- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREA...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Navy Federal Thread for CLI and Additional Cards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREAD

Hi Everyone,

Wanted to share my recent NFCU experience and also ask a couple questions.

Been a NFCU member for 2 years exclusively for banking. My 12th statement cut last week on my Go rewards card. The APR was 18% so I did a secure message through the app and asked for a rate reduction. They came back and said they could do 14.99% but that I had to confirm if I would accept it. I thought the way the response was framed left it open to negotiations so I asked for 9.99%. NFCU came back saying it is against fair credit practices to allow me to negotiate an APR and I have to have the same APR they would offer anyone in my credit profile, etc.

my current Score with EQ9 they show is 701. So I went back and said ok and I'll take the 14.99%.

Question...anyone ever heard of this? As far as not being able to negotiate with APR? NFCU said by taking the APR reduction now then I have to wait 1 year to ask for another one. Or I could decline it, wait a bit longer and see if I got a better APR. I don't carry a balance on a $5500 limit even though it's 1 of 2 of my daily drivers. I spend about 4-5k a month between my 2 NFCU cards.

2nd Question...Closing on a new construction home 12/18(fingers crossed). Right after, think next day lol, I want to apply for a 3rd NFCU card and hoping for at least a $10k starting limit. Already have a Cash rewards limit that's $2400. What's the best card option you think with a 700-710 FICO 8/9 score with EQ and TU? An additional note is that my Go rewards is up for a CLI next month. If I do the CLI first in November then do a new card app the next month is that smart? Or wait the other way around and do the 3rd card app in December then the CLI right after. Not sure if waiting a month between requests changes things.

Thanks for any help/suggestions!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREAD

@CreditOnTheRise1 congrats on yhe nice APR reduction.

IMHO I would wait until closing, try for the new card and then do the CLI request. SP CLI's can go away at any time and I wouldn't risk even a small chance of a HP while waiting to close. It's only one extra month. The best card to chose is the one that works best for your needs. Just remember the FS has a $5K min SL so it may be harder to get. 😉

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREAD

@Anonymous wrote:@CreditOnTheRise1 congrats on yhe nice APR reduction.

IMHO I would wait until closing, try for the new card and then do the CLI request. SP CLI's can go away at any time and I wouldn't risk even a small chance of a HP while waiting to close. It's only one extra month. The best card to chose is the one that works best for your needs. Just remember the FS has a $5K min SL so it may be harder to get. 😉

Thank you! I'll take what I can get with the APR. I'll try again next year to get it lower. And thanks for the info about waiting to close before I even do the CLI. I didn't even consider that it would be an off chance of a HP since all mine are normally SP's...but you're right. No need to chance it and risk the closing. That's why I love this group! Helps to have someone who isn't invested to give unbiased advice. I don't need the CLI so I'll wait til after closing.

Just took a look at the cards and the Cash Rewards fits me best with 0% Apr for 6 months and then $150 cash back. Offer good til Jan 2021. Not really interested in the others.

Anyone know if you can have 2 of the same cards? I already have a cash rewards because my NRewards graduated into one a few months back I but would take another one actually. Or can I product change to an Amex now and then apply for the cash rewards in December?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREAD

@Jordan23ww wrote:I am wondering with all that’s going on if anyone has recently gotten credit limit increases on 2 credit cards at the same time? In November my More Rewards and Flagship cards will both be eligible for increases. I've had the More Rewards since Feb 2020 and this will be my 2nd CLI. I've had the Flagship since August 2020 and this will be my 1st CLI. I put the majority of my monthly spend on the Flagship, close to $2000 per month. With the limit being $5200 I really need more on that card. The More Rewards I usually spend $100 to $300 on it, the limit is currently $17,300. I always pay both in full by the closing date, just want to get their limits up to $25,000 as soon as possible. Trying to decide if I will go for just 1 increase and space out the 2nd or just do them both simultaneously? I know it wasn’t unheard of before the pandemic to get increases on more than 1 card but a lot has changed.

just like CC applications, as long as your waiting for your 91/3, you should ask for a CLI. its all still a SP right now. so you could ask every month if you wanted to.

I remember when i had gotten my flagship it has a starting line of $15k. i had put maybe about $2k in 3 months.. when i had asked for a CLI, they increased it to $23k. so sometimes NFCU can be a bit odd every once and while. I'm passed my 91/3 since my last CLI for my flagship. i'm just waiting for my statement to cut in the next few days before i try to get another CLI on my flaghsip.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREAD

@CreditOnTheRise1 sure you can have two of the same cards. Keep in mind that Navy offers a super low BT rate in January to existing members and on new apps. I think it's usually 1.99%-3.99% for 12 months depending on the year. It's a great opportunity to move any lingering high interest balances and get them knocked out quickly. Congrats on the upcoming closing! How awesome to have a new house!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREAD

@mchang124 nice CLI last time on the FS! It sounds like you got in on the $8K max just before it became $4K for now. Since CLI attempts are every six months after a successful increase I was wondering if you have any plans for a second card?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREAD

@CreditOnTheRise1 wrote:They came back and said they could do 14.99% but that I had to confirm if I would accept it. I thought the way the response was framed left it open to negotiations so I asked for 9.99%. NFCU came back saying it is against fair credit practices to allow me to negotiate an APR and I have to have the same APR they would offer anyone in my credit profile, etc.

If you had a high UTI or something else you could do a quick fix to get a higher score then you could've waited but otherwise I think it makes sense that certain score teirs are bracketed into certain APR%

|

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|

Starting Scores (06/2016):

Current Fico8 Scores (Updated 10/24/23):

Current Fico9 Scores (Updated 10/24/23):

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREAD

@Anonymous wrote:@CreditOnTheRise1 sure you can have two of the same cards. Keep in mind that Navy offers a super low BT rate in January to existing members and on new apps. I think it's usually 1.99%-3.99% for 12 months depending on the year. It's a great opportunity to move any lingering high interest balances and get them knocked out quickly. Congrats on the upcoming closing! How awesome to have a new house!!

Oh man I didn't know that. Yea so I may plan to just wait until January to see what's available. I could use the BT for the last 5 grand on a car loan where the APR is terrible from 4 years ago and it's too late now to refi. I don't mind the temporary score ding for high UTI since I would already have the house. Closing is causing more stress so trying to push ahead! I may have to switch LO ASAP due to issues but that's for another thread!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREAD

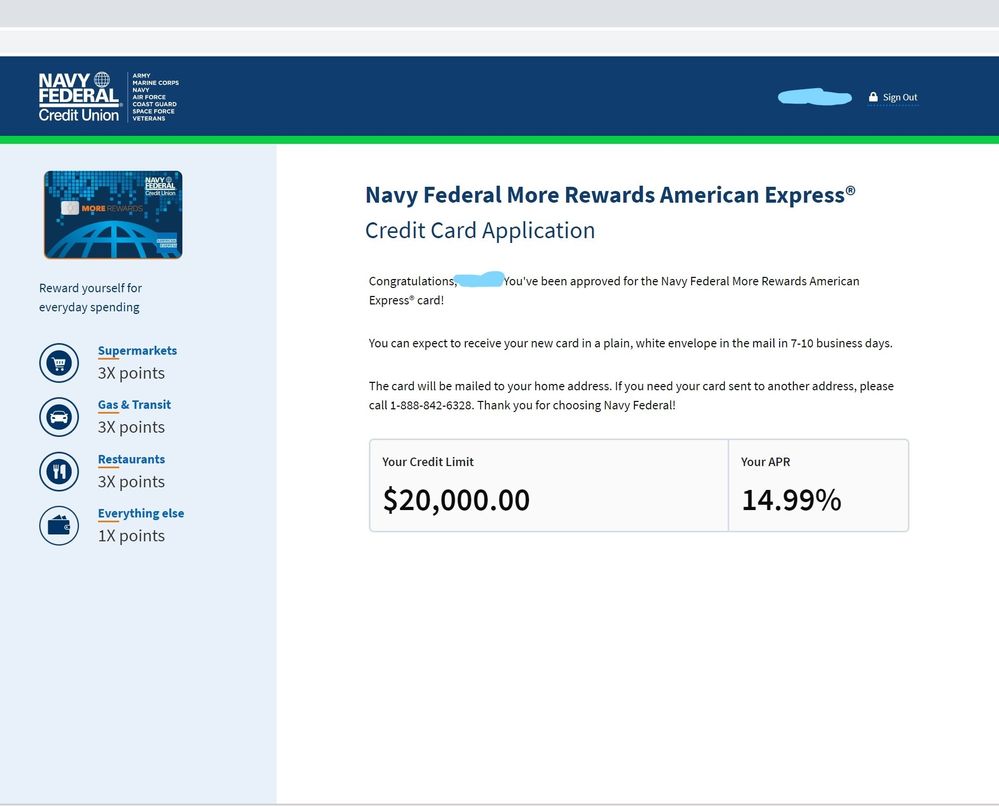

@BmoreBull wrote:@Anonymous I stuck my toe in the pool and the water was just fine. Not entirely pleased with the apr, but I never carry a balance. Now I have to return to the garden until the end of 2021. Thank you for all of the well wishes and good vibes.

@BmoreBull, Congratulations!!!!

Mark your calendar for one year anniversary of your new card and ask for an APR reduction![]()

Again, Very nice approval![]()