- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: Denied for Suntrust Credit because of unable t...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Denied for Suntrust Credit because of unable to match applicant to credit bureau record?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Denied for Suntrust Credit because of unable to match applicant to credit bureau record?

I applied for the Suntrust Cash rewards credit card just past mid May. I do not have a a prior relationship with Suntrust and applied online.

Received a denial letter. The reason for the denial is "Unable to march applicant(s) to credit bureau record". The letter includes an ID number and instructions to contact "Cardmember Services" via snail mail. No phone number to call or online access to get this cleared

I am dumfounded for several reasons.

I applied for another credit card, with one of Suntrust's competitors, few days prior to applying for the Suntrust credit card. I was approved by phone call in lest than 24 hours and the credit card arrived, ready to use before the Suntrust denial letter arrived.

To be fare, my Experian credit report does have an alias listed with the wrong letter for my middle name initial. But that has never been an issue for their competitors.

What is really baffling is I cannot find hard pulls from Suntrust at any of the big 3 credit reporting agencies. I checked less than a hour before this post. So where are they getting this info from?

The kicker is I did not really want this credit card in the first place. Having a Suntrust credit card makes it easier to have a Suntrust bank account. That is the reason I applied for the credit card.

Should I go into a branch and reapply or deal with the "Cardmember Services"?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied for Suntrust Credit because of unable to match applicant to credit bureau record?

if you dont want the card dont worry about applying for it. Go in and open an account and be done with it.

"Money isn't the most important thing in life, but it's reasonably close to oxygen on the "gotta have it" scale". ~Zig Ziglar

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied for Suntrust Credit because of unable to match applicant to credit bureau record?

@Anonymous wrote:What is really baffling is I cannot find hard pulls from Suntrust at any of the big 3 credit reporting agencies. I checked less than a hour before this post. So where are they getting this info from?

The kicker is I did not really want this credit card in the first place. Having a Suntrust credit card makes it easier to have a Suntrust bank account. That is the reason I applied for the credit card.

1) the reason for the mismatch and no INQ showing up is wrong SSN

2) then don't do anything

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied for Suntrust Credit because of unable to match applicant to credit bureau record?

I was recently declined on a Bloomingdale's card because they couldn't verify my identity. I called the reconsideration line and they are unable to send me a text on my cell phone. I'm guessing their technology might be lacking. Citi, AmEx, Cap 1, Disco & and all the rest manage to send me texts. But to be declined because they couldn't verify my identity was a wasted HP.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied for Suntrust Credit because of unable to match applicant to credit bureau record?

@Anonymous wrote:I applied for the Suntrust Cash rewards credit card just past mid May. I do not have a a prior relationship with Suntrust and applied online.

Received a denial letter. The reason for the denial is "Unable to march applicant(s) to credit bureau record". The letter includes an ID number and instructions to contact "Cardmember Services" via snail mail. No phone number to call or online access to get this cleared

I am dumfounded for several reasons.

I applied for another credit card, with one of Suntrust's competitors, few days prior to applying for the Suntrust credit card. I was approved by phone call in lest than 24 hours and the credit card arrived, ready to use before the Suntrust denial letter arrived.

To be fare, my Experian credit report does have an alias listed with the wrong letter for my middle name initial. But that has never been an issue for their competitors.

What is really baffling is I cannot find hard pulls from Suntrust at any of the big 3 credit reporting agencies. I checked less than a hour before this post. So where are they getting this info from?

The kicker is I did not really want this credit card in the first place. Having a Suntrust credit card makes it easier to have a Suntrust bank account. That is the reason I applied for the credit card.

Should I go into a branch and reapply or deal with the "Cardmember Services"?0 Links

My suggestion, if you don't already have one, would be to give up on the SunTrust card and try going for a BB&T card. Based on my experience and the reports from other members, they've been rubber-stamping approvals with only SPs.

On top of that, with the impending BB&T and SunTrust merger, your account will end up coming from the same combined entity when it's all said and done regardless of the credit product you have.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied for Suntrust Credit because of unable to match applicant to credit bureau record?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied for Suntrust Credit because of unable to match applicant to credit bureau record?

i think OP mentioned that it was an SP on original Suntrust credit card application. He couldn't find a hard inquiry on any of his reports.

That to me is interesting. i have an auto loan with SunTrust & when i go into account they have all offers for their LightStream Lending & travel rewards card on their website exclusively for me. if its an SP, its worth it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied for Suntrust Credit because of unable to match applicant to credit bureau record?

@swpopham wrote:

if you dont want the card dont worry about applying for it. Go in and open an account and be done with it.

Suntrust waives the monthly fee if you have one of thier credit cards.

@Anonymous wrote:

1) the reason for the mismatch and no INQ showing up is wrong SSN

I guess that's possibility. It would explain everything.

@snapcat wrote:

But to be declined because they couldn't verify my identity was a wasted HP.

Sucks doesn't it? At least in my case there were no hard pulls. No harm no foul.

@Anonymous wrote:

My suggestion, if you don't already have one, would be to give up on the SunTrust card and try going for a BB&T card. Based on my experience and the reports from other members, they've been rubber-stamping approvals with only SPs.

On top of that, with the impending BB&T and SunTrust merger, your account will end up coming from the same combined entity when it's all said and done regardless of the credit product you have.

I may look into BB&T. Thanks for the low down. I originally wanted a Suntrust checking account for specific reason. Having a Suntrust credit card waives the $20 monthly fee for the checking account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

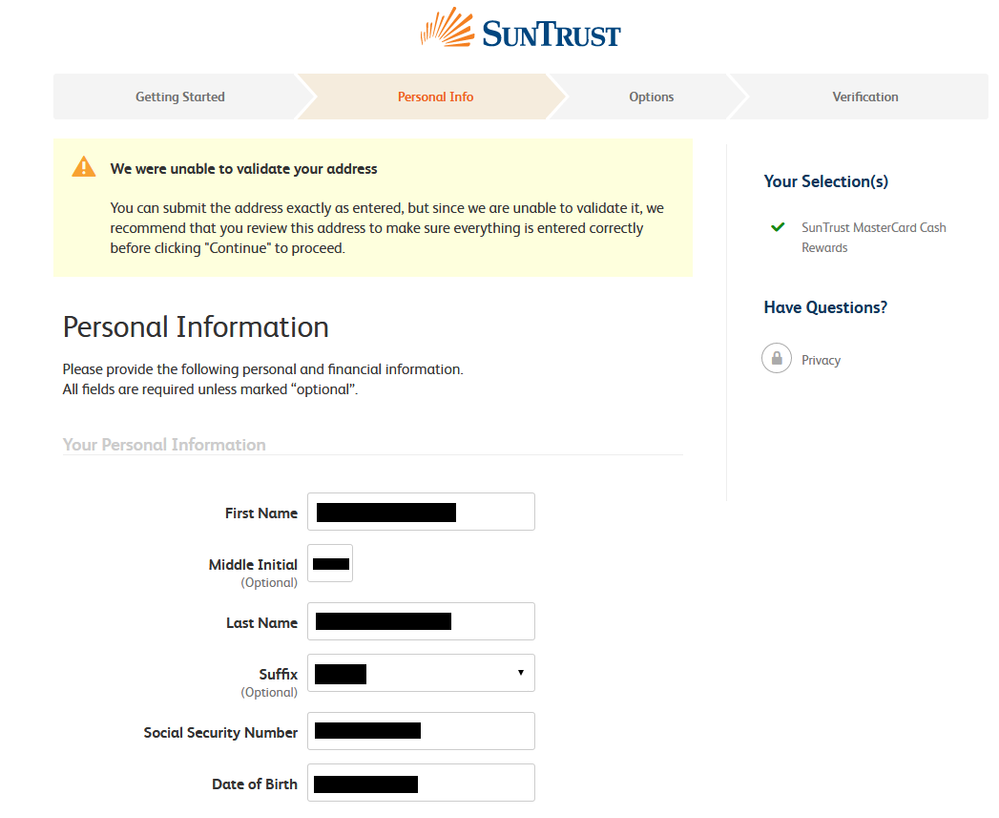

Now they cannot verify address?

I tried to re-apply for the credit card 15 mins ago. Now I am stuck because they cannot verify my address. I don't know why Suntrust is the only company to have this issue with me. I might try to go into a branch and apply.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Now they cannot verify address?

Its best to go to a branch. I had a problem with EQ and ST couldnt approve me. Sun Trust has a rep at EQ who handles any bank problems. The CSR will call them directly and ask what the problem is. My CSR called and got things rolling. It got fixed and 2 days later I got approved. And even got a call from a english rep from EQ apologizing for the mistake on the same day it was all resolved. Good Luck! Tell the rep to call Equisux.