- myFICO® Forums

- Types of Credit

- Credit Card Applications

- NFCU Flagship app went to review - update, denied

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

NFCU Flagship app went to review - update, denied

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Flagship app went to review - update, denied

I would try a secure message recon. It worked for me for a $5k to $25k CLI (which it seems you need to break through the $5k barrier) .

You are a victim of the high FICO NFCU penalty it seems.

Biz |

Current F08 -

Current 2,4,5 -

Current F09 -

No PG Biz Credit in Order of Approval - Uline, Quill, Grainger, SupplyWorks, MSC, Amsterdam, Citi Tractor Supply Rev .8k, NewEgg Net 30 10k, Richelieu 2k, Wurth Supply 2k, Global Ind 2k, Sam's Club Store 11.k, Shell Fleet 19.5k, Citi Exxon 2.5k, Dell Biz Revolving $15k, B&H Photo, $5k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Flagship app went to review - update, denied

I asked for recon by secure message. Guess it can't hurt. Will update if anything changes. This is not the first time that I felt like NFCU had some sort of "don't like this guy" mark on my file ![]()

FICO Resilience Index: 64. Cards: 5/24, 2/12, 2/6. Accounts including loans: 8/24, 4/12, 3/6. Card CLs total $213,900, or $240,400 including the AU card. Cards (oldest to newest)

Authorized user / Corporate / Auto loans / Personal loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Flagship app went to review - update, denied

Update: 24 hours later, they have not read my message yet ![]()

Or at least, message status is "sent". My older messages all have a status of "read", so I guess that means they haven't read it yet.

More fun with my parallel universe, Evil Spock version of NFCU.

FICO Resilience Index: 64. Cards: 5/24, 2/12, 2/6. Accounts including loans: 8/24, 4/12, 3/6. Card CLs total $213,900, or $240,400 including the AU card. Cards (oldest to newest)

Authorized user / Corporate / Auto loans / Personal loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Flagship app went to review - update, denied

@KJinNC wrote:Update: 24 hours later, they have not read my message yet

Or at least, message status is "sent". My older messages all have a status of "read", so I guess that means they haven't read it yet.

More fun with my parallel universe, Evil Spock version of NFCU.

I haven't heard from them yes.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Flagship app went to review - update, denied

I think your high score + lack of a relationship with them are probably the issue. I hope it works out for you!

Desired BK recovery line up complete 7/12/2021. Planning to garden until 8/2023 and potentially try for AMEX.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Flagship app went to review - update, denied

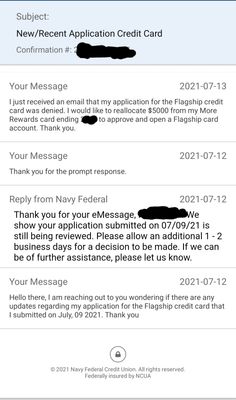

Bit of an update. I received a reply this morning, eight days after sending my message asking for a recon. They apologized for taking that long to reply, but said that they stood by their decision.

I did not ask (and do not plan to ask) about moving some of my existing card's CL so I can qualify for the Flagship's $5K minimum.

The response said that the factors they consider are monthly income (my monthly gross income is five digits and I seriously doubt is an obstacle), "details" from my credit reports (which could be anything, but my FICO 8 scores are 780-806), my account standing (flawless), "and other factors" (like what ... they don't like my haircut?).

To be fair, there are some oddities with my profile, mainly that I had nearly nothing on my reports 30 months ago, and now I have a ton of stuff on them. I could see that making a conservative lender nervous. But NFCU does not have a reputation as a conservative lender, to say the least, and I've had a positive relationship with them on my existing card since last May. So I am very confused by this.

I will say again, my experience with NFCU has been the exact opposite of what I see people post here. I am sure those positive experiences are true, but my negative experience is also true. It wouldn't be the first time I'm a voice in the wilderness, but if I didn't know NFCU had a great reputation, I would consider them a craptastic FI, close out my accounts, and warn others to avoid them. Knowing I'm probably an outlier, I guess I will stick around in case they get over whatever they don't like about me.

JMO, your mileage may (probably will) vary ...

FICO Resilience Index: 64. Cards: 5/24, 2/12, 2/6. Accounts including loans: 8/24, 4/12, 3/6. Card CLs total $213,900, or $240,400 including the AU card. Cards (oldest to newest)

Authorized user / Corporate / Auto loans / Personal loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Flagship app went to review - update, denied

Don't feel bad @KJinNC. I too don't get all the love for NFCU and wondered if they were trying to discourage me from building a relationship with them....which I know is crazy but it's been a weird experience with them for me. I applied for membership on June 16th, and it took almost a month, July 7th, for them to approve me. And this is after pulling my credit on June 22nd. After my approval, I immediately app'd for the Plat card and did receive an instant approval, but had to wait to actually receive the card before I could do my balance transfer because according to them, I needed to be aware of the terms. I assume that the terms were going to be different than what was on the application so I waited. I didn't receive my card until July 19th. The terms that came with the card were no different than the ones I downloaded before apping. I couldn't believe the delay. For a second I thought they had changed their minds and forgot to send me a denial letter because it took so long. On July 8th, I tried to recon my SL, and they didn't reply until July 20th - denied.

I did, however, get approved for membership and my cc with only a soft pull, and my SL is decent, despite my attempt at recon, so there's that. And after I received the card, they processed my balance transfer rather quickly with no further issues.

Prior to all of this, I had intended to make NFCU one of my primary FI, but for now, I'm going to hold off on that. With 10Million members, they may just be going through a rough growth spurt.......

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Flagship app went to review - update, denied

Not to turn this into a general NFCU discussion since that would probably fit better under Personal Finance, but when I joined last year, they fat-fingered my SSN on the phone without me realizing this, and denied a credit card application for some other reason (don't remember now what it was, but it was something specific like "too many cards opened recently"), then delayed my second credit card application because they couldn't find my credit report under the wrong SSN ... then finally brought this up to me and I was able to correct it, but how did they deny the first application?? Since that point, no real problems until this Flagship application. Overall, I get a Keystone Kops vibe, but I have hesitated to say that since there are so many people on this board who talk about how great they are, so I feel like I must be missing something. I feel like I have the mark of Cain on my account with them or something. Going to ignore them for a few years other than light use of my card with them, then may come back to it.

FICO Resilience Index: 64. Cards: 5/24, 2/12, 2/6. Accounts including loans: 8/24, 4/12, 3/6. Card CLs total $213,900, or $240,400 including the AU card. Cards (oldest to newest)

Authorized user / Corporate / Auto loans / Personal loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Flagship app went to review - update, denied

I hate to hear that KC. Hopefully as your relationship ages with NFCU, they will open up the vault. I've been noticing a lot denials for the Flagship this time around. They went a while without offering the big SUB, and it seems like they are being a little more selective this time. I have been chomping at the bit to app for it, but all the denials I've seen lately have given me pause, especially since i just got a $4K CLI on my Plat (bringing my TCL to $31,100) and opened $38K car loan with them in the last 5 weeks. I think I'll let things chill and maybe try to get this card later.

Hover over cards to see limits and usage. Total CL - $584,600. Cash Back and SUBs earned as of 9/1/22- $15292.65

CU Memberships

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Flagship app went to review - update, denied

@KJinNC Do you bank with them in any capacity? Most of the stories I've seen of folks with imperfect histories (like my bk) that do end up scoring huge lines seem to also do some form of DD/regular banking with them. You've built your profile in a nontraditional way, which clearly has worked for you, but if they aren't seeing your 5 figure monthly income coming to them and your relationship has strictly been a single credit card that doesn't carry a balance/produce interest then really the relationship has been pretty one-sided despite that it's in good standing. The pandemic could be playing a role as well.

Apologies if I've missed where you've described additional banking that you do with them.

Desired BK recovery line up complete 7/12/2021. Planning to garden until 8/2023 and potentially try for AMEX.