi @imaximous, may I ask your scores when you got approved for higher limits. Did you have previous relationship with US Bank before these approvals?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Business Card Approvals

@Red1Blue wrote:

@imaximous wrote:

After review, I got approved for the $30k.

My understanding is that USB auto-approvals aren't that generous for the most part. But, once an underwriter manually reviews your file, you could qualify for a much higher limit. You just gotta be willing to take an additional pull or provide docs if needed.This card went from $3k to $30k with a phone call right after auto- approval. My Altitude Reserve started at $5k and now sits at $40k. I'll be requesting a CLI soon because I do use this card heavily and need to cycle my limit often. USB has been great and never have issues with charges or declines for large purchases.

$20-30k purchases go through just like $5.

Hi @imaximous, may I ask your scores when you got approved for higher limits. Did you have previous relationship with US Bank before these approvals?

Between 750 - 760

Many new accounts. Probably 11 - 13 in 24 mos.

My relationship with USB started with Cash+ in early 2018, which I only got because I wanted to be eligible for the AR. I applied for AR about 2-3 weeks after getting approved for Cash+. Back then, it probably wasn't as difficult to get approvals as it may be now, but SLs were lowish at $5k each. Pretty sure the high spending helped with CLIs.

No deposit accounts. Only 3 CCs.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Business Card Approvals

@imaximous how long after you were approved did you request a manual review? I was approved for $5k but was told I had to wait until I receive the card to recon.

Thanks!