- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: NFCU application for Flagship rewards just bef...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

NFCU application for Flagship rewards just before mortgage like an IDIOT! lol

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU application for Flagship rewards just before mortgage like an IDIOT! lol

@visualfxpro wrote:

@OmarGB9 wrote:

@visualfxpro wrote:DECLINE!

Prequalified my butt! So what should I do now? Should I apply for a lower card at NFCU? What is my best chance at getting a $5000 limit now?

You really need to do careful research before applying. There's DPs around the forum that document how NFCU's prequal is pretty much useless...

How do I find that? I was searching around and it looks like there is no corrent DP for that.

Use the search bar for the credit card sections as there are three.

Here is another thread that is one of many DPs

https://ficoforums.myfico.com/t5/Credit-Card-Applications/NFCU-Pre-Qualify/m-p/6359245#M295221

Loans

Ford Credit Car Loan 2-year 6/22/2023 ($299/month)

Closed

Michigan Schools & Gov't CU Titanium 1/4/2019 - 10/2/2020

Ford Credit Car Loan 3-year 7/31/2018-6/6/2021

$1,500 Discover Card 10/2/2020 - 8/18/2021

$3,500 Citi DC 10/14/2020 - 12/11/2021

$8,000 DCU Personal Loan 5-year 5.99% 10/2/2020 - 4/30/2021

$8,000 NFCU CashRewards 1/2/2021 - 7/30/2022

$5,000 MSGCU Personal Loan 3-year 7.75% 4/22/2022 - 10/30/2022

Ford Credit Car Loan 2-year 6/7/2021 - 6/22/2023

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU application for Flagship rewards just before mortgage like an IDIOT! lol

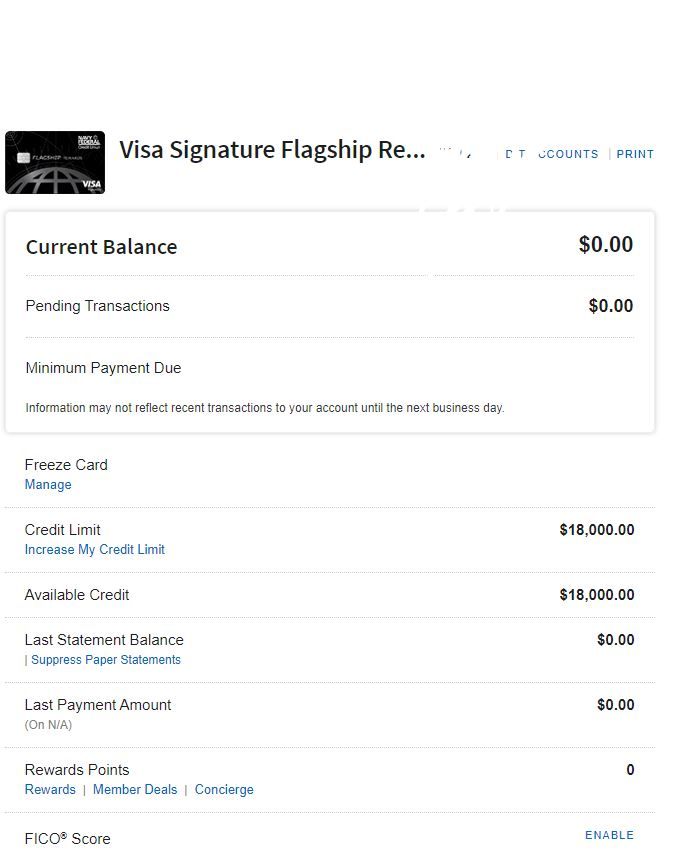

What the hell is this? ROFL. The site was down last night for a while. Then today I login and I see a Flagship card on my account???? **bleep**?? I got denied and have not even gotten my denial letter in the mail yet. Is this real or are they playing with me? Also $18k?? I MEAN...it LOOKS great, but so did the Matrix world, however they were all naked and plugged into some machine in a world with no sun. Is this real life? A sick joke? What is going on?

I actually got some email notice about an imporant message from NFCU, so I logged in a few days ago to see NOTHING in my secure box. Guys, I'm lost. Clearly...I'm about to make a phone call. I feel like calling and pretending like everything is normal. I'll just say "Just wanted to see when my card will arrive", as if nothing is wrong. Feel like if I say "I was denied and now I see", she will put me on hold and then come back with "I'm sorry sir, that was an error due to an outage last night. Unfornately we have to cancel that card since you did not qualify. When you get your card, please cut it up.". LOL

NFCU Flagship Rewards $25,000 | Capitol One $750 | TD Bank $1000 | Bank of America $3000 | Wells Fargo $500 | Amazon $4000

Charge Off from 2015: Municipal Credit Union $5300 ($6500 limit)[PAID IN FULL]

Credit Age: 4 years | Inquiries (6/12/24 month): 12 mo | Debt to Income ratio: 10%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU application for Flagship rewards just before mortgage like an IDIOT! lol

BTW, after talking to a rep who mentioned it might be because my account is dormant (had less than $20 in there. lol), I put $1000 in there. Then this happens...

NFCU Flagship Rewards $25,000 | Capitol One $750 | TD Bank $1000 | Bank of America $3000 | Wells Fargo $500 | Amazon $4000

Charge Off from 2015: Municipal Credit Union $5300 ($6500 limit)[PAID IN FULL]

Credit Age: 4 years | Inquiries (6/12/24 month): 12 mo | Debt to Income ratio: 10%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU application for Flagship rewards just before mortgage like an IDIOT! lol

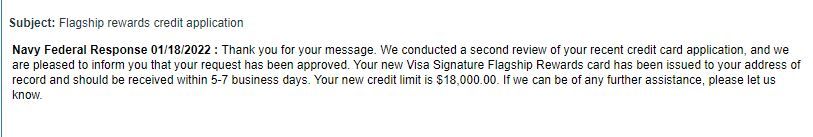

OK, so the message that they alerted me of days ago, finally shows up. This looks LEGIT guys!! HOLY SMOKES!! $18K!!

This is AMAZING!! I'm moving ALL my credit banking to NFCU! I only do $2000-$3000 in spending a month, so I can now just setup auto pays and live my life without watching my accounts like a hawk and worrying about when I can use my card, trying to avoid high utilizaion. I can now just check once a month! ![]()

Think I'll just setup an auto pay from my main account. I'll push maybe $600/mo to this card, PLUS setup a pay in full auto pay at NFCU if possible. This should be pretty safe. I'm VERY unlikely not to notice a payment failure from my main account, so at minum I would never be late. Maybe I'll even do a minum pay, auto pay at NFCU as a backup. If my $600 monthly payment fails for some reason, my auto pay will avoid a late. Minum pay will be so low, so if my account balance runs low, that should work at least.

As for the other cards. I'll put a specific small payment on there like Netflix on one card, Disney on the next. Setup a monthly pay that will equal this charge and make sure it's done early to make all these cards never report balances. Then once in a while I will use other cards, like buy dinner and pay right away, just to add some variety. Not sure how it looks to see 12 months of $30,$30,$30.....

Thoughts?

NFCU Flagship Rewards $25,000 | Capitol One $750 | TD Bank $1000 | Bank of America $3000 | Wells Fargo $500 | Amazon $4000

Charge Off from 2015: Municipal Credit Union $5300 ($6500 limit)[PAID IN FULL]

Credit Age: 4 years | Inquiries (6/12/24 month): 12 mo | Debt to Income ratio: 10%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU application for Flagship rewards just before mortgage like an IDIOT! lol

@visualfxpro wrote:

@OmarGB9 wrote:

@visualfxpro wrote:DECLINE!

Prequalified my butt! So what should I do now? Should I apply for a lower card at NFCU? What is my best chance at getting a $5000 limit now?

You really need to do careful research before applying. There's DPs around the forum that document how NFCU's prequal is pretty much useless...

How do I find that? I was searching around and it looks like there is no corrent DP for that.

BTW, NFCU told me today that it's POSSIBLE that my account being 'dormant' with them for 2 years is the reason for decline. So they DO look at account activity...SUPPOSEDLY. So my take from this is if you guys have plans on applying for their cards and your credit is not super strong. You should start using their services. Maybe a small personal loan. Maybe just regular deposits. Whatever you do, make sure you are not a dormant account when you apply.

Note, they approved me for $1M morgage last year. I did not take it, but being dormant did not affect that.

They watch everything on your reports. I was denied a CLI because of activity with other lenders. Don't remember the exact circumstances, but I believe I made a thread about it a couple of years ago