- myFICO® Forums

- Types of Credit

- Credit Card Applications

- I just don’t understand how capital one makes thei...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

I just don’t understand how capital one makes their decisions

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I just don’t understand how capital one makes their decisions

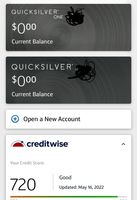

I have two capital one credit cards (QS and QS1 [upgrades from a plat]), both are low limit with high APR. I got them during my credit rebuild and rarely use them due to how low the limits are. Every time I try and request an increase i'm instantly declined. When I try and check their pre screen I am generally given 3 cards Savior One, Venture One, or a quicksilver all with high APRs (26%ish). I have a 720-750 credit score (EX being the highest). I just don't understand why I have other cards with a 12% APR and 25k limit but capital one seems me such high ris

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I just don’t understand how capital one makes their decisions

C1 takes on a lot of starter accounts they make their money on people screwing up, and/or fees. This is the same model just about every issuer uses... screw ups and fees.

Because of their target demographic on most cards they tend to give very low limit cards to limit exposure. Which flies in the face of what I am about to say. They give cli's based on you using the card recklessly like 80-90 utilization, every month you do that for 3-6 months and they will shower you with credit limits.

As for your score it is good but not stellar you also used a screen shot of a vantage3 score which is largely meaningless where are you normally checking your score?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I just don’t understand how capital one makes their decisions

This is standard CapOne behavior. They approve a lot of starter cards with low limits which rarely grow. I would probably just dump those cards in favor of a better one. Even another Capital One card could be better. CapOne won't give you an increase on the bucketed card, but then turn around and approve you for a 10k SL on a new card lol.

Good luck with whatever you decide!

Amex Cash Magnet: 18k

Fidelity Visa: 16.5k

Apple Card: 4.25k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I just don’t understand how capital one makes their decisions

They just denied me a CLI while using an old (2 months old) credit report. Really CrapOne - using data from almost 2 months ago? 🤦♀️

3/16/18 FICO9 TU-700 EQ-669 EX-716

6/26/18 FICO9 TU-750, EQ-672, EX-789

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I just don’t understand how capital one makes their decisions

@Beefy1212 wrote:C1 takes on a lot of starter accounts they make their money on people screwing up, and/or fees. This is the same model just about every issuer uses... screw ups and fees.

Because of their target demographic on most cards they tend to give very low limit cards to limit exposure. Which flies in the face of what I am about to say. They give cli's based on you using the card recklessly like 80-90 utilization, every month you do that for 3-6 months and they will shower you with credit limits.

As for your score it is good but not stellar you also used a screen shot of a vantage3 score which is largely meaningless where are you normally checking your score?

Cap1 is eliminating overlimit and late fees. They make most of their money from asset backed securities, which is a reason their cards don't grow. Once a card profile is packaged and sold as an ABS based on its credit rating, it's near impossible to change that card's rating, because it would requiring repackaging. Which leads to bucketed cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I just don’t understand how capital one makes their decisions

@SomewhereIn505 wrote:They just denied me a CLI while using an old (2 months old) credit report. Really CrapOne - using data from almost 2 months ago? 🤦♀️

Amex uses 2 month old data once you become a member.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I just don’t understand how capital one makes their decisions

I'm not a cap1 fan. I've had mine 2 years snd it's grown verrrrry slowly to just $700 CL.

Before I found this forum I had high utilization each month on it because, I thought, of the cash back on my QS1, and I wanted to grow the card. They rarely gave me an increase and only $100 at a time. Now, I have it a zero balance - do AZEO elsewhere- and it's sock drawered for aging purposes. After I've had it a while I'll just close it as I've already moved on.

my card is clearly bucketed. My daughter, on the other hand, got an initial CL on her QS1 of 3k- after 6 months they raised it to 7k. She rebuilt her credit just 3 years ago. 🤷🏼♀️

12/22 :

12/22 :

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I just don’t understand how capital one makes their decisions

@Alucard wrote:I have two capital one credit cards (QS and QS1 [upgrades from a plat]), both are low limit with high APR. I got them during my credit rebuild and rarely use them due to how low the limits are. Every time I try and request an increase i'm instantly declined. When I try and check their pre screen I am generally given 3 cards Savior One, Venture One, or a quicksilver all with high APRs (26%ish). I have a 720-750 credit score (EX being the highest). I just don't understand why I have other cards with a 12% APR and 25k limit but capital one seems me such high risk

When it comes to Capital One's business model, specifically with tranched accounts or specific CC offers, below is an article that provides more insight about ABS:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I just don’t understand how capital one makes their decisions

@FinStar wrote:

@Alucard wrote:I have two capital one credit cards (QS and QS1 [upgrades from a plat]), both are low limit with high APR. I got them during my credit rebuild and rarely use them due to how low the limits are. Every time I try and request an increase i'm instantly declined. When I try and check their pre screen I am generally given 3 cards Savior One, Venture One, or a quicksilver all with high APRs (26%ish). I have a 720-750 credit score (EX being the highest). I just don't understand why I have other cards with a 12% APR and 25k limit but capital one seems me such high risk

When it comes to Capital One's business model, specifically with tranched accounts or specific CC offers, below is an article that provides more insight about ABS:

Very cool and informative. I am def a 'convenience' user- one who PIF every month. I used to carry a balance but no longer. Interesting how they pool the cards and why.

maybe I'll close it now instead of giving them the benefit of using it to skew their algorithms 😂

12/22 :

12/22 :

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I just don’t understand how capital one makes their decisions

@Alucard wrote:I have two capital one credit cards (QS and QS1 [upgrades from a plat]), both are low limit with high APR. I got them during my credit rebuild and rarely use them due to how low the limits are. Every time I try and request an increase i'm instantly declined. When I try and check their pre screen I am generally given 3 cards Savior One, Venture One, or a quicksilver all with high APRs (26%ish). I have a 720-750 credit score (EX being the highest). I just don't understand why I have other cards with a 12% APR and 25k limit but capital one seems me such high risk

It is what it is. Imo, stop looking toward Cap One to expand, but other lenders . Cap One is at least transparent about their apr so there should be no shock here.