- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Key Factors that adversely affected your Navy Fede...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Key Factors that adversely affected your Navy Federal credit score

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Key Factors that adversely affected your Navy Federal credit score

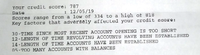

Hi I apologize if this is not the appropriate board to post this but this is my first post. I applied for the Navy Fed Cash Rewards card. I have been heavily researching Navy Feds processes and have been well educated thanks to all the posts on the forum. I was approved for 1k. After reading alot of the posts I know that this is common for first card issued. I recieved the letter indicating my Navy Fed Score and there are a few factors that I dont quite understand and are hoping someone here does. If I can clear a few things up before the 91 days when I apply for 2nd card that would be great.

Factor 1:

Number of balance decreases on non mortgage accounts in last 3 months

Recency of maximum aggregate bankcard balance in last 12

A bit of context. I let balances in the 3-11% range report to the bureaus but pay all accounts in full except discover that has 0% intro apr.

Anyone information would be greatly appreciated. I dont want to apply for 2nd card if theres a high chance of denial.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Key Factors that adversely affected your Navy Federal credit score

It’s all about relationship with Navy.

I got $1k on first card. I was pissed.

Less than a year later I have 3 cards with $43k in TCLs.

My Fico and Navy score both went down before getting CLIs and new/better cards.

Use your card and pay your card and make sound financial decisions and you will be fine with Navy.

DON'T WORK FOR CREDIT CARDS ... MAKE CREDIT CARDS WORK FOR YOU!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Key Factors that adversely affected your Navy Federal credit score

Thanks for responding. Thats comforting to know. My Navy score sits at 321 so hopefully over time it will improve. This whole credit building thing is strengthening my patience .

Another one of the factors was no open credit union trades in last 12 months. Ive always banked with large banks..so I guess Im on the right track.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Key Factors that adversely affected your Navy Federal credit score

When I started rebuilding, I was able to get into NFCU and my first card was a secured nRewards with like a 1,000 limit to start. I used the hell out of it for a few months, always paying in full. Within 6 months it was unsecured. Within three months after that I had a limit of over 20K. Before the end of my first year I had a cashRewards and GoRewards with a combined limit of over 40K. Got a car loan shortly after. Use the hell out of your NFCU card and try to pay in full as often as possible and they will quickly ramp up your limit and you will see your score go up, up and away.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Key Factors that adversely affected your Navy Federal credit score

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Key Factors that adversely affected your Navy Federal credit score

Too much is put into trying to understand these reasons . If your profile and income support huge limits, with Navy, more than likely you will achieve it. Even less than perfect profiles and LIErs get more than they usually bargain for. Time, good payment history are huge factors with Navy. Sometimes people wsnt it in a month when a couple of months is sll Navy asks for

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Key Factors that adversely affected your Navy Federal credit score

not sure I would put a ton of faith in their scoring model, I have a decent score with them but all 4 of the codes that supposedly feed into the score are bogus; I have no new credit, have a very seasoned file and > $100 of debt. as I have come to find out not every lender is going to be a good fit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Key Factors that adversely affected your Navy Federal credit score

@bourgogne wrote:not sure I would put a ton of faith in their scoring model, I have a decent score with them but all 4 of the codes that supposedly feed into the score are bogus; I have no new credit, have a very seasoned file and > $100 of debt. as I have come to find out not every lender is going to be a good fit.

That's not their proprietary model. That looks like EQ FICO 5. We all know that the scores used for mortgages stack the deck against us hard.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Key Factors that adversely affected your Navy Federal credit score

@bloccoblu wrote:Thanks for responding. Thats comforting to know. My Navy score sits at 321 so hopefully over time it will improve. This whole credit building thing is strengthening my patience .

Another one of the factors was no open credit union trades in last 12 months. Ive always banked with large banks..so I guess Im on the right track.

I had 333 and got $1k SL.

I had like 320 and got $20k SL.

Don't worry about scores. Use and pay.

DON'T WORK FOR CREDIT CARDS ... MAKE CREDIT CARDS WORK FOR YOU!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Key Factors that adversely affected your Navy Federal credit score

@Anonymous wrote:

@bourgogne wrote:not sure I would put a ton of faith in their scoring model, I have a decent score with them but all 4 of the codes that supposedly feed into the score are bogus; I have no new credit, have a very seasoned file and > $100 of debt. as I have come to find out not every lender is going to be a good fit.

That's not their proprietary model. That looks like EQ FICO 5. We all know that the scores used for mortgages stack the deck against us hard.

I was wondering what that was. I got it on my last letter. No idea what the Navy score is. Would be nice if someone found a way to make it public knowledge.