- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Need Some Amex Advise

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Need Some Amex Advise

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need Some Amex Advise

Ugh

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need Some Amex Advise

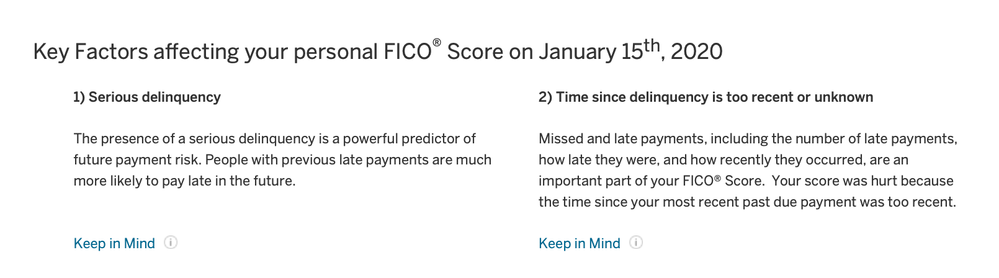

I just checked my "FICO Score Summary" in the Amex portal and this is what I see. I see a score of 652 (updated Jan 15th) and then the messages below that are contributing to my score. But the issue is, I dont have any recent delinquncies. I havent missed payments since CapOne in 2013 which are about to fall off in March of this year. How can that be considered recent? So where is this coming from? I just paid off an old student loan in December 2019 that was in default since March of 2016. Did that report wrong as a recent delinquency? Is a delinquency a missed payment?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need Some Amex Advise

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amex Gold Approval Chances w/ Recent "Lates"

Hi -

I have a recent "late payment" on my Experian report due to a closed student loan reporting wrong. I am in the process of disputing it hard and about to get the CFPB involved. But that is another story...

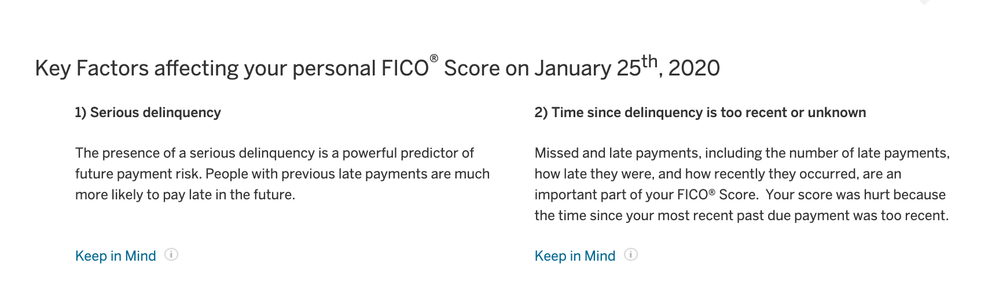

Amex naturally see's this as a "new" or recent delinquency. I am a current Delta Gold customer (since October 2019). Here is what I am wondering: If I fail to get this "late payment" corrected and hit a wall, what does this do to my chances of getting approved for an Amex Gold? How far back does Amex care about lates on your history? (see screenshot below of what it sees now. It is the only negative it sees as I have cleared up everything else). Note: This "delinquency" is recent, from December 2019 and is now 2 months old...and I had gotten approved for the Amex Delta Gold before it showed up. My score then was 635.

Here are data points as of today:

- Experian 669 (I know ONE point away from good)

- UTL 0% to 5%

- Delta Amex Gold: $1000 CL, opened October 2019, pass through around $2500 or so per month and pay in full every few weeks. Swipe every day.

- Discover IT: $1800, 3.5 years old. Very min usage. PIF always before statement cut

- Capital One: $300, Aug 2019. Very small usage and PIF. I guess just use it to show good payment. Score was 635 when approved and had other negative info on my report that has since been cleared up.

- Car payment: exceptional payment history for all auto loans for the last 10 years.

- Student loan from collections paid in full and closed.

So given the above and what Amex shows below and considering everything stays the same and I dont win the battle with the late payment - what are my chances for approval? and or how long am I SOL for? ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Gold Approval Chances w/ Recent "Lates"

@Anonymous

I have restored your thread and merged it into an existing topic that you had already started.

Please do not cross-post or start multiple threads on basically the same subject. It is confusing to other members trying to assist you and is against forum rules.

Thank you for your understanding and cooperation.

-FS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Gold Approval Chances w/ Recent "Lates"

Sorry, I should have continued the old thread given I just figured out what the new delinquency was.

Still learning ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Gold Approval Chances w/ Recent "Lates"

Good luck having the derog removed! Keep us posted!

Last App: BECU 02-26-2020

Pronouns: He/Him/His

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need Some Amex Advise

StephStamper,

You're heading in the right direction. Once you head day 91, try for the 3x CLI. If it get declined, call in for a recon during the week during office hours or early evening. If that doesn't work, check the preapprovals. You should see something within 90 days.

Guyatthebeach