- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Denied BofA CC. Will accepting the secured credit...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Denied BofA CC. Will accepting the secured credit card offer hurt my credit file?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Denied BofA CC. Will accepting the secured credit card offer hurt my credit file?

After being approved for AMEX Gold and Discover, I agreed to a verbal offer to apply for the BofA Cash Rewards CC while on the phone to replace a lost debit card. I told her I didn't think I was eligible (given that BofA was included in my 2004 BK), but she said I was eligible. Got denied, and now there are three hard inquiries for the next 12-24 months: AmEx Gold, Discover, and now BofA.

Question: Will it "hurt or help" my credit to accept the offer from BofA for the secured CC ($500 CL for $99 deposit). I am focused on getting the AmEx Platinum (weekly business travel needs), and I don't want to hinder my chances to reach my goal. I already have high limit credit cards, but not with BofA or any other bank (like Chase or Citibank). A guy on YouTube said I was already eligible for the AmEx Platinum, but when I called AmEx they said I'll have to wait six months to get an invitation to apply for the pre-approved AmEx Platinum. I just don't know if adding a secured CC will drop my credit score and result in yet another hard pull on my credit report.

I'm really not savvy with all of this stuff, so any advice and insight you're willing to share would be really rather nice to have as I stuble about reaching my goal. Thanks!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied BofA CC. Will accepting the secured credit card offer hurt my credit file?

@Anonymous wrote:After being approved for AMEX Gold and Discover, I agreed to a verbal offer to apply for the BofA Cash Rewards CC while on the phone to replace a lost debit card. I told her I didn't think I was eligible (given that BofA was included in my 2004 BK), but she said I was eligible. Got denied, and now there are three hard inquiries for the next 12-24 months: AmEx Gold, Discover, and now BofA.

Question: Will it "hurt or help" my credit to accept the offer from BofA for the secured CC ($500 CL for $99 deposit). I am focused on getting the AmEx Platinum (weekly business travel needs), and I don't want to hinder my chances to reach my goal. I already have high limit credit cards, but not with BofA or any other bank (like Chase or Citibank). A guy on YouTube said I was already eligible for the AmEx Platinum, but when I called AmEx they said I'll have to wait six months to get an invitation to apply for the pre-approved AmEx Platinum. I just don't know if adding a secured CC will drop my credit score and result in yet another hard pull on my credit report.

I'm really not savvy with all of this stuff, so any advice and insight you're willing to share would be really rather nice to have as I stuble about reaching my goal. Thanks!!

It makes no sense to apply for a secured card when you already have high CL cards in your pocket. Nope, not a good idea.

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied BofA CC. Will accepting the secured credit card offer hurt my credit file?

If you want to get back in with BOA, then I was say It's a good Idea. Also, if you can afford the $99 then go ahead. BOA is normally good at graduations and then you can grow it with SP over the years.

Chase FU $19.6k

BOA Cash Rewards $36k

BJs Perks Plus M/C $22k

Cap1 QS $4,950 (AU)

Best Buy $4k

Wells Fargo Active Cash $11.3

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied BofA CC. Will accepting the secured credit card offer hurt my credit file?

I do want to get back in good graces with BofA (and the $99 in not an issue), but not if having a secured CC with a low limit on my report will hurt my scores. Do the credit reporting agencies identify secured cards versus unsecured cards?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied BofA CC. Will accepting the secured credit card offer hurt my credit file?

$944,008 Amex BRG

$91,953 Amex SC

$58,351 Discover It

$50,046 BofA CR

$36,146 Amex PRG

$6,774 Cap1 QS

$963 Amex CM

$1,188,241 Yearly Spend

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied BofA CC. Will accepting the secured credit card offer hurt my credit file?

Thank you!! I'm starting to wonder if I should also apply for secured cards with Chase, Citibank, and Wells Fargo.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied BofA CC. Will accepting the secured credit card offer hurt my credit file?

@Anonymous wrote:Thank you!! I'm starting to wonder if I should also apply for secured cards with Chase, Citibank, and Wells Fargo.

Before you apply for secured cards, make sure they graduate (and research what the terms of graduation are), otherwise getting them can be a bit counter productive (Citi's does, Chase doesn't have one, I don't know about WF). If you're having to close cards to get your deposit back, and reapply for a new product, it will hurt your average age of accounts.

Having a secured card in itself doesn't hurt your profile or your score. I had three secured cards reporting when Chase handed me my 17k CSP, and that was after manual review (so yes, someone saw that I had secured cards). What's nice about secured cards is that you can set your own SL up to a point (as much as you're willing to deposit).

It is a great way to get in with banks if you are trying to establish a relationship with them (as you're talking about with BofA). Otherwise, since you have solid cards, I wouldn't recommend it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied BofA CC. Will accepting the secured credit card offer hurt my credit file?

It's known to graduate early depending on credit worthiness. Try asking around 5th month. Once unsecured, BoA cards are soft pull credit limit increases.

Also, you might get future prequal offer on your online portal for other unsecured card.

You can search for data points on myFICO for more answers.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied BofA CC. Will accepting the secured credit card offer hurt my credit file?

@601flyguy wrote:

It will report like any other credit card account. There is no way to tell it is secured by looking at your CR, no one will know but you and BofA. I would accept if you aren't concerned about the limit because it should grow over time.

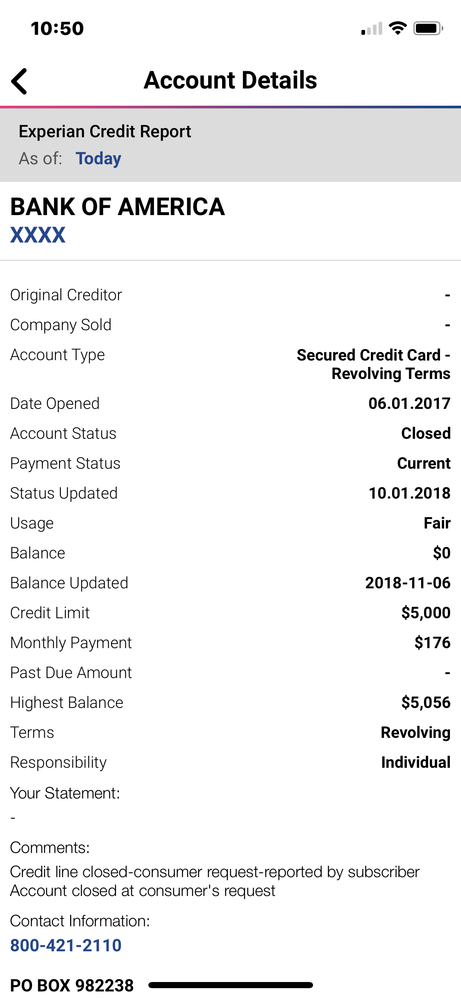

this is not true. I had a bofa secured card and closed it due to them not following through. On the cra's it reports in terms as "secured credit card".

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied BofA CC. Will accepting the secured credit card offer hurt my credit file?