- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: Amex Platinum Denial

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Amex Platinum Denial

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amex Platinum Denial

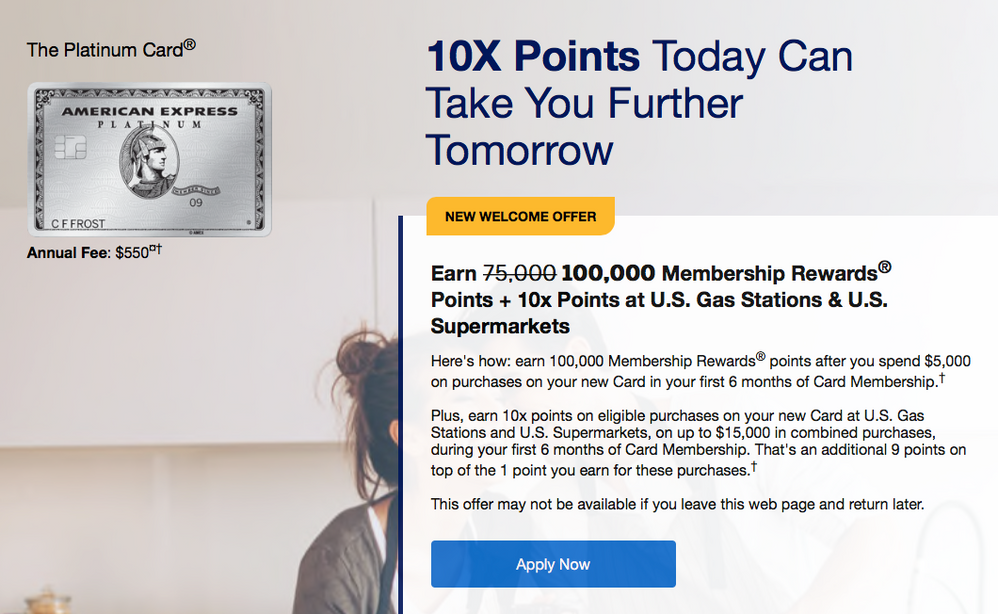

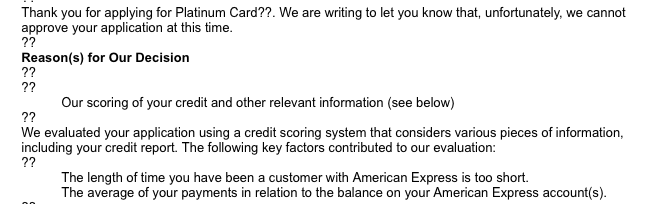

I had been researching the Amex Platinum card recently and I was able to trigger the 100K Welcome Offer with 10x on Grocery and Gas this weekend by just googling "American Express Platinum" and choosing 1 of the first 2 links. I applied on Sunday and instantly got the 7-10 day message. I honestly was shocked. In total I had gotten 4 cards in a row with no denials and without seeing the 7-10 day message. When I got the email to view my application progress I was able to view the reasons for my denial.

-The length of time you have been a customer with American Express is too short

-The average of your payments in relation to the balance on your American Express account(s).

My Amex History:

Blue Cash Everyday (Dec 2019) Authorized User

Blue Cash Preferred (April 2020)

Blue Business Cash (September 2020)

Amex Gold (November 2020)

Blue Business Plus (January 2021)

At the time of application, I had been with Amex for just under 14 months (I applied Sunday and Tuesday I hit 14 months). I know that isn't extremely long, but in my other applications which were even shorter than 13 months, that had never been an issue. All 4 of my applications have been instant approvals. So this reason caught me off guard.

The 2nd reason about my average of payments, in hindsight I understand, but going into it I didn't give it a 2nd thought. I have always paid my Amex cards in full before the statement date. On the Blue Cash Every Day and Blue Business Cash I had a $0 balance. On the Blue Cash Preferred I had a $19 balance. The Gold Card had a $349 balance but my closing date is 3 weeks away.

The Blue Business Plus card I believe was the kicker. In January I bought something that cost $3000. Since I have 0% interest for 12 months I decided to to take my time paying it off. When the statement came out my minimum payment was $35 but I paid $150. When I applied for the Platinum card my BBP balance was $2850 out of my $9000 limit. My utilization on that card was 31%. On my credit report I also am reporting a $5 balance on my NFCU Cash Rewards card and $10 balance on my Apple Card. My other 14 cards are all reporting $0 balances.

I contemplated doing a reconsideration so I called in to Amex. I was informed to do the reconsideration they'd have to run my credit. I really didn't want a hard pull so I didn't go through with it. I saw on my denial letter that the soft pull they used in my application was from Feb 3. My reported score is/was 736 on Experian. Nothing has changed on my report since then per MyFico so I was thinking it'd likely be a wasted pull. I'm not sure when I'll apply again, especially considering I plan to only pay $200 a month on the business card each month and then pay it off before interest is charged in 11 months.

![Capital One Quicksilver | $4000 | July 2013 [AU]](https://ecm.capitalone.com/WCM/card/products/quicksilver-card-art.png)

![Capital One Venture X | $40,000 | September 2023 [AU]](https://ecm.capitalone.com/WCM/card/products/venturex-cg-static-card-1000x630-2.png)

![Chase Amazon Prime | $12,000 | March 2020 [AU]](https://creditcards.chase.com/K-Marketplace/images/cardart/prime_visa.png)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Platinum Denial

You've obtained 4 cards from AMEX in the past 11 months, with 3 of them being in the past 6 months. I think this is just a case of moving a bit too fast.

And you're AU time doesn't really count as time with AMEX.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Platinum Denial

@Anonymous wrote:You've obtained 4 cards from AMEX in the past 11 months, with 3 of them being in the past 6 months. I think this is just a case of moving a bit too fast.

And you're AU time doesn't really count as time with AMEX.

Agreed. AMEX doesn't consider AU history as your own so basically you've been with them for less than a year. You have four applications in 10-11 months, three apps in the last 6 months. I would have taken the recon chance with the HP just to see how they would have evaluated your app. Taking a pull is nothing really and the bigger hit will come from the new account had they approved the Platinum card on recon

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Platinum Denial

@Anonymous wrote:You've obtained 4 cards from AMEX in the past 11 months, with 3 of them being in the past 6 months. I think this is just a case of moving a bit too fast.

And you're AU time doesn't really count as time with AMEX.

Oh ok. Thank you! I guess I was counting the time with AU too since on my first card on my own it says member since 2019 which is when I became an AU.

![Capital One Quicksilver | $4000 | July 2013 [AU]](https://ecm.capitalone.com/WCM/card/products/quicksilver-card-art.png)

![Capital One Venture X | $40,000 | September 2023 [AU]](https://ecm.capitalone.com/WCM/card/products/venturex-cg-static-card-1000x630-2.png)

![Chase Amazon Prime | $12,000 | March 2020 [AU]](https://creditcards.chase.com/K-Marketplace/images/cardart/prime_visa.png)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Platinum Denial

@simplynoir wrote:

@Anonymous wrote:You've obtained 4 cards from AMEX in the past 11 months, with 3 of them being in the past 6 months. I think this is just a case of moving a bit too fast.

And you're AU time doesn't really count as time with AMEX.

Agreed. AMEX doesn't consider AU history as your own so basically you've been with them for less than a year. You have four applications in 10-11 months, three apps in the last 6 months. I would have taken the recon chance with the HP just to see how they would have evaluated your app. Taking a pull is nothing really and the bigger hit will come from the new account had they approved the Platinum card on recon

Thank you for the information about the AU situation and recon feedback. I guess I have 30 days from my application date to still recon. I'll think about it.

Before I started my credit rebuild in August 2019 I had a Fico score of 583. A personal goal of mine had been to get into the "Very Good Credit" category which starts at 740. This is the 2nd time I've been on the cusp of 740. Last time I was at 738 and I applied for a card and my score dipped before I actually hit 740.

I guess though in the big scheme of things getting 100K MR points would be more satisfying than seeing I have Very Good Credit. 😂🤣😂 Thank you again for the feedback !

![Capital One Quicksilver | $4000 | July 2013 [AU]](https://ecm.capitalone.com/WCM/card/products/quicksilver-card-art.png)

![Capital One Venture X | $40,000 | September 2023 [AU]](https://ecm.capitalone.com/WCM/card/products/venturex-cg-static-card-1000x630-2.png)

![Chase Amazon Prime | $12,000 | March 2020 [AU]](https://creditcards.chase.com/K-Marketplace/images/cardart/prime_visa.png)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Platinum Denial

I'd give the recon a chance.

100K points is VERY useful - I only got 60K points when AMEX upgraded me from Gold to Platinum.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Platinum Denial

@4sallypat wrote:I'd give the recon a chance.

100K points is VERY useful - I only got 60K points when AMEX upgraded me from Gold to Platinum.

Thank you so much for your suggestion and feedback! I appreciate it! I am strongly considering going for a recon!

![Capital One Quicksilver | $4000 | July 2013 [AU]](https://ecm.capitalone.com/WCM/card/products/quicksilver-card-art.png)

![Capital One Venture X | $40,000 | September 2023 [AU]](https://ecm.capitalone.com/WCM/card/products/venturex-cg-static-card-1000x630-2.png)

![Chase Amazon Prime | $12,000 | March 2020 [AU]](https://creditcards.chase.com/K-Marketplace/images/cardart/prime_visa.png)