- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Amex Blacklist

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Amex Blacklist

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amex Blacklist

Hi Everyone,

I've been reading and learning alot from myFico forums, so I decided to see where I stood with American Express. I wanted to see if I was on their blacklist. I figuired I would be, but I wanted to see if I still show up in their database.

I appliled for the Blue Cash Everyday CC this month that I had previously opened one back in October of 2013. It was a soft pull. I had stopped paying on it in July of 2016 due to financial issues (DW lost her job) and we decided to file BK7. Amex sold my debt to a collection agency in November of 2016 (before official discharge 12/2016), so the collection agency was inlcuded in my BK and not Amex. Amex is no where to be found in my credit reports. It's like I never had credit with them.

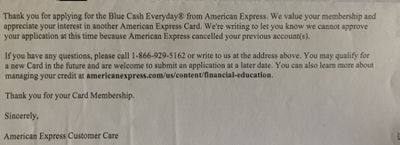

I received the following letter from Amex after my online decline:

I found the following number in another thread 1-800-921-6490 and called it. I entered my credit card number (I still have the card) and low and behold they still have me with a balance of 2,459 dollars. The collection agencey back in November of 2016 tried to collect 2,300. My initial SCL was 2,000.

I would like to have a relationship in my future with Amex, and I was wondering if it would be better to set up a payment plan or just pay them in full once I have the money saved? Also, is there any possiblty that they would decline my payment or payments?

I know I'm not guaranteed to get credit with them again. Also, my BK will stay on my credit reports for the next 8 years (activly also trying to get those remove early). Any advice would be appreciated.

Thanks,

Soxfaninfl

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Blacklist

IIRC, AmEx won't consider applicants until their BK has aged beyond 5 years. When was your BK filed and discharged?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Blacklist

Thanks for the response FinStar. My CR's show "on December 2016 when a Bankruptcy chapter 7-discharged was filed on your Experian Credit Report". TU and EX state the same. My official discharge was 4/2017. I would assume that any creditor would go by what's on my CR's correct?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Blacklist

Even if your BK miraculously fell off your reports yesterday, Amex would retain internal records, and you should probably not mess with removing correct items on your CR. You can do a lot of damage to your scores that way.

If Amex approved you, after $2k+ payment, you'd be looking at the card with a toy limit, stuck in purgatory for a long time. It's like paying one time annual fee of $2500 for $500.00 card. There is not even a guarantee that they will approve you after you pay. They may hold a grudge for another 10 years, whether you pay or not

Paying lenders after they have been included in BK is a ridiculous and strange idea to me, especially considering that the idea behind is to give you a fresh start and some breathing room.

Save your money, put it in savings or something. It may come in handy next time life happens.

I think the damage there is already done, and you should look into other lenders for the time being.

For now, your best bet are BK friendly lenders and their cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Blacklist