- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: American Express preapproval

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

American Express preapproval

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

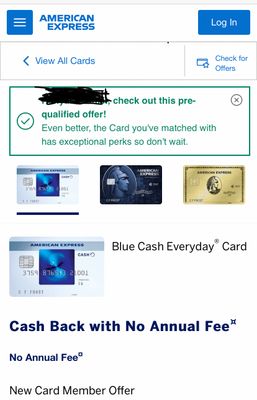

American Express preapproval

Question I go to Amex preapproval site from time to time. I always get message that No cards are a match for me. I figured I would try again just to see. This is what I got not sure if I should apply or not. I have a bankruptcy on my report discharged 2015.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express preapproval

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express preapproval

You are past the 5 year 1 month minimum waiting period after BK that Amex requires, as long as you didn't include them in your BK your odds are good for approval (assuming there is a fixed APR in the terms)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express preapproval

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express preapproval

Agreed with the above. Qualifying questions:

Whats your EX FICO8 score?

overall utilization?

inqyiries in the last 6/12 months?

most recent derog?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amex application

Sorry for the long post

I got called Amex received a preapproval the rep told me cards I was preapproved for. She then proceeded with the application read the terms and disclosures to me. She then said she was waiting on the reply then tells me that I have to speak to another dept so they can verify some information. The next rep tells me that they pulled my Experian report and that I have a fraud alert. I thought he meant he couldn't see the report. He said I need to contact Experian and have them put my phone number on my credit file and once they do give it 24hrs then gave me a number to call Amex back. I hope I didn't waste my time and a hard pull for nothing. Smh

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex application

With a fraud alert on your credit reports - if it's on one it should also be on the reports from the other to major CRAs - creditors are going to take extra steps to verify that it's really you applying for the card. If there are discrepancies in your application vs. what is in your credit report you risk failing verification tests; obviously there was a mismatch in phone numbers so out of caution AMEX noped your application.

This isn't something to shake your head over, every creditor will do this in order to protect themself and the potential victims from further fraud.

If you don't know why the fraud alert is in place you can ask Experian when you contact them to correct the phone number in your credit report. Don't be surprised if you have to follow up with a letter including something like a copy of your drivers license and a utility bill with your name on it.

As long as there is a fraud alert in place your applications for credit will be subjected to this higher level of scrutiny so if you plan to continue to apply for credit it behooves you to address this.

FICO 8 (EX) 846 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express preapproval

the thread title is "preapproval" but the post says "prequalified". Absent a hard pull, can someone explain the specifics of the difference? I've always thought of "prequalified" as nothing more than an enticement based on the lender's marketing information. Preapproved seems like they've actually run some numbers. Of course one could still be denied once all the cards are on the table.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express preapproval

@Anonymous wrote:the thread title is "preapproval" but the post says "prequalified". Absent a hard pull, can someone explain the specifics of the difference? I've always thought of "prequalified" as nothing more than an enticement based on the lender's marketing information. Preapproved seems like they've actually run some numbers. Of course one could still be denied once all the cards are on the table.

Honestly the two terms can pretty much be used interchangeably these days, as different lenders use both terms. Usually it means they "actually ran some numbers" and a person has met some preliminary qualifying criteria.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express preapproval

It varies from lender to lender but the difference tends to be along the lines that a prequalification is based on a less detailed review of your specific credit profile so while the odds of approval are still in your favor the accuracy in predicting approval/denial isn't as high as with a preapproval. You can have a prequalification or preapproval and still be denied.

FICO 8 (EX) 846 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion