- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Credit Journey - AMEX BCE Prequal - Denied - Cap1 ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit Journey - AMEX BCE Prequal - Denied - Cap1 Prequal SaverOne - Denied - want a 3rd card.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapitalOne SavorOne denied after pre-qualified offer

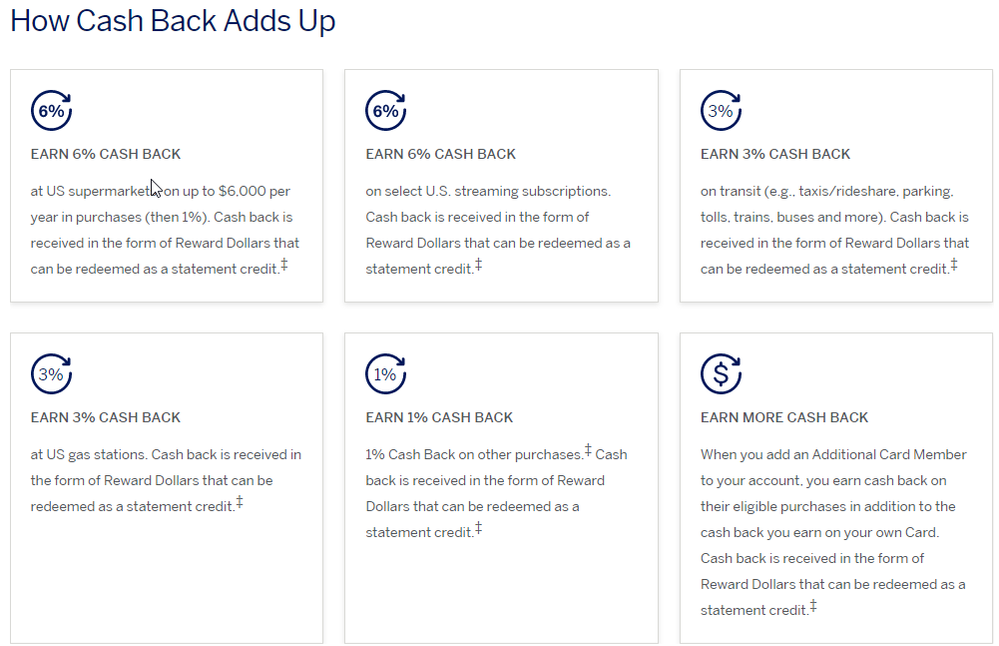

And if you're going to pay $95 you might as well get BCP for 6% on groceries / streaming services and the other tiers of rewards associated with it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapitalOne SavorOne denied after pre-qualified offer

Just wanted to chime in, everyone is bashing on OP for wanting a SavorOne and claiming the $95 AF, but only the Savor carries the AF. The SavorOne does not. Only difference is the groceries is 3% on the Savor One instead of 4% on the Savor, and the SUB is $150 on SavorOne instead of $300.

OP, I would cool it for 6-12 months and then try again if you really want that card.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapitalOne SavorOne denied after pre-qualified offer

nobody's bashing the OP omar, and you must read more carefully because i said the savor has an AF, not savorOne. Also, neither one has got 3% or 4% on groceries like you are saying. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapitalOne SavorOne denied after pre-qualified offer

LOL so being curious CK now says my approval chances for a "Capital One® SavorOne® Cash Rewards for Average Credit" is Poor. With a worse vantage score and higher utlization it said very good. An extra HP takes it from very good to poor? Total nonsense as others have said. Not that I'm applying for anymore credit for the next year just was curious.

Is CK really just a marketing tool for advertisers and it's only usage is just for some free credit monitoring? Vantage score is mostly pointless.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapitalOne SavorOne denied after pre-qualified offer

i can tell you, the card approval chances listed on places like that are just baloney. it's all a marketing gimmick to try and push you into applying so that they'll get a referral fee. even the ones on experian are phoney. so if you don't get a preapproval directly on the website of the creditcard issuer basically forget it. your odds went to poor because they know you apped and got denied, it's got nothing to do with the inq. my odds for every single card in existance shot up to "best" on experian now that they know i got approved for amex and barclays. they're saying i can get chase and a citi cards now, that's a total lie and i know it.

so it's a better way to just look on the forum here in the approval section to see your chances of approvals for each card. that's why i was saying to you what your odds are like on the uber card. knowing examples of approval criteria is helpful for knowing what to app for and when to do it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapitalOne SavorOne denied after pre-qualified offer

@Anonymous wrote:LOL so being curious CK now says my approval chances for a "Capital One® SavorOne® Cash Rewards for Average Credit" is Poor. With a worse vantage score and higher utlization it said very good. An extra HP takes it from very good to poor? Total nonsense as others have said. Not that I'm applying for anymore credit for the next year just was curious.

Is CK really just a marketing tool for advertisers and it's only usage is just for some free credit monitoring? Vantage score is mostly pointless.

Exactly.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapitalOne SavorOne denied after pre-qualified offer

@OmarGB9 wrote:

@Anonymous wrote:LOL so being curious CK now says my approval chances for a "Capital One® SavorOne® Cash Rewards for Average Credit" is Poor. With a worse vantage score and higher utlization it said very good. An extra HP takes it from very good to poor? Total nonsense as others have said. Not that I'm applying for anymore credit for the next year just was curious.

Is CK really just a marketing tool for advertisers and it's only usage is just for some free credit monitoring? Vantage score is mostly pointless.

Exactly.

Just for more data points being curious... Somehow I was pre-selected on CK for CreditOne and now it's fair approval chances with the credit one pre-selected offer revoked... Chances go down when my score improves for something that is extremely easy to get what? Maybe they'll stop sending me their crap now ![]() Perhaps this is encourgement to micromanage my payments so my UTL is 5% or lower.

Perhaps this is encourgement to micromanage my payments so my UTL is 5% or lower.

Hopefully this post adds some datapoints about CKs crap.

I want to see if CreditOne would pre-qualify me now or just deny me for the entertainment but that is a bad idea. I'll see if they send me more stuff in the mail.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapitalOne SavorOne denied after pre-qualified offer

Have you thought about doing a self-lender loan to give you a better credit mix, which helps your FICO score and credit file? I also want the SavorOne one day. I thought their pre-quals were solid, so that is surprising you were denied.

Green Dot Primor Secured (5/18) - $450 CL (CLOSED 2/2020)

Capital One Platinum (8/18) PC to Quicksilver (9/19) - $3800 CL

Capital One QuicksilverOne (3/19) - $4800 CL

Merrick Bank DYL VISA - No AF (6/19) - $1400 CL

Discover it Cash Back (9/19) - $2800 CL

Amazon Prime Store Card (4/20) - $10,000 CL

NFCU cashRewards (4/20) - $4500 CL

BB&T Spectrum Cash Rewards (5/20) - $3500 CL

Navy Federal More Rewards American Express® Card (3/21) - $9700 SL - at 9.65 %.

Experian FICO Score - 8/2018: 528

Experian FICO 8 Score - 9/2022 - 720

Equifax FICO 8 score 2/2022- 692

TransUnion FICO 8 score 10/2022 - 728

Experian FICO Mortgage Score - 725

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapitalOne SavorOne denied after pre-qualified offer

@Jannelo wrote:Have you thought about doing a self-lender loan to give you a better credit mix, which helps your FICO score and credit file? I also want the SavorOne one day. I thought their pre-quals were solid, so that is surprising you were denied.

Just looked and it doesn't interest me as it costs me money and no plans to borrow money right now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapitalOne SavorOne denied after pre-qualified offer

You're lending yourself money and in most cases get paid interest on the collateral you put into the account.