- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Just Took an L - Citi Recon Battle Comes to an End

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Just Took an L - Citi Recon Battle Comes to an End

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Just Took an L - Citi Recon Battle Comes to an End

@M_Smart007 wrote:

My sincere condolences to Citi ..for their loss.

I can say with, total Citi exposure @ $122,100.00 on Legacy and co-branded cards , Legacy cards are stuck.

Even running well over $50K on a $17.6K card (in one billing cycle), they still don't budge.

I will move all that spend to AODFCU, CSR, CFF and NFCU Flagship / Disco 5% cats /Affinity for the Hi5 Cats. / other cards for travel.

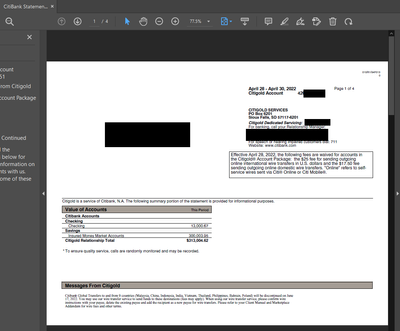

I signed up for Citigold (2) savings and (1) checking, for a FAT SUB. I am not impressed by their banking services.

Have moved ALL my monies out via FREE wire transfer.,

as soon as the SUB posted. .. ( I plan on closing the bank accts. this coming week)

I have been denied (3) Citi Legacy cards over a 4 year period. ..So I decided ..I am done with them.

Have since moved onto greener pastures. Most recently Affinity,

and some other CU's that do not seem to have "Lending Excuses" ...

We live and learn. ...and move on!

@M_Smart007 can Citi not clawback that SUB for closing the account right after getting the bonus?

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Just Took an L - Citi Recon Battle Comes to an End

@OmarGB9 wrote:

@M_Smart007 wrote:

My sincere condolences to Citi ..for their loss.

I can say with, total Citi exposure @ $122,100.00 on Legacy and co-branded cards , Legacy cards are stuck.

Even running well over $50K on a $17.6K card (in one billing cycle), they still don't budge.

I will move all that spend to AODFCU, CSR, CFF and NFCU Flagship / Disco 5% cats /Affinity for the Hi5 Cats. / other cards for travel.

I signed up for Citigold (2) savings and (1) checking, for a FAT SUB. I am not impressed by their banking services.

Have moved ALL my monies out via FREE wire transfer.,

as soon as the SUB posted. .. ( I plan on closing the bank accts. this coming week)

I have been denied (3) Citi Legacy cards over a 4 year period. ..So I decided ..I am done with them.

Have since moved onto greener pastures. Most recently Affinity,

and some other CU's that do not seem to have "Lending Excuses" ...

We live and learn. ...and move on!

@M_Smart007 can Citi not clawback that SUB for closing the account right after getting the bonus?

@OmarGB9 ,

I believe they can, this is why I waited so long to close the checking and two savings acct's.

I will call Citi and confirm ..before I close them out.

The Citi terms are here;

https://banking.citi.com/cbol/22/Q2/svg/cash/tiered/national/default.htm

https://banking.citi.com/cbol/22/Q1/checking/dig-nat/INBTA_NT_T-1500/default.htm

Current Offer;

https://banking.citi.com/cbol/savings/cash-offer/default.htm

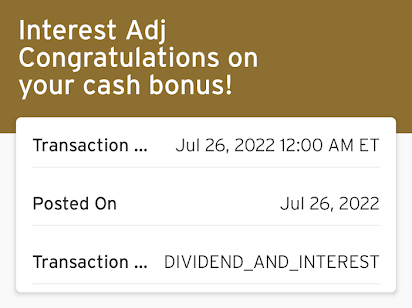

SUB was paid on 7-26-2022 ..(I added more funds, before the "within" 20 days after acct. opening.)

First 2 day statement, after Initial Acct. opening. _4-28-2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Just Took an L - Citi Recon Battle Comes to an End

Thanks for all the CITI data points, @PullingMeSoftly, and sorry to hear of your denial and frustrations with them. ![]() Your posting and that of @M_Smart007 give me pause since I've considered applying for another Citi card myself now that I'm out of the garden. (I had also considered one of the CITI banking SUBs but had held off. Now, I'm thinking I made the right choice.) I'm especially surprised that you were denied as a banking customer. Even US Bank and Bank of America appear more lenient about banking customers when they apply for credit cards.

Your posting and that of @M_Smart007 give me pause since I've considered applying for another Citi card myself now that I'm out of the garden. (I had also considered one of the CITI banking SUBs but had held off. Now, I'm thinking I made the right choice.) I'm especially surprised that you were denied as a banking customer. Even US Bank and Bank of America appear more lenient about banking customers when they apply for credit cards.

You wouldn't think that 1/6; 1/12; 5/24 would be grounds for a denial under the circumstances. This would put Citi in the same selective approval realm as Chase and US Bank. Perhaps, though, as @CreditCuriosity pointed out, it has more to do with the SUB value on that particular card combined with the other credit-seeking behaviors. Your results on a different card may have been better. In my case, I'm 0/6; 1/12; 1/24 so I might not run into the same issues but it still makes me wonder about their limiting criteria.

In other news, what is the reference to "big fat L". Is this a credit report code?

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Just Took an L - Citi Recon Battle Comes to an End

@Aim_High wrote:

In other news, what is the reference to "big fat L". Is this a credit report code?

Big fat L = Loss?

W = for the Win

I could be wrong, as I* often am.

In Citi News: They could care less how much money you have in their precious accounts, and how much you run through their precious cards.

I still get the "NO SOUP FOR ME" CLI![]()

Even gardening for 8 months did not do squat!

Relationship bank, I think NOT!

<end of rant>

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Just Took an L - Citi Recon Battle Comes to an End

@M_Smart007 wrote:In Citi News: They could care less how much money you have in their precious accounts, and how much you run through their precious cards.

Very interesting, @M_Smart007. This sounds contrary to my general observations about credit card limits and lenders. What do you think they do care about when considering an application? I've noticed that their limits do tend to run on the lower side for many profiles and cards, and lower than a consumer's other cards in many cases. And they do seem sensitive to recent credit-seeking, even though we don't have a known "metric" like Chase 5/24 or BofA 3/12 - 7/12.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Just Took an L - Citi Recon Battle Comes to an End

@Aim_High wrote:

@M_Smart007 wrote:In Citi News: They could care less how much money you have in their precious accounts, and how much you run through their precious cards.

Very interesting, @M_Smart007. This sounds contrary to my general observations about credit card limits and lenders. What do you think they do care about when considering an application? I've noticed that their limits do tend to run on the lower side for many profiles and cards, and lower than a consumer's other cards in many cases. And they do seem sensitive to recent credit-seeking, even though we don't have a known "metric" like Chase 5/24 or BofA 3/12 - 7/12.

" This sounds contrary to my general observations about credit card limits and lenders. "

It is very contrary, but again it is Citi![]()

More generous with co-branded cards. IMHO

If I were you, i'd look at Affinity FCU or elsewhere ...

@coldfusion, I believe ..Has their metrics. .. I will leave this one to the Pro's!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Just Took an L - Citi Recon Battle Comes to an End

@M_Smart007 wrote:

@Aim_High wrote:

@M_Smart007 wrote:In Citi News: They could care less how much money you have in their precious accounts, and how much you run through their precious cards.

Very interesting, @M_Smart007. This sounds contrary to my general observations about credit card limits and lenders. What do you think they do care about when considering an application? I've noticed that their limits do tend to run on the lower side for many profiles and cards, and lower than a consumer's other cards in many cases. And they do seem sensitive to recent credit-seeking, even though we don't have a known "metric" like Chase 5/24 or BofA 3/12 - 7/12.

" This sounds contrary to my general observations about credit card limits and lenders. "

It is very contrary, but again it is Citi

More generous with co-branded cards. IMHO

If I were you, i'd look at Affinity FCU or elsewhere ...

@coldfusion, I believe ..Has their metrics. .. I will leave this one to the Pro's!

Actually, it was the co-branded cards I have more in mind than their core/TY point cards. I already have Costco (which is very generous at $42K although it had started its' life as the AMEX Costco True Earnings card.) The others that are more attractive to me are the American Airlines AAdvantage cards. While the Premier is a nice card and the 80K SUB is juicy, I just don't want to diversify into another point-based system right now. I believe that for most of us average spenders, it's better to focus on a limited number of points systems, perhaps combined with some cash-back options.

I'd love to hear @coldfusion's observations about CITI, however. He always has a lot to add to the conversation.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Just Took an L - Citi Recon Battle Comes to an End

@PullingMeSoftly what a PITA! I've learned over the years when the process proves this difficult, most likely would end up a bigger headache in the future... so count your blessings.

I wonder if the Capital One Venture X or US Bank Altitude Connect would be a good alternate? They both have decent subs and very good travel reward programs.

TCL $678.5K: Personal $562.5K, Business $116K.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Just Took an L - Citi Recon Battle Comes to an End

Citi? Pertaining to core cards (not Retail Services or DNSB)

Generally, comparatively conservative starting limits especially with one's 1st Citi card. Not unusual for even Top Tier applicants to get a $5-6K starting limit or even less for their 1st Citi card, and it can be tough for an existing client to get a SL of more than $15K on an additional card.

CLI requests by defalt generate soft pulls but if there will be a hard pull they will warn you and choose to either proceed or withdraw the request. Soft pull CLIs are generally modest ($2K is around the usual max) but if a SP CLI request is approved they may then extend an offer to consider a larger CLI if you agree to a HP - if you refuse the HP at this point they do still honor the increase granted via the SP.

Aggressive ant-fraud monitoring of charges with no fear of declines. If a large charge you may get a call within 10-15 minutes from an anti-fraud specialist to discuss if you haven't already called in, so if traveling or brick-and-mortar shopping having a backup card with you is suggested.

The GrAAvy Train was a churners dream for several years until Citi finally derailed it and tore up the tracks. I never went anywhere near that train as AA has been dead to me for years.

FICO 8 (EX) 846 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Just Took an L - Citi Recon Battle Comes to an End

@coldfusion @Aim_High @M_Smart007 I have always looked at Citi with the side-eye. I don't know yall's ages, but I gather were all in the same neighborhood. (I'm 54) Back in the 80's, Citi had a state of the art ATM network, plenty of branches, and good products, at least in the Northeast. That said, they were among the LAST of the big banks to join the (NYCE, MAC, or whatever you want to call it) ATM networks. By a few years. So many of my friends dropped them when the rest of the planet was using their cards everywhere and if you had a Citi card you were stuck.

I always knew they were weird after that, and even nowadays I only use them for the BBY visa because... BBY. I even had an argument with them back in 2005 for a HP without my permission or knowledge when opening a checking account for my tenants to deposit into. They did remove the HP but they make me crazy. The mere existence of Chase and Amex makes me scratch my head as to why people bother with them, but of course I'm biased, and I've got a long memory 🤣