- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Does this mean I am off Discovers ban list lol?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Does this mean I am off Discovers ban list lol?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does this mean I am off Discovers ban list lol?

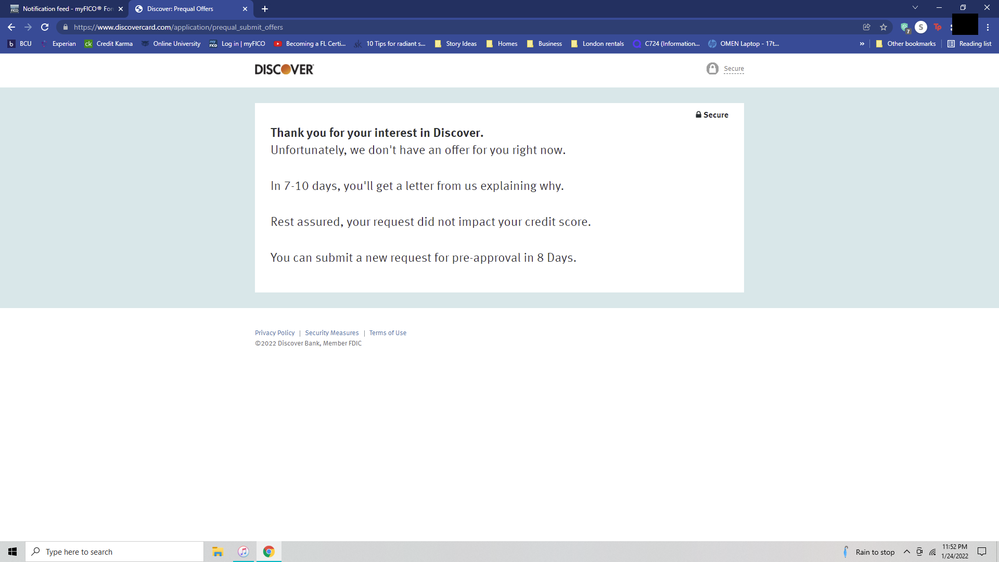

So I iib Discover with the IT and Miles cards for a combined total of like 800$ back in 2019 on the BK7. I do the prequal a lot and usually get status of prior/existing Discover Card. But these last two times I have just been getting no offer 8 day to try again message. Good sign orrr?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does this mean I am off Discovers ban list lol?

I don't think so, 2019 is still VERY recent in credit terms, and when you burn Disco in BK, they definitely remember and blacklist for a LONG time.

I feel like the letter will probably cite the previous relationship.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does this mean I am off Discovers ban list lol?

@Anonymous514 wrote:

So I iib Discover with the IT and Miles cards for a combined total of like 800$ back in 2019 on the BK7. I do the prequal a lot and usually get status of prior/existing Discover Card. But these last two times I have just been getting no offer 8 day to try again message. Good sign orrr?

I'd be curious to see what the letter states. Please post the results once you receive it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does this mean I am off Discovers ban list lol?

I'll update when I get the letter

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does this mean I am off Discovers ban list lol?

Prior unsatisfactory account Lol

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does this mean I am off Discovers ban list lol?

@Anonymous514 wrote:Prior unsatisfactory account Lol

As suspected, @OmarGB9 was not wrong (post #2). But, thanks for providing the DPs which definitely reinforces what was mentioned on another, separate thread about the displayed/splash message and the actual results.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does this mean I am off Discovers ban list lol?

For me, I had a charge off with them and it was exactly 7 years. Then they offered me a card on the prequalified site.

High limit, but wanted to test the waters to see if I could get a CLI with a Chapter 7 on my report. No dice. They stated on the soft pill request that a BK was showing.

Once that came off I was able to get a higher CL. So for me, 7 years after BK for a card, 10 years for a CLI on that card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does this mean I am off Discovers ban list lol?

No, it does not, unfortunately. It COULD, but I've seen people get this message while they are still on the blacklist. Sorry.

1/26/20 AmEx Cash Magnet $35k CL, wife

2/19/20 BB&T/Truist Rewards $11k SL- impulse application

2/22/20 Citi Double Cash WEMC $2.9k-->$4.4k-->$8.4k-->$13.4k-->$17.4k-->$19.4k-->$22.4k AU, wife

3/8/20 Wells Fargo Propel AmEx/Autograph VISA $2900-->$3200-->$5000-->$8800 CL- AU, wife

3/9/20 Truist Rewards $11k SL- AU, wife- impulse app

3/21/20 REDcard MasterCard (TD Bank) $2500-->$6000-->$6500 CL

11/24/20 AmEx Cash Magnet $10k SL-->36hr-->$20k-->$35k CL

6/10/21 SoFi World Elite MC (TBOM) $7000 SL

1/19/22 AppleCard/GS $6k-->$10k-->$11k AU, wife

8/15/22 Chase freedom flex $10.3k SL-->$12.5k-->$15k AU, wife

7/5/23 Lowes/Synchrony $4k-->$10k-->same day-->$35k CL

8/2/23 Chase freedom flex $19k --> $22.8 CL

8/2/23 Discover $8k SL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does this mean I am off Discovers ban list lol?

@JLRDC909 wrote:For me, I had a charge off with them and it was exactly 7 years. Then they offered me a card on the prequalified site.

High limit, but wanted to test the waters to see if I could get a CLI with a Chapter 7 on my report. No dice. They stated on the soft pill request that a BK was showing.

Once that came off I was able to get a higher CL. So for me, 7 years after BK for a card, 10 years for a CLI on that card.

Things have changed then. Two yrs post BK. I started with $2500 on the first card. Got many CLI's back in 2018-19 thanks to @AverageJoesCredit and his moves with Disco. Lots of spend. Got the second card and then combined the 2 for 14g's. Might be a new DP. Lots of changes with many lenders over the past 6 yrs. Least your in.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does this mean I am off Discovers ban list lol?

I seen pre-qual offers despite still being blacklisted

1/26/20 AmEx Cash Magnet $35k CL, wife

2/19/20 BB&T/Truist Rewards $11k SL- impulse application

2/22/20 Citi Double Cash WEMC $2.9k-->$4.4k-->$8.4k-->$13.4k-->$17.4k-->$19.4k-->$22.4k AU, wife

3/8/20 Wells Fargo Propel AmEx/Autograph VISA $2900-->$3200-->$5000-->$8800 CL- AU, wife

3/9/20 Truist Rewards $11k SL- AU, wife- impulse app

3/21/20 REDcard MasterCard (TD Bank) $2500-->$6000-->$6500 CL

11/24/20 AmEx Cash Magnet $10k SL-->36hr-->$20k-->$35k CL

6/10/21 SoFi World Elite MC (TBOM) $7000 SL

1/19/22 AppleCard/GS $6k-->$10k-->$11k AU, wife

8/15/22 Chase freedom flex $10.3k SL-->$12.5k-->$15k AU, wife

7/5/23 Lowes/Synchrony $4k-->$10k-->same day-->$35k CL

8/2/23 Chase freedom flex $19k --> $22.8 CL

8/2/23 Discover $8k SL