- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Barclay CC let's put our heads together

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Barclay CC let's put our heads together

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclay CC let's put our heads together

GARDEN GOAL: MARCH 2014

LAST APP: 08/20/2013

---=[NORTHBOUND]=---

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclay CC let's put our heads together

DISCOVER IT- 5.2K BARCLAY REWARD- 3.2K

PAYPAL REWARDS -6K VICTORIA SECRETS -1750

USAA AMEX-5.5K CITI TY PREFR 3.1K(NPSL) CHASE FREEDOM -1K

SPORTSMAN VISA- 8K AMEX ED PRFD- 8.5

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclay CC let's put our heads together

@phillyguy12 wrote:open dec 2012 instant approval 1300 line

apped khols feb 2013 approved 1000

apped amex bce april 2013 approved 1000

june 2013 barclay auto cli double line to 2600

june 2013 amx 3x cli

normal usuage on barclay 600+ month pif after stmt cuts some months carry small bal

no AA yet

Thanks phillyguy your case is a little different you app'ed after approval and still got the double CLI

As everyone else you did carry a balance somethimes interesting

Have you done your research of the CC?

Does it fit your spending?

Do you have a plan for the bonus w/o going into debt?

Can you afford the AF?

Do you know the cards benefits? Is it worth the HP?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclay CC let's put our heads together

@djc1puno wrote:

Phillyguy...so I've append and opened a few cards in that first 6 months of barclay approval and still got ur cli! Great info as a lot a people that app or accumulate inqs within that first 6 months have not receive cli...barclay truly is confusing...but then again u still put good usage on it per month. Maybe that helps a lot

I noticed that too

Have you done your research of the CC?

Does it fit your spending?

Do you have a plan for the bonus w/o going into debt?

Can you afford the AF?

Do you know the cards benefits? Is it worth the HP?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclay CC let's put our heads together

@staifokuzed wrote:

So what i am gathering. No new accounts or inquires ever. Use it or lose it. Pay them large payments every month as they like cash flow. Report ur balance and dont try to lower utility by paying before statement. It is as if u have just got married to an extremely sensitive computer. That gets super sensitive when u seek new friends and will over react as if ur actions were the worst thing that has happened to it. So what do u do at this point. In January i was terrified i would have AA cause of an auto loan. Not so much anymore. I do like Barclay and have even open an online savings with them. I am waiting for a fresh SP from them as may 28 was the last peek they had. I will be sure to of any changes.

Lol on the computer and new friends

Have you done your research of the CC?

Does it fit your spending?

Do you have a plan for the bonus w/o going into debt?

Can you afford the AF?

Do you know the cards benefits? Is it worth the HP?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclay CC let's put our heads together

the only AA if you want to consider it AA is they took their rewards boost feature away from me, i was comparing offers w/ them and discover then it was gone, when i emailed them they just said not all accounts have it,

Barclay's Mastercard-13.5k

Credit Union Visa-1k

Discover-24k, Khols-2k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclay CC let's put our heads together

@phillyguy12 wrote:the only AA if you want to consider it AA is they took their rewards boost feature away from me, i was comparing offers w/ them and discover then it was gone, when i emailed them they just said not all accounts have it,

Oh wow thought that was for all cardholders thanks for the FYI very valuable info

Have you done your research of the CC?

Does it fit your spending?

Do you have a plan for the bonus w/o going into debt?

Can you afford the AF?

Do you know the cards benefits? Is it worth the HP?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclay CC let's put our heads together

yea i use it alot for stuff they give 2x pts for so i assme thats why there are a few posts on here about it randomly disappering from accounts

Barclay's Mastercard-13.5k

Credit Union Visa-1k

Discover-24k, Khols-2k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclay CC let's put our heads together

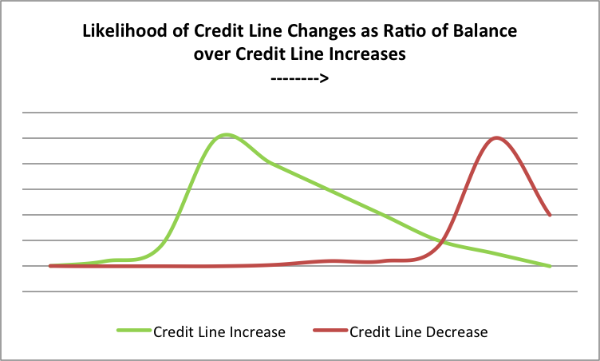

Utilization going from left to right. Likelyhood of CLI or CLD from bottom to top

Taken from Barclay Ring blog

Starting Score: 515

Starting Score: 515Current Score: EQ08 711 EX08 731 TU08 735

Goal Score: 740+

Amex BCP $25k | Discover IT $15.7k | Cap 1 QS $10k | PSECU $10k | Citi DC $9300 | Citi DP $6800 | Barclay Ring $6500 | PayPal Extras MC $5045 | DCU $5000 | Chase Slate $5000 | Barclays AA $4100 | Chase Freedom $4000 | Union Plus $1000 | Target $500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclay CC let's put our heads together

Here's what Barclays thinks:

We define “bad behavior” as:

- Credit losses or charge offs – these are balances charged by our cardmembers who subsequently stopped making monthly payments

- Balance attrition - these are balances that, for example, were charged by our cardmembers who then decided to transfer them to another lender

- Inactivity – opening a card but never using it to make purchases or transfer balances

And the “good behavior” is:

- Carrying a balance and making at least a minimum payment every month (to avoid becoming a credit loss)

- Transferring a balance to our card - from another lender’s card

- Actively using the card every month

Starting Score: 515

Starting Score: 515Current Score: EQ08 711 EX08 731 TU08 735

Goal Score: 740+

Amex BCP $25k | Discover IT $15.7k | Cap 1 QS $10k | PSECU $10k | Citi DC $9300 | Citi DP $6800 | Barclay Ring $6500 | PayPal Extras MC $5045 | DCU $5000 | Chase Slate $5000 | Barclays AA $4100 | Chase Freedom $4000 | Union Plus $1000 | Target $500