- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: Navy Federal Datapoints Thread for Membership,...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

I just tried the Amex card they had and got completely denied right there. They actually did do a HP as well. Disappointing but I'd be happy to try again in a few more months or sometime late in August when I'm officially two years out of BK discharge. Not sure if that had anything to do with it as well. I also submitted a CLI on my current card to see what happens.

Current FICOS: Mid 640s-50s on all reports, Ch 7 BK D/C Aug 2019

Starting scores: EX - 534, EQ - 574, TU - 516 | Total TLs: $91k approx | Total Utilization: 17%, getting this back down

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

I posted my approval over in the Credit Approvals section, but wanted to add my first Navy approval over here in the official thread. ![]()

nRewards Secured Visa

SL: $200

Instant Approval in App

TU: 517

AAoA: 5yrs

Income: $11.5k

BK7 Discharged 9 days ago

Mod note: Here's a link to the approval thread: https://ficoforums.myfico.com/t5/Credit-Card-Approvals/NFCU-nRewards-Secured-Approval/td-p/6374970 --UB

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

Scores: TU: 738 EQ: 740 EX: 681

Background: Military STAR never paid the bill and let it fester for almost a year, sent to collections and was paid off with my tax return in 2019. Navy fed member since May 2020, NSecured applied and approved same month. Auto upgraded to NRewards with $2000 SL in 12/2020. AU on Chase Amazon, and Chase Freedom Flex combined limit $40k-perfect payment history.

Application: More rewards AMEX 07/2021 instant approval $25,000 SL. HP was on TU.

CLI: NRewards 07/2021 I only requested $2,000 trying to avoid HP, not knowing $4,000 was the magic number. No instant approval it took a day for it to show up in my account status. No HP.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

@chalupaman wrote:I just tried the Amex card they had and got completely denied right there. They actually did do a HP as well. Disappointing but I'd be happy to try again in a few more months or sometime late in August when I'm officially two years out of BK discharge. Not sure if that had anything to do with it as well. I also submitted a CLI on my current card to see what happens.

Sorry to hear the outcome didn't play out in your favor @chalupaman. Just keep in mind that any new applications for their CCs (loans, CLOC, etc.) will reault in a HP. Only the CLI requests (via mobile app or desktop) can typically result in SP (for the most part). Just something to consider whenever you decide to try for the More Rewards AmEx again.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

I requested a CLI around 1 a.m. today (7/26/2021) and checked my CL which reflects my 4k CLI. Somewhere within a 10 hour turnaround it seems.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

Another data point - opened NFCU membership/checking/savings 4/21, $200 total balance w/ no other activity. Applied for first card last night. Much higher than expected for first card, but other card options had less cash back than my 2% Penfed PCR, so I couldn't see having enough activity to generate much future love from NFCU.

More Rewards AMEX

SL: $25,000

Instant Approval in App

TU: 828

TU inquiries 0/12, 3/24

AAoA: 10+ yrs

BK13 filed 11/13 Discharged 6/19

Oct 2019 EQ 672 TU 643 EX 663

Julu 2021 EQ 840 TU 828 EX 819

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

DW opened NFCU CashReward Visa 10/20/20 SL of $1,000 Used the card heavily and paid off or down to a low balance. March misjudged the payment/statement and ended up over her limit on her March Statement by $19 was paid off the next day. Applied for and received a moreRewards Amex with $11,000 SL in May but could not get a credit line increase on this card until today 07/26/21, asked for $4000 was given $2000 to make her new CL $3000!

Moral of the Story: don't go over your limit and if you do, don't let the statement cut while it is.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

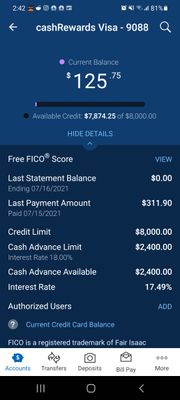

I put in for a CLI on my CR about 330 this morning. Just got home from work and checked my account, it's updated with the 4K max they've been giving.

So, the card started at $500 15 months ago, today it went from 4K to 8K. I'm pretty happy with this progression.

I probably average about $250-$300 a month on this card. Not the most spend but some.

I've been with Navy for about 17 months. I have part of my direct deposit go there, not the majority though.

EQ9 745

NFCU Cash Rewards 16K CL

Citi Custom Cash 7.5K CL

AODFCU Visa Sig 5K CL

Discover IT 2.5K CL

Capital One QS 3600 CL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

@Mr_Mojo_Risin wrote:I put in for a CLI on my CR about 330 this morning. Just got home from work and checked my account, it's updated with the 4K max they've been giving.

So, the card started at $500 15 months ago, today it went from 4K to 8K. I'm pretty happy with this progression.

I probably average about $250-$300 a month on this card. Not the most spend but some.

I've been with Navy for about 17 months. I have part of my direct deposit go there, not the majority though.

EQ9 745

@Mr_Mojo_Risin: Congrats on your CLI! Have you received an APR reduction on your cashRewards CC, yet? You're eligible to request an APR reduction after 12 months.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

@USMC_Winger wrote:

@Mr_Mojo_Risin wrote:I put in for a CLI on my CR about 330 this morning. Just got home from work and checked my account, it's updated with the 4K max they've been giving.

So, the card started at $500 15 months ago, today it went from 4K to 8K. I'm pretty happy with this progression.

I probably average about $250-$300 a month on this card. Not the most spend but some.

I've been with Navy for about 17 months. I have part of my direct deposit go there, not the majority though.

EQ9 745

@Mr_Mojo_Risin: Congrats on your CLI! Have you received an APR reduction on your cashRewards CC, yet? You're eligible to request an APR reduction after 12 months.

I haven't requested an APR reduction yet. I was eligible a few months back but just haven't yet.

I don't carry an any balances but it is a good idea to request it just in case.

Thanks for the heads-up 👍

NFCU Cash Rewards 16K CL

Citi Custom Cash 7.5K CL

AODFCU Visa Sig 5K CL

Discover IT 2.5K CL

Capital One QS 3600 CL