- myFICO® Forums

- Types of Credit

- Credit Card Applications

- BB&T Soft Pull Application

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

BB&T Soft Pull Application

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

BB&T Soft Pull Application

I got a soft pull approval last year and don't remember the process. Once you receive your pre approval, and select "Accept your offer," do you see your approved credit limit prior to actually accepting the card? So similar to Apple, can you decide not to take it if you're not happy with the limit or once you see the limit you've accepted a new account? Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BB&T Soft Pull Application

@Tito1183 wrote:I got a soft pull approval last year and don't remember the process. Once you receive your pre approval, and select "Accept your offer," do you see your approved credit limit prior to actually accepting the card? So similar to Apple, can you decide not to take it if you're not happy with the limit or once you see the limit you've accepted a new account? Thanks!

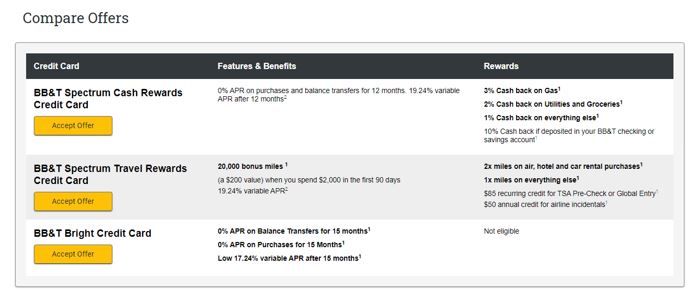

If I recall correctly, you don't see the CL before the approval, but I think you do see the APR. Here is an old one I took a pic of earlier this year.

Potential Future Cards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BB&T Soft Pull Application

Yes I saw that, thanks.

Do you recall if once you see that screen, it routes you to input ALL your info again? Want to make sure I'm not walking into a cold app hard pull when I have the offers. I know a hard pull is always a possibility.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BB&T Soft Pull Application

@Tito1183 wrote:Yes I saw that, thanks.

Do you recall if once you see that screen, it routes you to input ALL your info again? Want to make sure I'm not walking into a cold app hard pull when I have the offers. I know a hard pull is always a possibility.

I am going to let someone else answer this. Not because I don't want to answer ![]() , but if you look up my name and BB&T and do a search on the forums, you'll read of all my difficult escapades as it pertains to BB&T and the pre-q. What I went thru is definitely not the norm.

, but if you look up my name and BB&T and do a search on the forums, you'll read of all my difficult escapades as it pertains to BB&T and the pre-q. What I went thru is definitely not the norm. ![]() Going to tag @GApeachy and see if she can help

Going to tag @GApeachy and see if she can help

Potential Future Cards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BB&T Soft Pull Application

@Wavester64 lol, you did ride the rollercoaster didn't ya. But hey, you landed it....that's all that counts.

@Tito1183 As far as hp vs. sp, the normal "thing" to happen with the BB&T prequal is that once you receive the offers you immediately accept one card which then takes you to the application page. From there you will fill out all your info. that's on your Equifax report (key- input exactly as it is on your Equifax credit report ie. address- current) from there you'll answer some trick questions, could have to do with you or a close relative and then you'll upload (sometimes) your driver's license # and such. Then you'll get your answer and it should not come at the price of a hard pull. DP's suggest the app via prequal/immediate app is how it's done. I've done it 4 times. All sp's.

My advice to you is:

1. pull your Equifax credit report via Credit Karma (addresses, employment, etc) and have it on hand during the app.

2. do not back out of the app and later return and expect it to be a sp. That's where it can get tricky.

3. prequal and apply at the same time. Don't delay expecting it to return only not to see it and cold app; you'll get a hp. A previous prequal will not protect you from a hp via cold app.

Good Luck, let us know if we can help further and/or if you went for it.![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BB&T Soft Pull Application

@Tito1183 wrote:Once you receive your pre approval, and select "Accept your offer," do you see your approved credit limit prior to actually accepting the card?

No, you do not.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BB&T Soft Pull Application

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BB&T Soft Pull Application

Great info, thanks for sharing @GApeachy

Do you know if this is still the process in 2021? Are they still using Equifax, or now using TU since the merger with Suntrust? I'm considering pulling the trigger myself...when app'ing for multiple cards with them, is it advised to do the same day...or wait--what's the suggested timeline?

Thanks in advance!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BB&T Soft Pull Application

@growthadvocate wrote:Great info, thanks for sharing @GApeachy

Do you know if this is still the process in 2021? Are they still using Equifax, or now using TU since the merger with Suntrust? I'm considering pulling the trigger myself...when app'ing for multiple cards with them, is it advised to do the same day...or wait--what's the suggested timeline?

Thanks in advance!

They are still keeping things separate (or business as usual) until their products as a combined [Truist] entity are consolidated. So, if you follow @GApeachy's steps as outlined above during the pre-qualification process, it should go as expected.

As far as doing 2 products at once, not sure. This could trigger a fraud or verification flag (some folks reported some processing issues in the past), but maybe GApeachy (or others who have tried this fairly recently) can provide you with some feedback.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BB&T Soft Pull Application

Thoughts @GApeachy ?

I know that you mentioned having multiple accounts--what's the best sequence of applications if objective is to get more than 1 card?