- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: Navy Federal Thread for CLI and Additional Car...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Navy Federal Thread for CLI and Additional Cards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

@Jccflat wrote:

When is the earliest I could go for a third card?

First card opened mar 21 $9.600

Cli on June 21 to $20,600

And second card 25k

TU Fico 773

Navy is my only cards besides 2 AU cards I also have

Sept. 21st

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

@FicoGuy2019 wrote:

@Anonymous wrote:Well I guess my APR request is waiting til next month. Somehow my EQ9 dropped from 695 to 673. I don’t know why but my EQ9 is the most unpredictable score I have. 8s will stay within a 10 point range (my over 10 point drop was losing AoOA >10, fluctuations are minimal otherwise), EQ9 has about a 30 point spread.

Keeping my fingers crossed for you...I know being patient can be the hardest thing.

Being patient can be a very hard thing. I was patient on my 3rd card, not giving it two thoughts, right up until the moment earlier this morning when I stopped being patient. Hoping for some SP love I tugged on the CLI Luv Lever & asked for a modest 7K CLI.

So far no HP. And now I wait while they review, patiently or not.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

@Anonymous wrote:

@Jccflat wrote:

When is the earliest I could go for a third card?

First card opened mar 21 $9.600

Cli on June 21 to $20,600

And second card 25k

TU Fico 773

Navy is my only cards besides 2 AU cards I also haveSept. 21st

September 20th actually as long as three statements have cut by then as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

@Anonymous wrote:Well I guess my APR request is waiting til next month. Somehow my EQ9 dropped from 695 to 673. I don’t know why but my EQ9 is the most unpredictable score I have. 8s will stay within a 10 point range (my over 10 point drop was losing AoOA >10, fluctuations are minimal otherwise), EQ9 has about a 30 point spread.

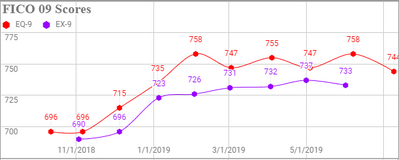

I've also noticed my EQ-09 seems to have the widest range. The last few months it has been a rollercoaster.

Not a lot changed in my profile. I looked through my statements. I normally let a <10% balance get reported on all 3, now 4, of my cards.

Looks like Capital One autopay still goes through even if I manually pay after the statement cuts. So I alternate between reporting $0 and $2. Leads me to believe that EQ-09 is particularly sensitive to how many cards report balances.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

Does NFCU have "months since last baddies" when applying for CLI? I have some but are 18-24 months old. I've requested a CLI a couple months ago which was declined for having baddies. I'm wondering if they have like a 36 or 48 months since policy or something like that.

Really do not know if anybody knows this. I was / am confused that I have an under 4% UTIL, and NFCU still have on top, too high util.

As for baddies, I think a lot of it depends on the amount. Unless you messed up like me and callanged them at about 5 yrs, then they all moved up on the list. My CR dropped 35 +/- after the challange/review. [5 cards, < $900, went to charge off].

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

@Anonymous wrote:

@Anonymous wrote:Well I guess my APR request is waiting til next month. Somehow my EQ9 dropped from 695 to 673. I don’t know why but my EQ9 is the most unpredictable score I have. 8s will stay within a 10 point range (my over 10 point drop was losing AoOA >10, fluctuations are minimal otherwise), EQ9 has about a 30 point spread.

I've also noticed my EQ-09 seems to have the widest range. The last few months it has been a rollercoaster.

Not a lot changed in my profile. I looked through my statements. I normally let a <10% balance get reported on all 3, now 4, of my cards.

Looks like Capital One autopay still goes through even if I manually pay after the statement cuts. So I alternate between reporting $0 and $2. Leads me to believe that EQ-09 is particularly sensitive to how many cards report balances.

Ah! That’s right! I forgot that EQ has a penalty for >33% of cards with a balance. Out of 11 revolving accounts reporting, 4 of them have a balance. For some reason EQ has a 1/3 penalty instead of the 1/2 that the other bureaus do. That’s probably exactly what it is. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

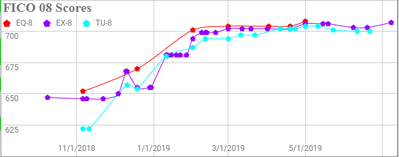

FICO 8 Starting Score: (2 DEC 17)

FICO 8 Current Score: (27 JAN 21)

FICO 8 Goal Score:

Hover over my cards to see my limits and utilization!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

@rdrarmy wrote:

@Creditaddict or anyone with experience and or knowledge, could you give me your personal opinion on whether or not I should request a CLI on my $20K NFCU Platinum card that I opened in January 2019? I was looking at requesting a CLI to $25K. This morning my FICO 9 score updated on my NFCU app and I proceeded to request a CLI on my Cash Rewards card for $25K. My request was approved, but not for the full amount. I was only approved from $6k to $13K. What do you think?

@rdrarmy If you have asked for 25K and got 13K, you may have hit your internal limit for the time being. Not to worry, it doesn't take long to build more up tho.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

Or it’s only based on the TU new pull and the internal score ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

So I have 3 cards with Navy. Got my platinum 9/18(cli 12/18), CLOC 12/18, Flagship 12/18, and Amex 3/19. My scores are higher than they were when I got any of them. Got all 2nd and third cards at 91/3 and cli at 91/3. No late payments on any. One card and CLOC are $0, Flagship is at 18% and Amex is at 10%. All other cards in my report are $0.

I just applied yesterday for cli for the Flagship from 15k to 25k. Got the 24 hour message. Haven't received any emails from them. No messages on the website. And no update to my limit. I did get an HP to my TU account right after the app.

Any hope I might still have a chance? Or is the fact that it has been about 30 hours and nothing happen mean it was declined? Should I call to see what is going on?