- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Closing New Card Approvals For Future Chase Cards

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Closing New Card Approvals For Future Chase Cards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closing New Card Approvals For Future Chase Cards

Chase frequently soft pulls after approval. That's how people end up with receiving cancelled cards in the mail.

I think it's terrible idea to finish off app spree with Chase Card.

Hopefully, it will all work out for OP

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closing New Card Approvals For Future Chase Cards

@Remedios wrote:Chase frequently soft pulls after approval. That's how people end up with receiving cancelled cards in the mail.

I think it's terrible idea to finish off app spree with Chase Card.

Hopefully, it will all work out for OP

I couldn’t agree more. Chase is conservative, and monitors like a hawk.

I wish OP luck, but chance of denial or closure.

Also, Brian has insight with prior Chase employment.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closing New Card Approvals For Future Chase Cards

@SBR249 wrote:

@Brian_Earl_Spilner wrote:

@SBR249 wrote:

@Carlosjb3 wrote:

@Anonymous wrote:

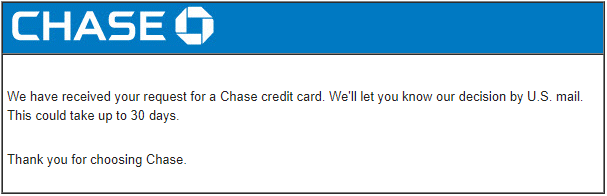

Yep, better app quick, even if chase denies you I mean what are you gonna lose by having another inquiry, you already know missed out on the chase cards. Probably best option will be to look at Amex at this point.I just apped for the Chase Freedom Unlimited and got the message below

Is this usually bad news?

The good news is that that's not the message you get for being over 5/24. IIRC, many times 30 days message is a more information needed for verification but I could be wrong.

I received the same message and verified within an hour it was denial for 5/24

But I bet you were already over 5/24 reporting on your CR. The OP just got 4 new cards last week, chances are not all of them will have reported yet. So if verified, maybe it won't turn into a 5/24 denial.

This is true, but we just had a poster about a month ago that was in a similar situation. When chase realized he shouldn't have been approved in the first place, they shut down his card a couple of months after the fact. BUT, he probably could have flown under the radar if he hadn't applied for a second Chase card triggering the review.