- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Apping For A USBank Personal AND Biz Card (Can Be ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Apping For A USBank Personal AND Biz Card (Can Be Approved For Both?)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Apping For A USBank Personal AND Biz Card (Can Be Approved For Both?)

Hello, can I app for both a USBank personal card and business card, one right after the other? If I get approved for one, will my chances of being approved for the other decrease?

The reason I'm asking is, because I see 2 USBank cards with 0% APR balance transfer offers. The biz card is attractive because it would allow me to slide some debt off my personal credit report (it would only report on my business reports). But I wanted to make sure which card would give me the highest CL (willing to recon if necessary and take the additional HP for both cards x 2).

Please let me know if this is a dumb idea lol.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Apping For A USBank Personal AND Biz Card (Can Be Approved For Both?)

Since you're particularly asking about the odds, focus on the application that would be of priority. Also, business application discussions are reserved for the Business Credit section of the forums - just FYI.

That said, unless you really have a well-established relationship with USB, the odds of obtaining both back-to-back, would be trivial at best. Then again, we don't know enough about your profile, scores, utilization, other tradelines/limits, or whether you have a USB relationship, what your inquiries and/or new accounts are like in the past 12 months or so, etc.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Apping For A USBank Personal AND Biz Card (Can Be Approved For Both?)

@FinStar wrote:Since you're particularly asking about the odds, focus on the application that would be of priority. Also, business application discussions are reserved for the Business Credit section of the forums - just FYI.

That said, unless you really have a well-established relationship with USB, the odds of obtaining both back-to-back, would be trivial at best. Then again, we don't know enough about your profile, scores, utilization, other tradelines/limits, or whether you have a USB relationship, what your inquiries and/or new accounts are like in the past 12 months or so, etc.

FICO scores right now range from 770-805, about $200K income, 14% util overall, 5 other credit card accounts with limits from $20k to $45k, 0 inquiries or new accounts in past 12 months. I've had a prior relationship with USBank a few years when I had the Cash+ Visa card. I paid in full every month and was always in good standing. I closed it when they dropped the reward category I used it for. I don't currently have a relationship with them.

Normally I would just app for the biz card, as a higher limit would be likelier, but I've read on here that the Business Platinum Card is only dishing out $3k-$5k max to most people.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Apping For A USBank Personal AND Biz Card (Can Be Approved For Both?)

One can easily obtain very decent SLs out-of-the-gate with USB whether personal and/or business. It just depends what your overall profile looks like for USB on the personal and business side + what they are willing to approve. My suggestion would be to prioritize the card that would be of benefit to you in the long term.

If you feel your profile can support both, then submit both apps, starting with the personal one first. Just keep in mind that if you already have higher CLs elsewhere, then it's possible USB may only approve a 'right-sized' CL -- they won't necessarily match your other lines in a variety of cases. If you have substantial deposits on both fronts, then you can leverage that part of your USB relationship.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Apping For A USBank Personal AND Biz Card (Can Be Approved For Both?)

I Don't Think it's a Dumb Idea at All, I Just Did it.. Lol

After Several Recent New Accounts, I Saved US Bank for Last, Knowing they Pull TU for Me, and I Suprisingly Only Had 2/6 2/12 7/24 Inquires & 2/6

5/12 on New Accounts.. I've

Had a Business Silver Checking for 10years Sole Proprietor, So I Applied and Got the 7-10 Notice

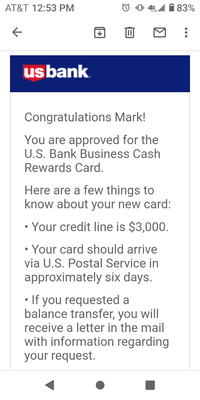

After 10 Long Days & Memorial Weekend, I Got the Email"

"Congrats Approved for 3k"

For Business Cash Rewards Card, on June 2nd Showed Up in My Account.. Next Day I Called UW for another Hard Pull Increase, So that's Now 4 Inquires, 2 New from Them,

CLI Pending Again, Email, Call or Letter..

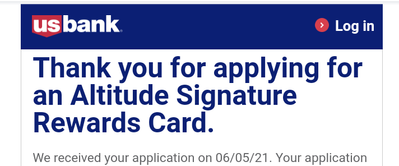

So I Said What the Heck, I Really Want the New Altitude Connect Personal Card, Applied Yesterday, Pending Also.. I'll

Let you Know..

With Your Nice Scores, Income, Low Inquires and New Accounts

You're Looking Good for Both,

Good Luck and Let Us Know!

Started 10/17 Ex 593 EQ 605 TU 620

Home Depot 25k

ICCU Premier Rewards Visa 20k

America First CU Signature Rewards 23.5k

PenFed Gold Visa 11k

Penfed Platinum Rewards 15k

Penfed Power Cash Rewards 24k

FNBO World 13.6k

NFCU Platinum 23k

NFCU Cash Rewards 9k

BMO HARRIS Cash Back 11.5k

Citi Double Cash. 8.3k

CITI Simplicity 6.8k (PC'd to Rewards+ 6/21)

BofA Cash Rewards 9.1k

Amex Hilton Honors 3.1k

Discover It 3k

Lowe's Advantage 25k.

>BUSINESS CARDS

Amex Business Lowe's 3k

Amex Blue Business Cash 13.8k.

AMEX Blue Business Plus 25k

BMO Harris Biz Platinum Rewards 7.5k

Lowe's 4 Pros 13k

US Bank Triple Cash Rewards 8k

Desert Financial CU Elan 20k

US Bank Platinum 25k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Apping For A USBank Personal AND Biz Card (Can Be Approved For Both?)

In truth though that's still a YMMV situation, and you also have an existing relationship with the ten year old Biz Checking account. It's no secret that USB can be a "relationship bank", more so when a person wants to open more than one account in a short span. It's definitely a good thing being 0/12 though so there's that.

As mentioned earlier I'd definitely app the card you want most first, then app the second one without the expectation of being approved.

Good Luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Apping For A USBank Personal AND Biz Card (Can Be Approved For Both?)

So True! @Anonymous First I Want to Thank You, for All The Knowledge and Excellent Advice,

I've Been Rebuilding Since 10/17

Started Fico8 593 EX, Just Joined After Reading and Absorbing Info for 3 Years,

I Got a Brand New Travel Trailer Last Year "0" down and Refi'd my Truck for the Same Payment as

The Original Truck Payment and Just Got a New Car w "0" down,

& 3k Negative Equity on Trade 0.9%, Grateful for You and Others on this Forum..

The Relationship May Help, Hopefully! For My 2nd Card,

And You're Right, If @Rikkumz

Has the Profile and Really Wants the Cards, Then Go for Both! And Like Alot Have Said Here, There's Other Lenders and Options..

I Really Like BMO Harris, Just Opened a Biz Checking Account

And It "Came With a Biz Platinum Rewards Card" and Got Approved for "Cash Back Card"

Instant 2 Cards and Biz Account

Pretty Good Welcome Bonus.. Lol

I Will Repost When I Get Results

On 2nd US Bank Card and DP's

Will Help Others, Thanks Again!

Started 10/17 Ex 593 EQ 605 TU 620

Home Depot 25k

ICCU Premier Rewards Visa 20k

America First CU Signature Rewards 23.5k

PenFed Gold Visa 11k

Penfed Platinum Rewards 15k

Penfed Power Cash Rewards 24k

FNBO World 13.6k

NFCU Platinum 23k

NFCU Cash Rewards 9k

BMO HARRIS Cash Back 11.5k

Citi Double Cash. 8.3k

CITI Simplicity 6.8k (PC'd to Rewards+ 6/21)

BofA Cash Rewards 9.1k

Amex Hilton Honors 3.1k

Discover It 3k

Lowe's Advantage 25k.

>BUSINESS CARDS

Amex Business Lowe's 3k

Amex Blue Business Cash 13.8k.

AMEX Blue Business Plus 25k

BMO Harris Biz Platinum Rewards 7.5k

Lowe's 4 Pros 13k

US Bank Triple Cash Rewards 8k

Desert Financial CU Elan 20k

US Bank Platinum 25k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

US Bank Approval/Denial Process

A question for everyone who got applied for a US Bank card recently but wasn't immediately approved...what was your "status" before you got confirmation of approval?

When I apped on 6/13...I got a message that my application couldn't be instantly approved and to wait however many days and so on and so forth.

When I called the automated UW line to check the status of my application this morning on 6/16 (it's only been 3 days since I apped)...I get the message "Your application was unable to be approved" and I will be receiving "documentation" within however many days.

Is that a flat out rejection or is it just too early before my application has actually been reviewed and the status changed? Have any of you experienced the same thing?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Approval/Denial Process

It's a denial. You'll get a letter in the mail saying you have too many new accounts or too many inquiries in the last 12 months.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Approval/Denial Process

@MrDisco99 wrote:It's a denial. You'll get a letter in the mail saying you have too many new accounts or too many inquiries in the last 12 months.

I have 0 new accounts or inquiries in the last 12 months. And only 1 in the last 24 months that drops off my report completely in July.

I currently have 14% utilization with FICO scores ranging from 770ish to 800ish and total credit limits less than half of my reported income.

If this is a denial...I'm honestly shocked, as it's the 1st time I've been denied for credit since like 2003.