- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Navy Federal Datapoints Thread for Membership, CLI...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

Thinking about the future.

If I apply for my second card sometime next year when my TU report is clean of baddies, but my EQ report still has 1 baddie, assuming they pull TU, will their knowledge of my EQ baddie cause them to deny my app or pull EQ when it's been reported that most pulls for new apps are TU?

Or should I wait for both my TU and EQ reports to be clean before applying?

3/6, 5/12, 14/24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

@GZG wrote:Thinking about the future.

If I apply for my second card sometime next year when my TU report is clean of baddies, but my EQ report still has 1 baddie, assuming they pull TU, will their knowledge of my EQ baddie cause them to deny my app or pull EQ when it's been reported that most pulls for new apps are TU?

Or should I wait for both my TU and EQ reports to be clean before applying?

They pull TU9 for new cards.

>/ nfcu platinum 15k, BABY NEEDS NEW SHOES !!!!!

closed-- reflex, applied bank, first digital, mission lane, ikea, fingerhut, big lots, valero gasoline, ollo, more to come

Rebuilding since September 2020

who i burned - chase, cap 1, TD bank, Sync, were the biggies

Income 40k

Total utilization around 20 pct depending on my current usage/needs

Ficos in the 680 - 690 range, the 9's slightly higher than the 8's

My vantage scores 708 - 711

TCL - about 110k

Retired since 2017

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

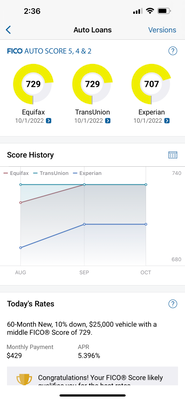

Navy pulled TU 4 for my auto loan.

>

> >

> >

> >

> >

> >

> >

> >

> >

>

Starting Score:

0

Current Score:

My highest 818

Goal Score:

850

Take the myFICO Fitness Challenge

/

/

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

@RobynJ wrote:Navy pulled TU 4 for my auto loan.

I am 00.000001% sure that is a TU Mortgage score ... like EX FICO2

@RobynJ, I edited to reflect accuracy.

Did not know about Auto Score 4![]() But then I have not had a car payment in 7 years or more!

But then I have not had a car payment in 7 years or more!

I also do not pull my scores from myFICO.

On Experian, for Auto ... I only get

FICO® Auto Score 2

FICO® Auto Score 8

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

As you can see this is auto score 4 not mortgage score. I know this is what they pulled as it's the only score that comes close to matching the price you pay for credit letter they sent and it was exactly the same.

>

> >

> >

> >

> >

> >

> >

> >

> >

>

Starting Score:

0

Current Score:

My highest 818

Goal Score:

850

Take the myFICO Fitness Challenge

/

/

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

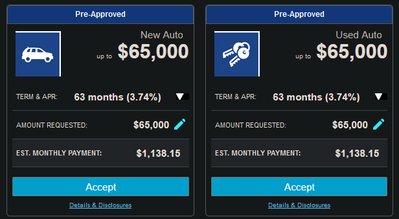

These are the current Auto offers I have;

Very Solid Pre-Approvals from Service CU

Sorry, getting way OT.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

Do I need to wait 6 months if I got an automatic CLI from Navy Fed? Or does the 6 month period between requests only apply to self-iniated requests?

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

@Space_Daddy wrote:Do I need to wait 6 months if I got an automatic CLI from Navy Fed? Or does the 6 month period between requests only apply to self-iniated requests?

Thank you!

Unfortunately ...Auto CLI's reset the 6 month period.

This is a good reason to send a secure message and have them (Auto increases) turned off.

I did just that, I think it was over a year ago .. maybe two.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

Thanks for letting me know. My automatic CLI have me an extra $2000 (from $9000 --> $11,000) but I'm guessing that I'd get a bigger increase if I requested it myself.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

CREDIT CARDS

- Pulls TU9

Does anyone know if this would be the FICO Score 9 or the FICO Bankcard Score 9?

Revolving Accounts