- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREA...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Navy Federal Thread for CLI and Additional Cards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREAD

@M_Smart007 wrote:

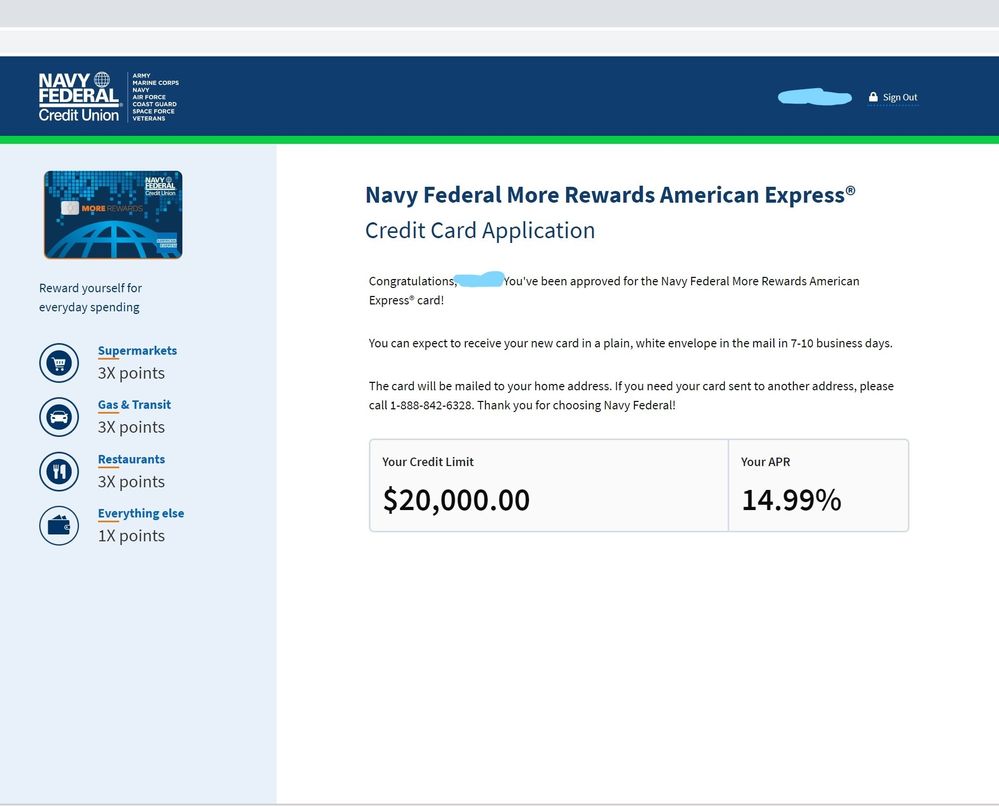

@BmoreBull wrote:@Anonymous I stuck my toe in the pool and the water was just fine. Not entirely pleased with the apr, but I never carry a balance. Now I have to return to the garden until the end of 2021. Thank you for all of the well wishes and good vibes.

@BmoreBull, Congratulations!!!!

Mark your calendar for one year anniversary of your new card and ask for an APR reduction

Again, Very nice approval

Thank you. I'll be waiting patiently for the apr reduction. Hopefully by then I'll have earned their trust.

Starting Fico Scores:November 2019

Current Fico Scores: January 6, 2021

Goal Scores: 700 across all three

Goal Scores: 700 across all three

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREAD

Yesterday Morning requested a CLI on my Amex MoreRewards card, so far no change in the limit.

Asked for $6500 increase knowing the cap on CLI's is $4K.

It has been a while since I had a CLI on that card. If I don't get anything,

Will wait until December 10th ... and ask on the Flagship.

From Monday, June 8, 2020 (Last Flagship CLI)

Added 6 months >> Result: Tuesday, December 8, 2020

I really hope that I do not get offerd the $500 Navy special on the MoreRewards.

If I do, I will decline it.

Even if they add $4K, I will still be just a little shy of Navy's $80K max exposure / across all CC's.

I will post the outcome.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREAD

@CreditOnTheRise1 wrote:Hi Everyone,

Wanted to share my recent NFCU experience and also ask a couple questions.

Been a NFCU member for 2 years exclusively for banking. My 12th statement cut last week on my Go rewards card. The APR was 18% so I did a secure message through the app and asked for a rate reduction. They came back and said they could do 14.99% but that I had to confirm if I would accept it. I thought the way the response was framed left it open to negotiations so I asked for 9.99%. NFCU came back saying it is against fair credit practices to allow me to negotiate an APR and I have to have the same APR they would offer anyone in my credit profile, etc.

my current Score with EQ9 they show is 701. So I went back and said ok and I'll take the 14.99%.

Question...anyone ever heard of this? As far as not being able to negotiate with APR? NFCU said by taking the APR reduction now then I have to wait 1 year to ask for another one. Or I could decline it, wait a bit longer and see if I got a better APR. I don't carry a balance on a $5500 limit even though it's 1 of 2 of my daily drivers. I spend about 4-5k a month between my 2 NFCU cards.

2nd Question...Closing on a new construction home 12/18(fingers crossed). Right after, think next day lol, I want to apply for a 3rd NFCU card and hoping for at least a $10k starting limit. Already have a Cash rewards limit that's $2400. What's the best card option you think with a 700-710 FICO 8/9 score with EQ and TU? An additional note is that my Go rewards is up for a CLI next month. If I do the CLI first in November then do a new card app the next month is that smart? Or wait the other way around and do the 3rd card app in December then the CLI right after. Not sure if waiting a month between requests changes things.

Thanks for any help/suggestions!

On the APR reduction, it is either take it or leave it. Sorry No negotiating

As far as CLI / New Credit card .. Go for the Credit card first, wait for approval .. then Ask for a CLI on you other card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREAD

@AllZero wrote:

@BmoreBull wrote:@Anonymous I stuck my toe in the pool and the water was just fine. Not entirely pleased with the apr, but I never carry a balance. Now I have to return to the garden until the end of 2021. Thank you for all of the well wishes and good vibes.

Congratulations on your approval! That's a great starting limit on the first card. You probably all ready know, mark your calendar on anniversary of account open to ask for APR reduction.

@AllZero, Sorry, I had posted before I read your post![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREAD

@CreditobsessedinFL wrote:

@Anonymous wrote:

No mine was delayed before reflected after approvalAgreed; mine, my daughter's and my son's took longer than the 24/48 hours and the increase was simply and magically reflected In the overall available balance, no fanfare, no confetti or congratulations.

@CreditobsessedinFL, Great DP's![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREAD

@Anonymous wrote:Just became a member of Navy today, but first a little background. I'm in rebuilding mode with my credit, have settled 3 accounts till now, debt was 41k settled for 17k (citi mc, citi bestbuy, sofi) and 2 others with amex debt was 11k have agreed to pay full ammount to get amex plat card back and have been told I'd also get the optima card too (kinda confusing since it seems to be if you get optima you will not get another account on top of that from reading the forums here) anyways have around 8k left to pay which will be finished in the next 2-3 months.

In the meantime have gotten 3 secured cards from capitol one, discover and tdbank, each with $500 limit. (all in the past 2-3 months)

My fico score 8 as of today are: Eq 632, Tu 653 & Ex 621.

After doing research on the forums and especially this thread I decided to give NFCU a go, called today opened a checking & savings account and applied for CC at the same time, got approved for the cashRewards CC with limit of $1,000, I was expecting to be denied tbh but super happy to be approved and so thankful to all of you for showing me and others the way!!

Now for the future, after 91d/3statements which Navy card would you all suggest I go for? Or would it make sense to wait till those 2 amex cards are paid off and they show 0 balance on the report..

Super excited again with Navy, they seem to be the best!!!

@Anonymous, Congratulations and welcome to the Navy family![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREAD

@Anonymous wrote:I wanted to add my experience for the sake of DPs.

I joined NFCU last week. There was no HP for membership.

I applied and was instantly approved for a credit card with them. It was a HP on TU. I was given a limit of $3000. I was not pleased with this as it was by far my lowest limit. The same day of the approval I sent a message requesting a reconsideration of my SL. A couple of days later I received a message stating that they had raised my limit from $3000 to $10,100. While far from my highest limit, it is a much more usable one.

@Anonymous, Congratulations and welcome to the Navy family

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREAD

@mchang124 wrote:So earlier this week after my statement had posted on my cash rewards card, i decided to go for a CLI. Prior to the CLI, my limit was $2500. in the passed 3 months i've spent only $38 on the card (yes, i said only $38). I requested $10k, they gave me a total credit line of $6500 (a $4k CLI). Not bad considering i barely use the card and i use my Flagship and More Rewards alot more.

no HP for the CLI. Gotta love NFCU!

DP's -

EX Fico 8 740 / TU Fico 8 754 / EQ Fico 9 787 (NFCU still using EQ9 to show your CS on their site)LOL INQ's, have gotten 3 personal cards this year (Flagship, Venture, PenFed Platinum Rewards) and one business card with NFCU (mastercard)

Income: $100k

UTI: 1.28%

Total Overall CL prior to CLI: $117k

Grats on your increase![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREAD

@M_Smart007 wrote:Yesterday Morning requested a CLI on my Amex MoreRewards card, so far no change in the limit.

Asked for $6500 increase knowing the cap on CLI's is $4K.

It has been a while since I had a CLI on that card. If I don't get anything,

Will wait until December 10th ... and ask on the Flagship.

From Monday, June 8, 2020 (Last Flagship CLI)

Added 6 months >> Result: Tuesday, December 8, 2020

I really hope that I do not get offerd the $500 Navy special on the MoreRewards.

If I do, I will decline it.

Even if they add $4K, I will still be just a little shy of Navy's $80K max exposure / across all CC's.

I will post the outcome.

Good Luck! I'll be looking forward to the outcome! I know how much they love you @M_Smart007

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREAD

@Anonymous wrote:@mchang124 nice CLI last time on the FS! It sounds like you got in on the $8K max just before it became $4K for now. Since CLI attempts are every six months after a successful increase I was wondering if you have any plans for a second card?

I actually carry 3 cards (maximum) with NFCU: cash rewards, more rewards and flagship. my Cash Rewards used to be an nRewards secured card that graduated from $200 to $2000, then I requested a CLI 6 months later which brought it up to $2500 and then again recently and bumped that to $6500. My more rewards had started out at $15k (my first 5 figure CC in general) and after 91/3 requested a CLI which i got $23k (pre-covid).

My flagship i got in march of this year, after some spend and my 91/3 requested a CLI and received a total CL of $23k. I had stopped using my flagship cuz i had gotten the C1 Venture card with the 50k bonus and used that card for the passed 5 months. but i have swtiched back to my flagship since i didnt get a CLI on my venture card. I've spent roughly about $4k in the passed 2 months with normal expenses and have already passed my 91/3 since my last CLI. I'm getting ready to request $35k but i know if they give me a CLI, it will be only $4k bringing up my flagship to $27k. which i would be fine with.