- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: Navy Federal Datapoints Thread for Membership,...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

@OmarGB9 wrote:I don't know that you have to wait 190 days. But for sure it's starting to look like you need to wait for 6 statements to cut. Like I said previously, mine was only 186 days/6 statements when I tried the second time last week.

@OmarGB9 That's a great point! It's probably the 6 months and 6 statements that are more important. I think with my last 2 limit increase requests (my wife's Cash rewards at 182 days and my More Rewards at 183 days) both being initially denied for asking too soon and then approved a few days later I'm just choosing to err on the side of caution.

It is no fun for me waiting 4 to 5 days to be denied just to turn around and be approved the next day. I think I'll just wait until day 190 to avoid the hassle. Like you said though 186 days could be fine if a 6th statement has been released too!

![Capital One Quicksilver | $4000 | July 2013 [AU]](https://ecm.capitalone.com/WCM/card/products/quicksilver-card-art.png)

![Capital One Venture X | $40,000 | September 2023 [AU]](https://ecm.capitalone.com/WCM/card/products/venturex-cg-static-card-1000x630-2.png)

![Chase Amazon Prime | $12,000 | March 2020 [AU]](https://creditcards.chase.com/K-Marketplace/images/cardart/prime_visa.png)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

@800wannabe420 wrote:

@MarcuzAgrippa wrote:Started my CC journey with a Nsecured card back in Sept. 2020 with a $300 limit. This doubled 3 months later to $600. On my 04/23/2021 statement, it went unsecured and the limit became $2k with a product change to a cashRewards card.

By my math, I should be clear to ask for an increase correct?

My plans are to ask for the CLI and then app for the More Rewards card. I do have a balance on the card at the moment. Have better results been seen on the CLI and apping for a new card with a zero balance on the existing card?

You should be good for both a new app and a CLI request. I would suggest you determine which of the two actions is most important to you and perform that first. A successful CLI could put you over NFCU's internal limit and produce a denial for a cc application.

@800wannabe420 I went ahead and pulled the trigger late last night. Did an app for the NFCU More Rewards Amex and got immediate approval for a $5,100 limit. Right after I pulled the trigger on a CLI on my cashRewards card. Woke up today to a $4k increase putting me at $6k on that card as well. Happy with both results considering my credit profile has a CO on it still reporting for over $11k.

Authorized User: Cap1 $4250 w/ 3+ years AAoA, AMEX $1k w/ less than a year AAoA

Current Auto Loan:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

@MarcuzAgrippa wrote:

@800wannabe420 wrote:

@MarcuzAgrippa wrote:Started my CC journey with a Nsecured card back in Sept. 2020 with a $300 limit. This doubled 3 months later to $600. On my 04/23/2021 statement, it went unsecured and the limit became $2k with a product change to a cashRewards card.

By my math, I should be clear to ask for an increase correct?

My plans are to ask for the CLI and then app for the More Rewards card. I do have a balance on the card at the moment. Have better results been seen on the CLI and apping for a new card with a zero balance on the existing card?

You should be good for both a new app and a CLI request. I would suggest you determine which of the two actions is most important to you and perform that first. A successful CLI could put you over NFCU's internal limit and produce a denial for a cc application.

@800wannabe420 I went ahead and pulled the trigger late last night. Did an app for the NFCU More Rewards Amex and got immediate approval for a $5,100 limit. Right after I pulled the trigger on a CLI on my cashRewards card. Woke up today to a $4k increase putting me at $6k on that card as well. Happy with both results considering my credit profile has a CO on it still reporting for over $11k.

Excellent!!!

If you did not receive the lowest APR for your More Rewards card (currently 9.65%), mark your calendar for 365 days and (assuming responsible use) you will be eligible to request a reduction of your APR. This annual request also applies to your Cash Rewards card.

With your Navy success, a new Apple CC and a recent (less than 6 months) car loan, I would STRONGLY suggest a trip to the garden and work on your utilization and your 11K+ CO.

Not every lender is as generous as NFCU!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

I just got a CLI on my More Rewards AMEX after 185 days. $8k increase to $37k now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

@RASULL12 wrote:I just got a CLI on my More Rewards AMEX after 185 days. $8k increase to $37k now.

That's some sweetness, glad to hear it!

I'm eligible next month on both of my cards, hopefully I can break 30K also.

Enjoy it!

NFCU Cash Rewards 16K CL

Citi Custom Cash 7.5K CL

AODFCU Visa Sig 5K CL

Discover IT 2.5K CL

Capital One QS 3600 CL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

I've had the nRewards secured since Oct 2020. I was feeling frisky in June and saw they do pre-qual and I was given the options of all cards, I didnt expect anything special so I just chose the nRewards (should've chosen a better one) and was given a $15k CL. I've recently put on charges I couldn't pay off immediately (perks of having a vehicle) and I'm at 5k/15k. My secured still hasn't graduated. At what point should I just close that card? How long should I keep it open in hopes that it moves over?

Starting Score 12/2018: 521 EX; 553 TU; 508 EQ

Current Score 04/2021: 627 EX; 632 TU; 622 EQ

Goal Score: 700

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

@CrimsonMoon93 wrote:I've had the nRewards secured since Oct 2020. I was feeling frisky in June and saw they do pre-qual and I was given the options of all cards, I didnt expect anything special so I just chose the nRewards (should've chosen a better one) and was given a $15k CL. I've recently put on charges I couldn't pay off immediately (perks of having a vehicle) and I'm at 5k/15k. My secured still hasn't graduated. At what point should I just close that card? How long should I keep it open in hopes that it moves over?

I certainly wouldn't close the card, unless you desperately needed the money you put down on it.

Since it's been over a year and you've had another Navy card for about 6 months, send them a secure message or call in and ask them about it.

EDIT- You may want to get your balance down below 30%, it could be a consideration for a graduation.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

Navy is making me a little nervous. How long have others seen recently to get approved for CLI on mobile app or website? I imagine my CLI is just up for normal review but I'm surprised at how long they are taking this time.

I just did a hefty BT ($25K) since they were offering $0/0% on my Platinum card. Then I asked for the CLI. It's been crickets for about 24 hours. I usually see their CLIs when my "available balance" is updated on mobile app/website.

The stupid thing is that if it spooked them, I don't really need the BT and could pay it off immediately. I just did it to cycle some balance through the card to show utilization and payment history. I got the Platinum for the low APR and don't use it regularly since it has no rewards program.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

@Aim_High wrote:Navy is making me a little nervous. How long have others seen recently to get approved for CLI on mobile app or website? I imagine my CLI is just up for normal review but I'm surprised at how long they are taking this time.

I just did a hefty BT ($25K) since they were offering $0/0% on my Platinum card. Then I asked for the CLI. It's been crickets for about 24 hours. I usually see their CLIs when my "available balance" is updated on mobile app/website.

The stupid thing is that if it spooked them, I don't really need the BT and could pay it off immediately. I just did it to cycle some balance through the card to show utilization and payment history. I got the Platinum for the low APR and don't use it regularly since it has no rewards program.

I just tried for my CLI above 25k and they are silent. Hasn't even responded with a "hey, we will put both your cards at 25k, now leave us alone" lol

FICO 5 ,4, 2 - 10/2023 FICO 8 - 10/2023 FICO 9 - 10/2023 FICO 10 - 10/2023

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

@1GaDawg85 wrote:

@Aim_High wrote:Navy is making me a little nervous. How long have others seen recently to get approved for CLI on mobile app or website? I imagine my CLI is just up for normal review but I'm surprised at how long they are taking this time.

I just tried for my CLI above 25k and they are silent. Hasn't even responded with a "hey, we will put both your cards at 25k, now leave us alone" lol

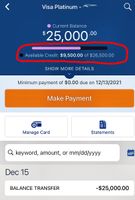

Thanks @1GaDawg85! Yes, it's funny how they don't tell you they approve it. You kinda have to read between the lines on the "Credit Available" statistics on the summary page. Mine was just approved, about 26 hours after I requested, so maybe there is hope for yours also! Lol ![]()

It shows a balance of $25K ... plus available credit of $9,500 remaining of a $26,500 credit limit. Which of course, doesn't add up, unless you allow for a pending $8,000 CLI adjustment to my (old) $26,500 credit limit to a new $34,500 limit. They talk about "AMEX Math" but this is "Navy Math." Lol

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.