- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Chase Bank, how I covet thee 5/24 CC!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Chase Bank, how I covet thee 5/24 CC!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Bank, how I covet thee 5/24 CC!

I feel like such a cheater! NFCU across the street from Chase, watching me walk in. I still love you NFCU.

Your FICO credit scores are not just numbers, it’s a skill.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Bank, how I covet thee 5/24 CC!

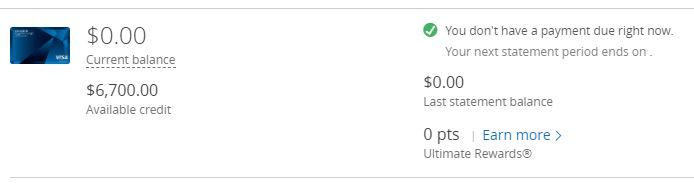

In short, I walked out of Chase approved for a CSP with $6,700 SL.

I unfroze all of my credit bureau files for today

I was 10 minutes early for my appointment time and was shown in a few minutes after my arrival. Debbie was my personal banker. She asked if I was there to apply for a credit card and if I was a current customer. I told her that I had my auto lease through Chase and that I wanted to see what CC I was pre-approved for. I told her that I was 5/24 and that in my Chase account page, Just For You offers, showed me pre-qualified offers but not for the card that I wanted. She asked which card and I told her the Southwest Rapid Rewards Priority CC.

Debbie told me in the 15 years she has been working at Chase, she has never seen pre-approvals for SWRR CC in branch. She said she would take a look anyway.

After verifying my identification employment and income, she pulled my offers and I was Pre-Approved for all of Chase's Core CCs. She said the reason I was only pre-qualified online is because I haven't updated my income in the last 12 months.

She showed me the screen and sure enough, I was pre-approved for all of Chase's Core CCs. No Southwest cards were offered pre-approved. Interestingly though, United's Explorer CC was shown as pre-approved.

Again, Debbie said that the Co-Branded cards are typically not offered as pre-approved in branch, only the core CCs.

Debbie stated that with preapprovals, there is a 98% approval rate. The 2% not approved is due to changes in someone's credit report since the AR. So I decided to go for the CSP. Debbie said to not be surprised if it "went to lending" since I am currently 5/24. Fifteen seconds after she submitted the application it came back approved for $6,700 at 21.74% APR.

Data points

I had a $1000 CO with WAMU in 2008 and it appears that Chase has forgiven me for this transgression.

I have been 5/24 since Nov 2018 and the pre-qualified on Chase.com was a solid offer as it was a pre-approval in branch.

The only relationship I have had with Chase Bank is my Subaru Lease since Aug 2018.

Chase does not offer pre-qualified or pre-approvals for co-branded cards in branch.

I took an HP on Transunion

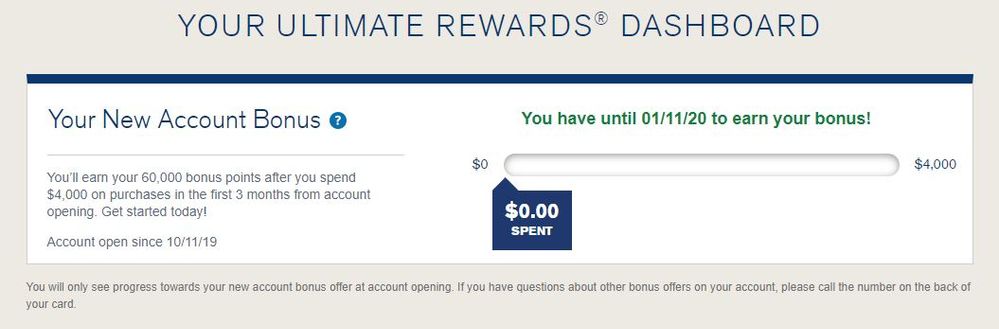

When I arrived home I found this on my Chase accounts page.

Now I get to wait for my new metal card in the mail and enter the Gardening Hall of Shame!

Your FICO credit scores are not just numbers, it’s a skill.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Bank, how I covet thee 5/24 CC!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Bank, how I covet thee 5/24 CC!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Bank, how I covet thee 5/24 CC!

Congrats! I'm glad Chase and Debbie made it worth it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Bank, how I covet thee 5/24 CC!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Bank, how I covet thee 5/24 CC!

The new thread can be found here:

https://ficoforums.myfico.com/t5/Credit-Card-Approvals/I-have-joined-the-Gardening-Hall-of-Shame/td-...