- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Navy Federal Thread for CLI and Additional Cards

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Navy Federal Thread for CLI and Additional Cards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

@Anonymous wrote:

The rate is tied to prime. Feds dropped prime .25% so rates went down

LOL! I see! How funny—I have lived in ignorance about this all this time! Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

Hey NFCU'ers Been awhile since i was on as RL has been kicking my butt but I finally have a chance to get in here.

@Anonymous You're getting to be quite the NFCU expert now. ![]()

In my EXP and DP's over the last 2+years with NFCU, this is what i can share as well. As always YMMV.

They operate very differently then any bank and most CU's TBH.

- Navy doesn't need babied. As long as you are PIF or making large payments they are happy. I have seen DP's where someone had 80% util but was making 10-15% TCL payments per month and still got a CLI to 25k.

- As for pulls, 98% of the time EQ9 is used for CLI/loans/CLOC and TU9 is used for new cards. I say 98%, however, as in some rare cases we have seen an EX9 pull (maybe EQ/TU were frozen, which is the common reason for a rare pull) If Navy wants an HP, they will go to the normal channels frist and then the other ones if they are unsccuessful. Expect the HP, be happy if its SP (CLI only, new apps WILL be pulled)

- SL and CLI is very dependant on your profile mostly DTI and history. Most of us with a dirty profile will start out at a 1k card myself included. Recon is not very successful for that, but as the history grows and profile improves then you will see better and better quickly. We have seen CLI take 6 months for some drity profiles as well.

In my situation, i started very dirty. So it took longer to build that history. I didn't get a monster approval until my 3rd card, so second card may not be as large, but they do grow fast, it just takes patience grasshopper. I got 3 cards 91/3 back to back and i'm certain that if i had waited 6 months on my dirty profile, i would have had much larger SL's. Clean profiles or low DTI/high incomes do tend to grow faster.

Can't wait to hear of the success all of you have. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

@Anonymous I don't know about expert overall but I am certainly becoming an expert in getting "no" from them! 😔

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

Key Factors:

Number of open satisfactory accounts that are 24 months or older.

(Plus inquires/new accounts).

All of my open accounts are in good standing. Zero of them are 24 months or older (except my mortgage - which is only showing as a positive account because Chase sold it and the new account is pristine but has the original account opening date)

I’ve seen similar reasons listed from other lenders (regarding age of open revolving accounts-but without the specific 24 months listed).

My oldest account is 23.5 years old. Even with the 30 accounts I’ve opened in 2 years (yes, 30-i didn’t say I was smart), my Average age of accounts is almost 4 years old. Overall age isn’t an issue.

I had planned to close my remaining subprime, fee-vulture cards. But I guess I will let them all have a second birthday before is ax them.

Also interesting-my internal NFCU score dropped from 294 in June to 284 now. That’s expected as my Util and DTI increased during that time and my initial card saw minimal use. But they still tripled my CL on the first card ($700-$2100) and gave me the more rewards at $10k (both of which I’m thrilled with).

Anyway-since the letter specifically mentioned 24 months for open, satisfactory accounts - I figured I would share as I’ve not seen that specific age listed before (and it certainly applies for me).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

Hello For clarification When i am looking for the start date of my 91 days before I apply for my second card am I looking at the date on my first statement that shows when I was charged the fast card fee which is the same day i got approved? it was ordered june 17. so 91 days from that date? Already got 3 statements so thats good. I just want to make sure i am not doing it from the wrong date. Also has anyone been approved for a 2nd card when they made large payments monthly but still have 90% credit usage? Thank you in advance!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

@jago22

Navy doesn't need babied. As long as you are PIF or making large payments they are happy. I have seen DP's where someone had 80% util but was making 10-15% TCL payments per month and still got a CLI to 25k.

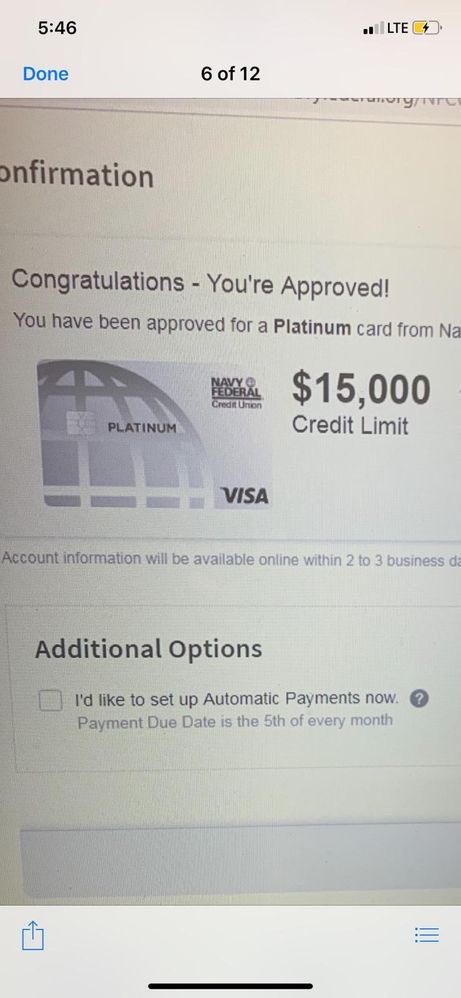

OMG you are so correct My balance on my cash rewad is 8975/9300 I just applied online right now for a second card the platinum and got approved for $15000!!!!!! omg I cant even belive it your post made me apply. THNAK YOU THANK YOU. Navy really does care about relationships. FYI income is 100K and I was making 2000 a month payments and i have hella baddies on my credit (7) omg but i added hella tradelines but my score is like 620. OMG I cant even believe it!! Also they checked transunion!

@Anonymous wrote:Hey NFCU'ers Been awhile since i was on as RL has been kicking my butt but I finally have a chance to get in here.

@Anonymous You're getting to be quite the NFCU expert now.

In my EXP and DP's over the last 2+years with NFCU, this is what i can share as well. As always YMMV.

They operate very differently then any bank and most CU's TBH.

- Navy doesn't need babied. As long as you are PIF or making large payments they are happy. I have seen DP's where someone had 80% util but was making 10-15% TCL payments per month and still got a CLI to 25k.

- As for pulls, 98% of the time EQ9 is used for CLI/loans/CLOC and TU9 is used for new cards. I say 98%, however, as in some rare cases we have seen an EX9 pull (maybe EQ/TU were frozen, which is the common reason for a rare pull) If Navy wants an HP, they will go to the normal channels frist and then the other ones if they are unsccuessful. Expect the HP, be happy if its SP (CLI only, new apps WILL be pulled)

- SL and CLI is very dependant on your profile mostly DTI and history. Most of us with a dirty profile will start out at a 1k card myself included. Recon is not very successful for that, but as the history grows and profile improves then you will see better and better quickly. We have seen CLI take 6 months for some drity profiles as well.

In my situation, i started very dirty. So it took longer to build that history. I didn't get a monster approval until my 3rd card, so second card may not be as large, but they do grow fast, it just takes patience grasshopper. I got 3 cards 91/3 back to back and i'm certain that if i had waited 6 months on my dirty profile, i would have had much larger SL's. Clean profiles or low DTI/high incomes do tend to grow faster.

Can't wait to hear of the success all of you have.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

@Anonymous wrote:@jago22

Navy doesn't need babied. As long as you are PIF or making large payments they are happy. I have seen DP's where someone had 80% util but was making 10-15% TCL payments per month and still got a CLI to 25k.

OMG you are so correct My balance on my cash rewad is 8975/9300 I just applied online right now for a second card the platinum and got approved for $15000!!!!!! omg I cant even belive it your post made me apply. THNAK YOU THANK YOU. Navy really does care about relationships. FYI income is 100K and I was making 2000 a month payments and i have hella baddies on my credit (7) omg but i added hella tradelines but my score is like 620. OMG I cant even believe it!! Also they checked transunion!

@Anonymous wrote:Hey NFCU'ers Been awhile since i was on as RL has been kicking my butt but I finally have a chance to get in here.

@Anonymous You're getting to be quite the NFCU expert now.

In my EXP and DP's over the last 2+years with NFCU, this is what i can share as well. As always YMMV.

They operate very differently then any bank and most CU's TBH.

- Navy doesn't need babied. As long as you are PIF or making large payments they are happy. I have seen DP's where someone had 80% util but was making 10-15% TCL payments per month and still got a CLI to 25k.

- As for pulls, 98% of the time EQ9 is used for CLI/loans/CLOC and TU9 is used for new cards. I say 98%, however, as in some rare cases we have seen an EX9 pull (maybe EQ/TU were frozen, which is the common reason for a rare pull) If Navy wants an HP, they will go to the normal channels frist and then the other ones if they are unsccuessful. Expect the HP, be happy if its SP (CLI only, new apps WILL be pulled)

- SL and CLI is very dependant on your profile mostly DTI and history. Most of us with a dirty profile will start out at a 1k card myself included. Recon is not very successful for that, but as the history grows and profile improves then you will see better and better quickly. We have seen CLI take 6 months for some drity profiles as well.

In my situation, i started very dirty. So it took longer to build that history. I didn't get a monster approval until my 3rd card, so second card may not be as large, but they do grow fast, it just takes patience grasshopper. I got 3 cards 91/3 back to back and i'm certain that if i had waited 6 months on my dirty profile, i would have had much larger SL's. Clean profiles or low DTI/high incomes do tend to grow faster.

Can't wait to hear of the success all of you have.

congratulations on your approval! that is a monster credit line. NFCU is the best credit union in the nation hands down. I'm glad I'm a member. they give me a second chance when no body else would.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

@Anonymous

Congrats.. that is a nice approval and SL. Scores are not that important to Navy, so i'm sure the large payments and 100K income helped more than a 700 score would have. As long as they believe you can repay what you are given, you get alot.

I dont have that much income, and it took till my third card due to my profile, but with history, i was able to get a 15k MR and a 14K CLOC, same day.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

@Anonymous wrote:@Anonymous I don't know about expert overall but I am certainly becoming an expert in getting "no" from them! 😔

Same here. With lower income and how much Navy does give out, i think until i'm clean profile wise, i'm at my maximum with them for now.

As i build more history, i'd say the door will open up again once more.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

@jago22

Thank you so much and I think you are right!! NFCU is theee bomb. Wonder what my third card will be. already excited lmao. Wonder if I should apply for the CLOC?