- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Navy Federal Thread for CLI and Additional Cards

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Navy Federal Thread for CLI and Additional Cards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

@Anonymous wrote:

@swpopham wrote:

@Creditaddict wrote:By popular demand and the fact that when someone posts to the other Navy Federal CLI thread it crashes my "Mail" program I think we should do a new updated one since we hopefully get the $25k request part.

UPDATE:

~ You can no longer move CL's from one account to open a 2nd account that has been denied.

~ Navy seems to be enforcing a new 6 month between CLI policy

~ 6-month policy doesn't apply to getting a 2nd card. Some are having success at just over a month of first card approval

~ New Max button is your friend for CLI requests.

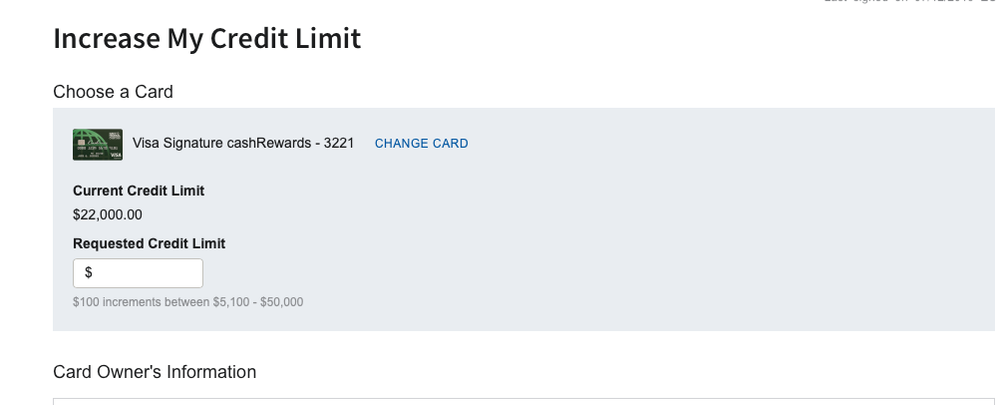

Is this button gone? This is what I see on my side

I do think it is gone. It was there for my first CLI request this fall, but showed me the same limit request box when I apped a week ago.

My CLI Request is still there but it looks different from yours.

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

So I figured last night since my wife was turned down for a CLI (it may have not been 6 months yet since her card graduated and she got the inital CLI) I'd have her try for a 2nd card. She got the usual 24 hour message and we hadn't heard anything this morning. I'm not sure why I can't see the link for checking application status but I found the link for it, put her info in, and saw that it had been approved but she hasn't received a text or email yet and it doesn't show up yet on her Account list.

I took a look at the Offers on her account and see a CLOC. Is this a preapproval for a CLOC or just an ad? We have a checking account under my name that she's a joint owner for and I haven't looked at my offers yet.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

@CreditInspired wrote:

@Anonymous wrote:

@swpopham wrote:

@Creditaddict wrote:By popular demand and the fact that when someone posts to the other Navy Federal CLI thread it crashes my "Mail" program I think we should do a new updated one since we hopefully get the $25k request part.

UPDATE:

~ You can no longer move CL's from one account to open a 2nd account that has been denied.

~ Navy seems to be enforcing a new 6 month between CLI policy

~ 6-month policy doesn't apply to getting a 2nd card. Some are having success at just over a month of first card approval

~ New Max button is your friend for CLI requests.

Is this button gone? This is what I see on my side

I do think it is gone. It was there for my first CLI request this fall, but showed me the same limit request box when I apped a week ago.

My CLI Request is still there but it looks different from yours.

It's after you press the "IncreseMy Credit Limit" hyperlink that you get the page he showed. There used to be a button there to request the maximum amount, but now it makes you enter a specific request in the box.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

Sound advice, yes it’s a large, very large Increase request but I rather not “waste” the HP if I’m alright with a POI. Using them as my main checking account has to help with something maybe.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

@Anonymous wrote:

@CreditInspired wrote:

@Anonymous wrote:

@swpopham wrote:

@Creditaddict wrote:By popular demand and the fact that when someone posts to the other Navy Federal CLI thread it crashes my "Mail" program I think we should do a new updated one since we hopefully get the $25k request part.

UPDATE:

~ You can no longer move CL's from one account to open a 2nd account that has been denied.

~ Navy seems to be enforcing a new 6 month between CLI policy

~ 6-month policy doesn't apply to getting a 2nd card. Some are having success at just over a month of first card approval

~ New Max button is your friend for CLI requests.

Is this button gone? This is what I see on my side

I do think it is gone. It was there for my first CLI request this fall, but showed me the same limit request box when I apped a week ago.

My CLI Request is still there but it looks different from yours.

It's after you press the "IncreseMy Credit Limit" hyperlink that you get the page he showed. There used to be a button there to request the maximum amount, but now it makes you enter a specific request in the box.

When I clicked the link, it requested me to verify my contact info. I just cancelled because I would be some kind of upset if it automatically approved me. I'm in the garden 'til 2020 and I don't want any HPs

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

Ladies & Gentlemen,

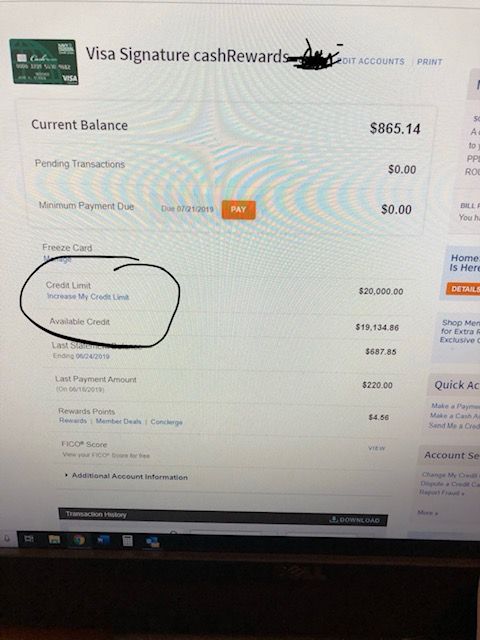

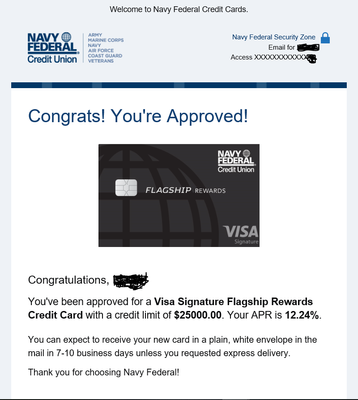

OMG OMG OMG!!! How can I even put what I just experienced a little over an hour ago into perspective or even choose the right words to express the joy that I am filled with? Let me go back to six days ago when my FICO 9 score updated on my app when I decided to request not one, but two CLI's on my two NFCU cards. The requests were about 8 hrs apart from each other and it only used 1 HP. One was for my VS Cash Rewards which had a limit of 6K (opened in Aug 2015 with an initial SL of 5K) and the other one was the Platinum with a SL of 20K (opened in Jan 2019). I submitted a CLI request on both of them for 25K and they were each respectively countered at 13K (VS) and 23.5K (Platinum). Nonetheless, I thought I rolled the dice on those two requests when I submitted them. Especially after having received their counters. Here we are today and after doing some additional reading and educating myself some more, I decided to apply for the NFCU Flagship card. I've had an itch on my fingers for the last six days and I thought to myself what were my chances? Well after hitting the submit button and after the website doing some thinking, the screen changed to the congratulations page. And boy was I elated when I saw that screen. By the way, they pulled my TU credit report for their decision on the Flagship. I have got to say that Navy Federal is freaking amazing!! I love this bank, and I am thankful that they opened their doors to me when I needed someone to finance the car that I'm driving today. I started my relationship with them back in March of 2015 and I will forever be loyal to them!

FICO 8 Starting Score: (2 DEC 17)

FICO 8 Current Score: (27 JAN 21)

FICO 8 Goal Score:

Hover over my cards to see my limits and utilization!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

My wife got approved for a 2nd NFCU card (the Cash Rewards) at a $2500 SL. I'm happy she got this even though I'm confused on why they turned down the CLI request on her existing card. Very strange...

So are CLI requests now a 6 month waiting period and no longer 91/3? Just planning for these cards and getting CLIs for both later on down the line.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

@rdrarmy wrote:Ladies & Gentlemen,

OMG OMG OMG!!! How can I even put what I just experienced a little over an hour ago into perspective or even choose the right words to express the joy that I am filled with? Let me go back to six days ago when my FICO 9 score updated on my app when I decided to request not one, but two CLI's on my two NFCU cards. The requests were about 8 hrs apart from each other and it only used 1 HP. One was for my VS Cash Rewards which had a limit of 6K (opened in Aug 2015 with an initial SL of 5K) and the other one was the Platinum with a SL of 20K (opened in Jan 2019). I submitted a CLI request on both of them for 25K and they were each respectively countered at 13K (VS) and 23.5K (Platinum). Nonetheless, I thought I rolled the dice on those two requests when I submitted them. Especially after having received their counters. Here we are today and after doing some additional reading and educating myself some more, I decided to apply for the NFCU Flagship card. I've had an itch on my fingers for the last six days and I thought to myself what were my chances? Well after hitting the submit button and after the website doing some thinking, the screen changed to the congratulations page. And boy was I elated when I saw that screen. By the way, they pulled my TU credit report for their decision on the Flagship. I have got to say that Navy Federal is freaking amazing!! I love this bank, and I am thankful that they opened their doors to me when I needed someone to finance the car that I'm driving today. I started my relationship with them back in March of 2015 and I will forever be loyal to them!

Congrats!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

FICO 8 Starting Score: (2 DEC 17)

FICO 8 Current Score: (27 JAN 21)

FICO 8 Goal Score:

Hover over my cards to see my limits and utilization!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

How soon after getting approved for a credit card can one apply and get approved for another? I'm just curious; I don't plan on doing that. I'm an AU on my wife's first NFCU card and I just got approved the other day for my own NFCU card.

I'm trying to decide on applying for the CLOC but am not sure what amount to ask for. I tried earlier this year and asked for the full 15k and got a denial. I tried again right after for a much smaller amount and was still denied. I'm wondering now that I have my own NFCU credit card will that change things with trying to get an approval for the CLOC?