- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Navy Federal Datapoints Thread for Membership, CLI...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

Hello all,

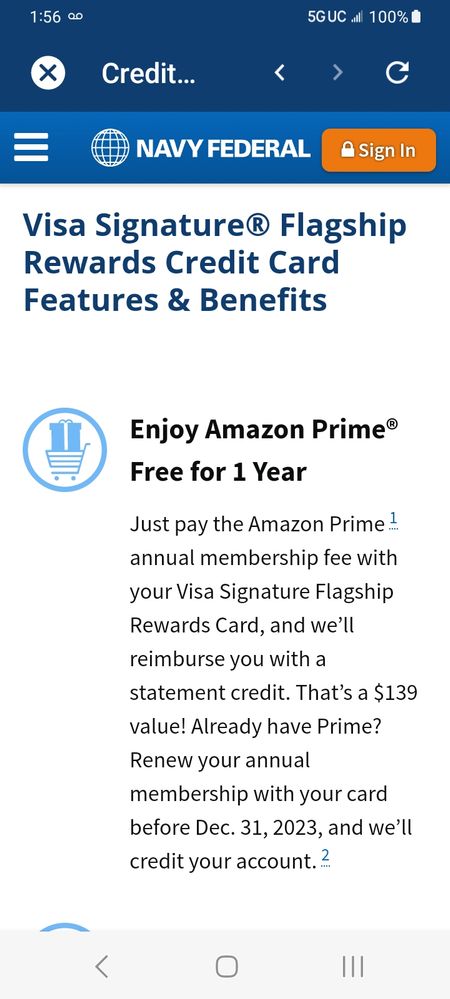

Has anyone with the Flagship had their Amazon Prime subscription reimbursed again this year? I've had it the last 2 years and am hoping they do it again this year. It's definitely made keeping the card worth it for me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

@GoTarHeels wrote:Hello all,

Has anyone with the Flagship had their Amazon Prime subscription reimbursed again this year? I've had it the last 2 years and am hoping they do it again this year. It's definitely made keeping the card worth it for me.

It appears this offer has been extended until 12/31/2023.

I also enjoy this benefit (if only they would include the tax).🙂

I use the Global Entry along with my significant other for a total of $179 annual savings. Not a bad return for a $49 annual fee 😀

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

I hope this doesn't apply to just new Flagship account holders! They were lenient last year and I hope it continues again.

Since I have other cards that pay for Precheck it doesn't help me as much, unfortunately. Even though it's only $49, 2x on everything and 3x on travel are not difficult categories to have covered by cards with no AFs, so it really wouldn't be worth it for me.

@800wannabe420 wrote:

@GoTarHeels wrote:Hello all,

Has anyone with the Flagship had their Amazon Prime subscription reimbursed again this year? I've had it the last 2 years and am hoping they do it again this year. It's definitely made keeping the card worth it for me.

It appears this offer has been extended until 12/31/2023.

I also enjoy this benefit (if only they would include the tax).🙂

I use the Global Entry along with my significant other for a total of $179 annual savings. Not a bad return for a $49 annual fee 😀

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

The new Flagship account holders offer has a different date (8/31/2023).

And I agree, 3% travel and 2% everything else can be easily duplicated/exceeded using other cards, however, combined with the No Foreign Transaction Fee along with the superior customer service makes this a valuable card for myself.

Since retiring and having my travel reduced from weekly (!!!) to 3-4 annually, this low annual fee card meets my needs without using a travel portal associated with some cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

Ok, awesome, that's good to know!

I'm with you on the travel portals. Not a fan of any of them, except for FHR. The value there can be too good depending on where you're travelling. Otherwise, I much prefer to book directly with the airline or hotel.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

A data point on when Navy Fed reports to the credit bureaus: My Platinum card statement closed on June 3, and the statement balance and new credit limit were reported to credit bureaus on June 7. Alerts on all credit score reporting apps (Vantage and Fico) continued through June 9. The 3rd was a weekend, but I believe last month, it was also at least a 2-3 lag between statement close and reporting to bureaus

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

Hey yall. Here's an interesting datapoint I wanted to add not sure if its been mentioned before. Previously I knew if you had any prior balances with NFCU you wouldn't be "forgiven" until paid in full. Well, I had a previous GoRewards which CLOSED with a $7k balance about 6 years ago while experiencing financial difficulty. I consistently paid on it since then ,as off today the current balance left $1300 . 3 years ago in my attempt to rebuild I opened a nRewards secured wit $300. This morning around 6 am,I woke up to the Congratulation your nRewards has been unsecured and your deposit is being returned email. I logged onto my Navy fed app, it is already reflecting with a new acct type and limit. I was indeed suprised considering i still have a balance left on my prior closed card. I am indeed grateful for the lessons learned and boost in utilization. Had I known this was a possibility of unsecuring I wouldnot have taken that 3 HP from Cap 1 just yesterday or I would have selected the Venture one instead of Savor one to not have 2 cashback cards.

Current fico 8 scores Eq-683 TU-687 ex 676 zero collections 1-2 inq on all reports

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

@OpenBook55 wrote:Hey yall. Here's an interesting datapoint I wanted to add not sure if its been mentioned before. Previously I knew if you had any prior balances with NFCU you wouldn't be "forgiven" until paid in full. Well, I had a previous GoRewards which CLOSED with a $7k balance about 6 years ago while experiencing financial difficulty. I consistently paid on it since then ,as off today the current balance left $1300 . 3 years ago in my attempt to rebuild I opened a nRewards secured wit $300. This morning around 6 am,I woke up to the Congratulation your nRewards has been unsecured and your deposit is being returned email. I logged onto my Navy fed app, it is already reflecting with a new acct type and limit. I was indeed suprised considering i still have a balance left on my prior closed card. I am indeed grateful for the lessons learned and boost in utilization. Had I known this was a possibility of unsecuring I wouldnot have taken that 3 HP from Cap 1 just yesterday or I would have selected the Venture one instead of Savor one to not have 2 cashback cards.

Current fico 8 scores Eq-683 TU-687 ex 676 zero collections 1-2 inq on all reports

Congratulations on your graduation and rebuild, and thanks for sharing your data points!

Last HP 08-07-2023

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

In case anyone is interested...I just got an $8000 limit increase that made me surpass the $80K Max Exposure rule with Navy Federal. Here's the post I made about it. https://ficoforums.myfico.com/t5/Credit-Card-Approvals/Navy-Federal-CLI-Surpassing-Max-Exposure/td-p...

![Capital One Quicksilver | $4000 | July 2013 [AU]](https://ecm.capitalone.com/WCM/card/products/quicksilver-card-art.png)

![Capital One Venture X | $40,000 | September 2023 [AU]](https://ecm.capitalone.com/WCM/card/products/venturex-cg-static-card-1000x630-2.png)

![Chase Amazon Prime | $12,000 | March 2020 [AU]](https://creditcards.chase.com/K-Marketplace/images/cardart/prime_visa.png)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

Hi all... quick question about when I should ask for my first CLI.

Jan statement cut on 22nd.

Converted from secured to unsecured on Jan 30.

First statement unsecured was Feb 22. That being said.. March, April, May, June...

Is my July 22 statement when I should ask for the CLI? Online correct?

Hard INQs last 12 months: EQ: 5 | TU: 8 | EX: 9

Verizon Visa $8500 Amex Delta Reserve $10,000 Care Credit $18,000

NFCU CashRewards $7500 Apple Card $7000 Best Buy $8000 Amazon $5000

NFCU auto loan (2022 Ford Bronco Sport Badlands - Cactus Gray) 6.95%

NFCU motorcycle loan (2024 Harley Davidson Road Glide - Alpine Green & Chrome) 9.45%

Total CL: $64,000 --- Total CC UTI: 27% --- AAoA: 5.5 years --- Income: $200k

Last app: 4-6-24