- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: Apply for AMEX Gold vs Chase CSP with my curre...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Apply for AMEX Gold vs Chase CSP with my current stats?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Apply for AMEX Gold vs Chase CSP with my current stats?

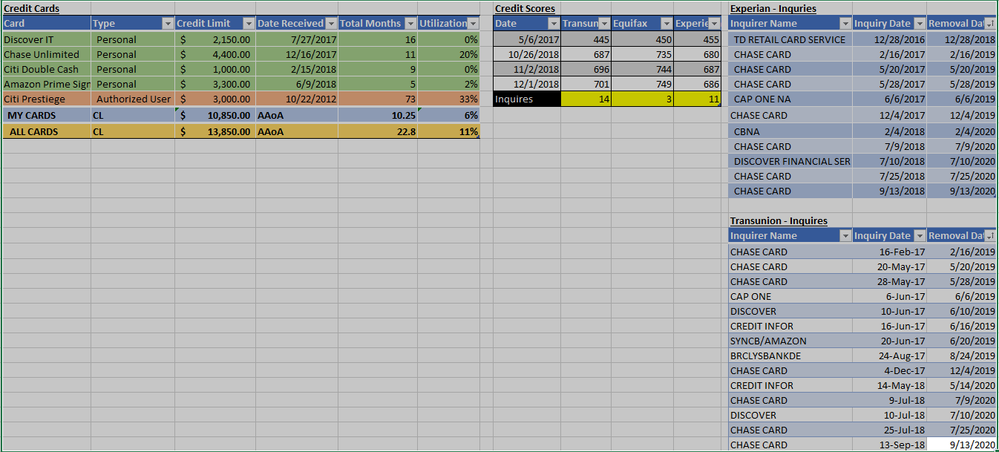

Below is an Image of the break down of my current credit profile.

I really want a travel credit card as it's the only thing missing from my current cards and I'm torn between the CSP and the Gold.

Pros for the CSP:

- Would be nice to have that as my 5th card for the 5/24 rule

- Already have a ton of UR points

- I mainly bank with chase

Pros for the Gold:

- Been wanting to get in the AMEX product line

- I could get the Limited Rose gold (purely flex value ik)

- I think it offers better rewards for my spend than the CSP

Negs for the CSP:

- Don't want to risk more unnecessary hard pulls

- Less likely to be approved than the AMEX Gold

Negs for the Gold:

- Isn't a chase card for the 5/24

- Not UR points

- My Experian score is the lowest currently

**Above all else**: I DON'T want anymore hard pulls without new credit, so just looking for input on what is the safest bet

P.S. For what is matters, credit krama has me as "EXCELLENT APPROVAL ODDS" for the Gold and "FAIR APPOVAL ODDS" for the CSR. Neither of the direct pre-approvals sites through Chase/AMEX shows me prequalified for the Gold/CSP.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Apply for AMEX Gold vs Chase CSP with my current stats?

How about just get both? That's if you are ok with the AFs. Some places don't accept Amex. It would be great to have a different network to fall back on.

Once your in with Amex. If you wanted any thing else they offer in the future, there's a good chance it will be a SP.

So what exactly are those two HPs going to do to your profile? IME, once you pass a certain number of HPs. The rest don't have much of an affect if any.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Apply for AMEX Gold vs Chase CSP with my current stats?

OP, you have a ton of Chase HP, 6-7 per CRA , but only two Chase cards

Were you asking for CLI or were you applying and they denied you?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Apply for AMEX Gold vs Chase CSP with my current stats?

@Anonymous wrote:

P.S. For what is matters, credit krama has me as "EXCELLENT APPROVAL ODDS" for the Gold and "FAIR APPOVAL ODDS" for the CSR. Neither of the direct pre-approvals sites through Chase/AMEX shows me prequalified for the Gold/CSP.

You may already know this, but I wouldn't put much stock into what credit Karma is showing in regards to approval odds. I would stick with the Lender sites for that to be more accurate.

| Total CL: $321.7k | UTL: 2% | AAoA: 7.0yrs | Baddies: 0 | Other: Lease, Loan, *No Mortgage, All Inq's from Jun '20 Car Shopping |

BoA-55k | NFCU-45k | AMEX-42k | DISC-40.6k | PENFED-38.4k | LOWES-35k | ALLIANT-25k | CITI-15.7k | BARCLAYS-15k | CHASE-10k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Apply for AMEX Gold vs Chase CSP with my current stats?

nice job getting your credit scores up to the 700+ range in a short amount of time.

I'm no expert but have experienced some of the questions you've asked yourself. Over the past few years I have sought out Chase, Amex, etc. for credit products. I'll try to answer putting myself in your position or echoing some of the wiser members of the forum

-RonM21 makes a point all veterans would tell you, ignore the Credit Karma approval odds. They are not accurate and apparently based on a shallow review of your data and other members' data. I've been approved for cards that were poor or fair odds. There are data points of 'excellent' approval odds getting denied. Instead check for pre approvals from the bank direct. In my experience, I was in no position to get the Sapphire Preferred because I had opened 4 credit cards in 2018 but Chase sent me a green check/pre-approval offer with a fixed APR so I took a chance and replied to the offer - was approved, but barely - got the starting limit of $5,000. I had already been declined for the card previously for having too many recent cards(5/24)

-I'm assuming a lot of the Chase inquiries on EX and TU were denials for new cards and CLIs? what was the feedback they provided?

have you spoken to reconsideration on those occassions to have a more in depth discussion about their denial reasons? those things are

what you want to focus on when deciding when it is right to apply.

-noticed AAoA for your own accounts is under 1 year. And that your Freedom Unlimited is about to be 1 year old and your Chase Amazon card is about to be 6 months old. Not knowing your income and other debt/obligations and assuming all derogatory and lates were removed from your profile like you described and there's no oversights that could be bringing down your score then I would say that any denials you get would be from the age of your credit history.

-how much do you travel? I see you have some nice cash back options with the Discover rotating 5%, the double cash back for first year. You didn't really need the Citi DC until year 2 of Discover. I'm not too familiar with Amazon fine print but I'm guessing you could get 5% back on Amazon Fresh? and of course Whole Foods is grocery so there's tons of cash back on top of when Discover has the grocery and wholesale categories on 5%. The Citi DC also beats the FU. ....so anyway yeah - what type of travel have you done recently and what do you expect in the next two years? the Gold card will really only get you direct flight purchase bonuses+incidental reimbursement. Right now the Gold Card strength is dining and grocery(which you have as Discover bonus category and possibly Prime card) so although the MR points have a strong value you're only going to benefit if you're flying and booking direct/amex portal, can't book through OTAs.

With SP you get a lower return per purchase but a broader travel category. You could transfer saved up UR points from your FU.

so I guess you need to

a) figure out what type of travel purchases you'll make and determine which card will provide better returns

b) if the answer is Sapphire then I think you need to look back on the 14 Chase inquiries that I see on your Excel sheet. Work on the specific denial reasons...if I understand correctly the last was mid September? That is close enough to be relevant towards your current profile.

My advice

-safe and hopefully smart play -------I would not apply until FU was at least 12 months old and Prime is at least 6 months old. That's not too far away. Obviously it would be best to have you AAoA be 24 months + but if you really have to get the Rose Gold then apply for the AMEX shortly before their offer ends, this way you're doing it when your credit is a wee bit more aged.

-fast and loose play - -------you could theoretically apply for both at the same time(same day) if you really needed to have both and were prepared to meet the spending requirements for the SUB.

if you want a referral for either card and it's permitted in the forum I can DM

either way, good luck on your journey. Would like to hear how you play it and the results.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Apply for AMEX Gold vs Chase CSP with my current stats?

I wouldn't put much emphasis on Credit Karma approval odds. My experience was when they had a card with excellent approval odds, I was denied, but with poor to fair, I was approved. They also have my approval odds for the CSP at fair and the CSR at excellent. I find that somewhat strange. However, since I am over 5/24, I have no chance of approval for either one.

FICO 9 EX 780

AMEX - Platinum, BCP, Delta Platinum, Simply Cash Plus, Blue Business Cash (Business)

Barclay - Arrival Plus, AAdvantage Aviator

Capital One - Venture, Sparks (Business)

Chase - FU, CSP

Citi - Premier, PLOC

Discover It Miles

TD Cash Visa

US Bank Altitude Reserve

Wells Fargo Propel AMEX

PNC Points Visa

FNBO Evergreen Visa

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Apply for AMEX Gold vs Chase CSP with my current stats?

As for the all the chase hard pulls. I really didn't understand how credit applications work. So I just applied to a bunch of chase products, before I finally went resources like YouTube and MyFico to understand I was making a huge mistake and needed to start with a secured card.

Yeah I definitely don't trust the credit krama site which is why I wanted to bounce ideas off you all here.

I think I'm leaning towards the Amex Gold, but am going to wait till right before the cut off date of the benefits to apply to give myself the best chance possible!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Apply for AMEX Gold vs Chase CSP with my current stats?

If you really need a travel card, do the math and see which one makes more sense.

If it's the CSP you want, that's the one you should go for first. Worst case scenario, they say no.

I made the mistake of not going for the card I needed, and went instead with the one I merely wanted.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Apply for AMEX Gold vs Chase CSP with my current stats?

From what I have read the Amex Gold card is easier to get because it is a charge card. Based on your DPs I would say you have a good chance with the Gold. CSP will always be there when you get under 5/24 and it will give your accounts time to age and grow.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Apply for AMEX Gold vs Chase CSP with my current stats?

With the Amex gold if your E is around 670 you have a good shot of getting it. I was just approved last night with a 660 EX. Because you have UR point you may want to try for the CSP. Do you have any trips planned coming up? If not wait, unless you want to get the rose gold. But there is no crime to have both if you can meet the min spend and rack up points.