- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: AOD FCU Denial Interesting Notes

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

AOD FCU Denial Interesting Notes

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AOD FCU Denial Interesting Notes

Thank you!

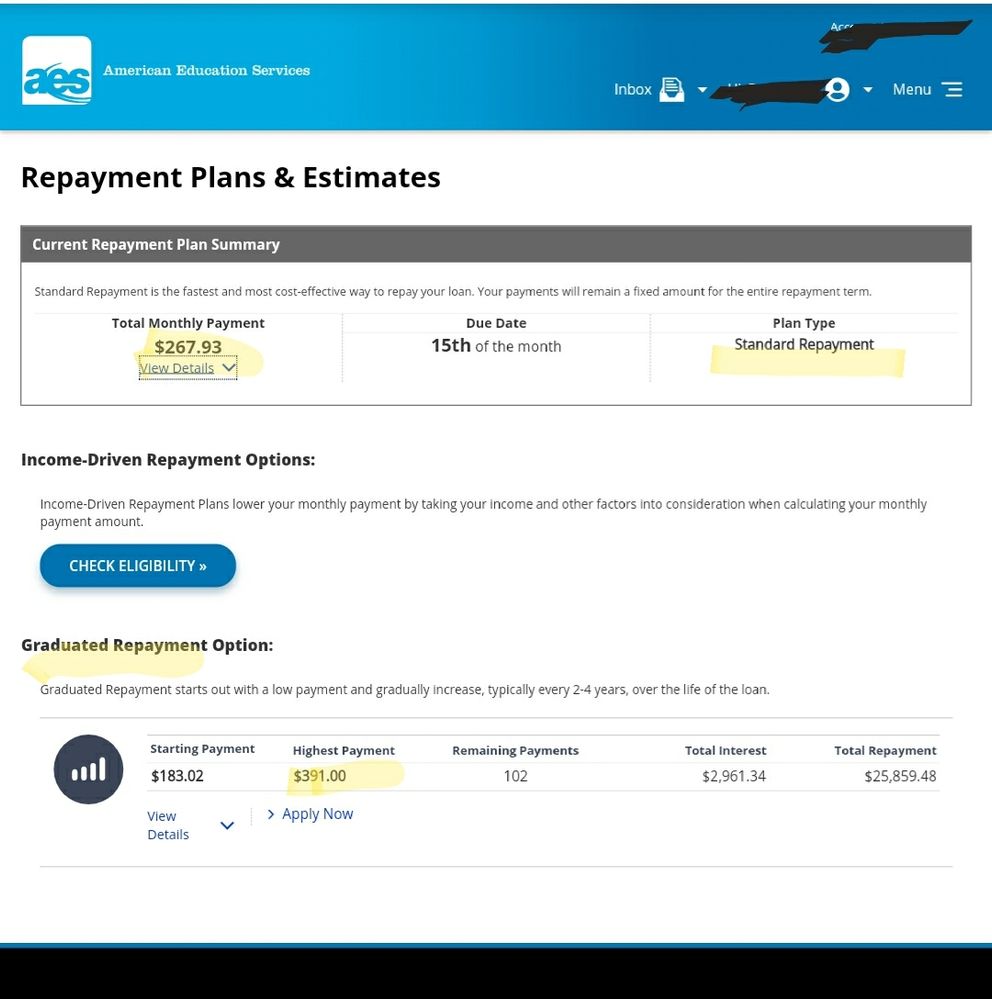

I am on a standard plan, as indicated in the picture I am posting.

Based on AOD'S perspective, they will not use the $391 amount which is based on a Graduated plan but the $268 amount based upon a Standard plan?

That is specifically what I have been giving thought to.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AOD FCU Denial Interesting Notes

@Credit4Growth based on the DPs the OP provided they will use your monthly payment as long as you are not on a plan that requires yearly recertification, which is how the income based plans work.

Desired BK recovery line up complete 7/12/2021. Planning to garden until 8/2023 and potentially try for AMEX.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AOD FCU Denial Interesting Notes

Thank you, I do not know how I missed that understanding. This does help me.

Enjoy the weekend!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AOD FCU Denial Interesting Notes

@Anonymous wrote:So I applied for an auto loan and the Visa signature card. Spoke with a very nice gentleman over the last week or so and today finally got my denials. Just an FYI for future applicants, if you have significant student loan debt you will probably be denied.

They use the maximum payment when calculating those. In my case, I am on an income driven plan. The maximum payment for my loans is right at $1,000.00. My actual payment is $208 each month. Because my income driven has to be certified each year, they do not allow the use of that information and use the maximum payment possible. In my case, $1,000 is 20% of my monthly gross income by itself. I'm not sure if this is the norm but I've never encountered underwriting like that before. I just wanted to throw that out there for future applicants so they aren't caught off guard.

Thanks for noting this @Anonymous

I've added a brief statement about it in our "Known factors impacting approvals, limits, and APR's" section of the AOD approvals thread.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AOD FCU Denial Interesting Notes

@PullingMeSoftly wrote:

@Anonymous wrote:So I applied for an auto loan and the Visa signature card. Spoke with a very nice gentleman over the last week or so and today finally got my denials. Just an FYI for future applicants, if you have significant student loan debt you will probably be denied.

They use the maximum payment when calculating those. In my case, I am on an income driven plan. The maximum payment for my loans is right at $1,000.00. My actual payment is $208 each month. Because my income driven has to be certified each year, they do not allow the use of that information and use the maximum payment possible. In my case, $1,000 is 20% of my monthly gross income by itself. I'm not sure if this is the norm but I've never encountered underwriting like that before. I just wanted to throw that out there for future applicants so they aren't caught off guard.

Thanks for noting this @Anonymous

I've added a brief statement about it in our "Known factors impacting approvals, limits, and APR's" section of the AOD approvals thread.

Based on my convos with them, if your total exposure is 2x of your income, I would expect a denial too. some may slip in, but within that is the new norm after the stampede. I think they certainly have now become officially a conservative lender.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AOD FCU Denial Interesting Notes

@RootDet wrote:

@PullingMeSoftly wrote:

@Anonymous wrote:So I applied for an auto loan and the Visa signature card. Spoke with a very nice gentleman over the last week or so and today finally got my denials. Just an FYI for future applicants, if you have significant student loan debt you will probably be denied.

They use the maximum payment when calculating those. In my case, I am on an income driven plan. The maximum payment for my loans is right at $1,000.00. My actual payment is $208 each month. Because my income driven has to be certified each year, they do not allow the use of that information and use the maximum payment possible. In my case, $1,000 is 20% of my monthly gross income by itself. I'm not sure if this is the norm but I've never encountered underwriting like that before. I just wanted to throw that out there for future applicants so they aren't caught off guard.

Thanks for noting this @Anonymous

I've added a brief statement about it in our "Known factors impacting approvals, limits, and APR's" section of the AOD approvals thread.

Based on my convos with them, if your total exposure is 2x of your income, I would expect a denial too. some may slip in, but within that is the new norm after the stampede. I think they certainly have now become officially a conservative lender.

Makes me glad I got in when I did.

FICO 8 (EX) 846 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AOD FCU Denial Interesting Notes

@Anonymous wrote:So I applied for an auto loan and the Visa signature card. Spoke with a very nice gentleman over the last week or so and today finally got my denials. Just an FYI for future applicants, if you have significant student loan debt you will probably be denied.

Sorry for your denials and that you got caught by that DTI issue, @Anonymous . I wish you had seen these reports earlier because this issue has already been documented.

In the original AOD FCU Visa thread (*see below), there were numerous reports of members reporting denials or documentation issues with AOD when there was:

(1) self-employment or unusual compensation

(2) High total DTI in general

(3) Student loan debt repayment calculations.

This just reiiterates that all of these are sensitive issues for them.

Original AOD thread:

https://ficoforums.myfico.com/t5/Credit-Cards/Juicy-new-3-CB-offering-from-local-CU/td-p/5971983

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AOD FCU Denial Interesting Notes

Sorry that happened OP. It sucks they calculate it that way, makes no sense and is very unfair.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores: