- myFICO® Forums

- Types of Credit

- Business Credit

- Re: You can now pre-qualify for the business FNBO ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

You can now pre-qualify for the business FNBO 2% Cashback card

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: You can now pre-qualify for the business FNBO 2% Cashback card

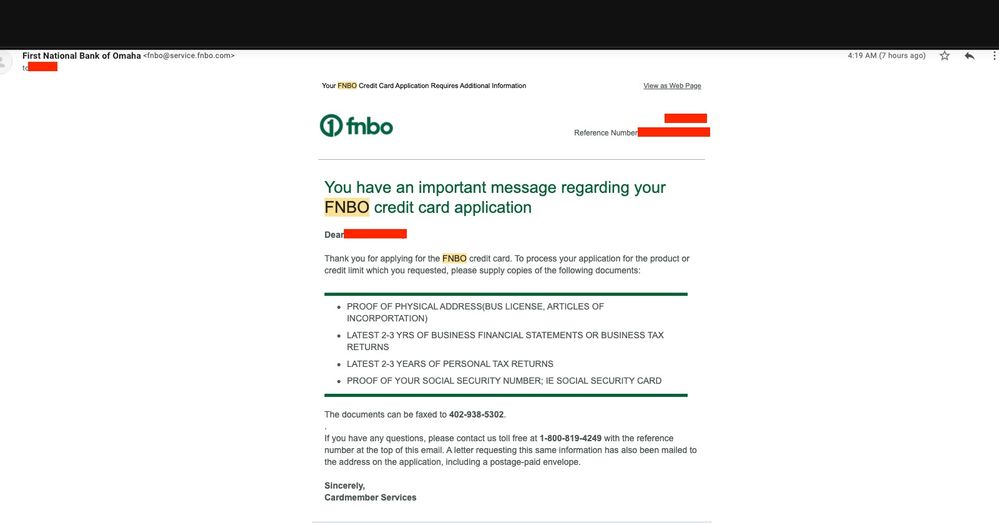

Just an update on my app as its in pending status....Called in to see if anything was needed it seems the follwoing are an issue:

1. Business address, they are requesting the business license with the business address ( I have this)

2. They are requesting a bill or something with the business address ( SBA loan going there)

3. A phone number

I left a message to the underwriter to call me back so I could get a email or fax number to send over documents to them and state that no on ever called me on my phone to verify me. Unsure why my app has been delayed and really unsure why FNBO has these issues of getting my business address..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: You can now pre-qualify for the business FNBO 2% Cashback card

@AzCreditGuy wrote:Just an update on my app as its in pending status....Called in to see if anything was needed it seems the follwoing are an issue:

1. Business address, they are requesting the business license with the business address ( I have this)

2. They are requesting a bill or something with the business address ( SBA loan going there)

3. A phone number

I left a message to the underwriter to call me back so I could get a email or fax number to send over documents to them and state that no on ever called me on my phone to verify me. Unsure why my app has been delayed and really unsure why FNBO has these issues of getting my business address..

i just got a letter requesting same w a fax # . I called and spoke to the UW and said im not sending 4 - 6 years of combined taxes for an small biz account and whether or not they can proceed w articles & my social (which in itself is a LOT). He said to go ahead and send it over and they will process w those dox I provide.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: You can now pre-qualify for the business FNBO 2% Cashback card

@Anonymous wrote:

@AzCreditGuy wrote:Just an update on my app as its in pending status....Called in to see if anything was needed it seems the follwoing are an issue:

1. Business address, they are requesting the business license with the business address ( I have this)

2. They are requesting a bill or something with the business address ( SBA loan going there)

3. A phone number

I left a message to the underwriter to call me back so I could get a email or fax number to send over documents to them and state that no on ever called me on my phone to verify me. Unsure why my app has been delayed and really unsure why FNBO has these issues of getting my business address..

i just got a letter requesting same w a fax # . I called and spoke to the UW and said im not sending 4 - 6 years of combined taxes for an small biz account and whether or not they can proceed w articles & my social (which in itself is a LOT). He said to go ahead and send it over and they will process w those dox I provide.

Thanks for the info....faxing over documents now!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: You can now pre-qualify for the business FNBO 2% Cashback card

Update, it seems I was declined because of my business address. I will have to call on Monday to see what the heck is going on but I dont recommend FNBO, they have too much of a Barclays vibe when it comes to issuing credit. The prequal tool they use is a complete lie, even though its based on a soft pull that at the time, which is the same as hard pull; FNBO seems to question every little thing. I got a $25k card from a major bank and the process with them was flawless, FNBO seems like a nightmare to even go through the process.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: You can now pre-qualify for the business FNBO 2% Cashback card

@AzCreditGuy wrote:Update, it seems I was declined because of my business address. I will have to call on Monday to see what the heck is going on but I dont recommend FNBO, they have too much of a Barclays vibe when it comes to issuing credit. The prequal tool they use

is a complete lie, even though its based on a soft pull that at the time, which is the same as hard pull; FNBO seems to question every little thing. I got a $25k card from a major bank and the process with them was flawless, FNBO seems like a nightmare to even go through the process.

Never had any issues with FNBO -- 7 CCs later (personal and biz versions). As has been mentioned elsewhere, not every FI will be the right fit for all. Another misconstrued perception, the pre-qualification portal is not a pre-approval, and just as the personal version of this particular card, plenty of DPs that confirm it's not 100% solid. The initial SP performed is only accessing preliminary data for the pre-screened offer, so no, it's not a lie and not the same data when they access your full reports. Once they perform the HP it's when they obtain a full picture of your credit file. Otherwise, you'd see everyone getting approved for this card with only a SP.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: You can now pre-qualify for the business FNBO 2% Cashback card

@FinStar wrote:

@AzCreditGuy wrote:Update, it seems I was declined because of my business address. I will have to call on Monday to see what the heck is going on but I dont recommend FNBO, they have too much of a Barclays vibe when it comes to issuing credit. The prequal tool they use

is a complete lie, even though its based on a soft pull that at the time, which is the same as hard pull; FNBO seems to question every little thing. I got a $25k card from a major bank and the process with them was flawless, FNBO seems like a nightmare to even go through the process.

Never had any issues with FNBO -- 7 CCs later (personal and biz versions). As has been mentioned elsewhere, not every FI will be the right fit for all. Another misconstrued perception, the pre-qualification portal is not a pre-approval, and just as the personal version of this particular card, plenty of DPs that confirm it's not 100% solid. The initial SP performed is only accessing preliminary data for the pre-screened offer, so no, it's not a lie and not the same data when they access your full reports. Once they perform the HP it's when they obtain a full picture of your credit file. Otherwise, you'd see everyone getting approved for this card with only a SP.

@FinStar Your experience and my experience are different, thats why this board is here.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: You can now pre-qualify for the business FNBO 2% Cashback card

@AzCreditGuy wrote:

@FinStar wrote:

@AzCreditGuy wrote:Update, it seems I was declined because of my business address. I will have to call on Monday to see what the heck is going on but I dont recommend FNBO, they have too much of a Barclays vibe when it comes to issuing credit. The prequal tool they use

is a complete lie, even though its based on a soft pull that at the time, which is the same as hard pull; FNBO seems to question every little thing. I got a $25k card from a major bank and the process with them was flawless, FNBO seems like a nightmare to even go through the process.

Never had any issues with FNBO -- 7 CCs later (personal and biz versions). As has been mentioned elsewhere, not every FI will be the right fit for all. Another misconstrued perception, the pre-qualification portal is not a pre-approval, and just as the personal version of this particular card, plenty of DPs that confirm it's not 100% solid. The initial SP performed is only accessing preliminary data for the pre-screened offer, so no, it's not a lie and not the same data when they access your full reports. Once they perform the HP it's when they obtain a full picture of your credit file. Otherwise, you'd see everyone getting approved for this card with only a SP.

@FinStar Your experience and my experience are different, thats why this board is here.

True, but the SP/HP datapoints are factually based, that was the point. This also provides clarity and transparency for others who may not be familiar with the pre-qualification platform and how FNBO operates. For reference, you can also view the results of the Evergreen personal version in the Application section of the forums.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: You can now pre-qualify for the business FNBO 2% Cashback card

@FinStar wrote:Just a quick PSA - let's keep the discussions on topic to the FNBO's business card. This thread isn't about Chase Ink or iterations of business profiles (those discussions can be addressed via a separate thread), etc. Posts that were not relevant or off-topic have been removed. Thank you for your understanding.

Just my input, In this particular situation, I was contemplating which one to apply for first, Chase or FNBOs, so it was helpful to know he applied for Chase first and still got approved with FNBO with the recent Chase inquiries. Personally, when trying to formulate a strategy of what to apply for and what order I should aply for them in it's good to hear related information.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: You can now pre-qualify for the business FNBO 2% Cashback card

@Thermionic_E wrote:Important data point for me: I had received a so called prestigious invitation for an fnbo personal credit line with language like "select few" and "expect extraordinary buying power" in it and got the same one again today, the previous one coming a week before I tried to the prequalify tool and I didn't realize fnbo had sent the previous app invite. I feel this means I was specifically targeted and it may have influenced my 15k line and acceptance.

The following information has kept my emotions in check when deciding whether to pull the trigger on a credit app....

- The Marketing Department creates the invitations and advertisments

- The Legal Department makes the Marketing Department to remove the pie in the sky

- The Underwriting Department makes the decision

(Number 4 is just ironic humor) - The Customer Service Department is trained wrong until the business customers call to complain and properly trains them

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: You can now pre-qualify for the business FNBO 2% Cashback card

I saw this card on a recent YT video and decided to take shot. Got $15k w/ 15.24%. Applied as a sole prop. Pulled personal Experian, score ~745. Was pre-approved for the same numbers.

Business Trade Lines - Chase Ink Cash - $4,000 (original limit $19,600); Chase Ink Preferred - $10,000; AmEx BBP - $5,500; Hilton Honors Business - $5,000; FNBO Evergreen Business - $15,000; Elan Business Visa (Alliance CU) - $20,000; Citi Business AAdvantage Platinum Select - $16,000; Marcus GM Business - $2,500; Kabbage LOC - $9,500; Marriott Bonvoy Business - $14,600; Barclays AAdvantage Aviator WE Business - $7,000; IHG Rewards Premier Business - $5,000; Delta Platinum Business - $16,400; Edward Jones Business (Elan) - $2,000; Barclays Wyndham Earner Business - $7,000

Total CLI - $399,900