- myFICO® Forums

- Types of Credit

- Credit Card Applications

- PayPal Credit Denied

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

PayPal Credit Denied

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PayPal Credit Denied

I was denied for PayPal Credit, they pulled from Equifax, my Equifax Fico 8 is 645 Utilization 61% with one collection. There was only one inquiry on my Equifax profile in the past year. The thing is they did not ask for full social security number only the last 4, i thought this was a soft pull, as it turns out it is a hard pull and i was denied. Isn't this a FCRA violation or something? This can't be right. No reconsideration line to try and reevaluate , they would not even talk to me about t. Any options? I will definitely dispute, but this does not seem right!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PayPal Credit Denied

Unfortunately, it is not a FCRA violation. So, disputing is going to yield a fruitless effort.

When applying, regardless if the lender prompts for the last 4 digits of your SS# or the full string, you are providing permissible purpose for access to your credit file. PayPal Credit [SYNCB] applications are not SP, even if it only asks for the last 4 of the SS# on the application form.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PayPal Credit Denied

@FinStar wrote:Unfortunately, it is not a FCRA violation. So disputing is going to yield a fruitless effort.

When applying, regardless if the lender prompts for the last 4 digits of your SS# or the full string, you are providing permissible purpose for access to your credit file.

Most soft pulls ask for the last 4 digits so i am somewhat confused, thanks for responding however!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PayPal Credit Denied

I'm sorry you were declined!

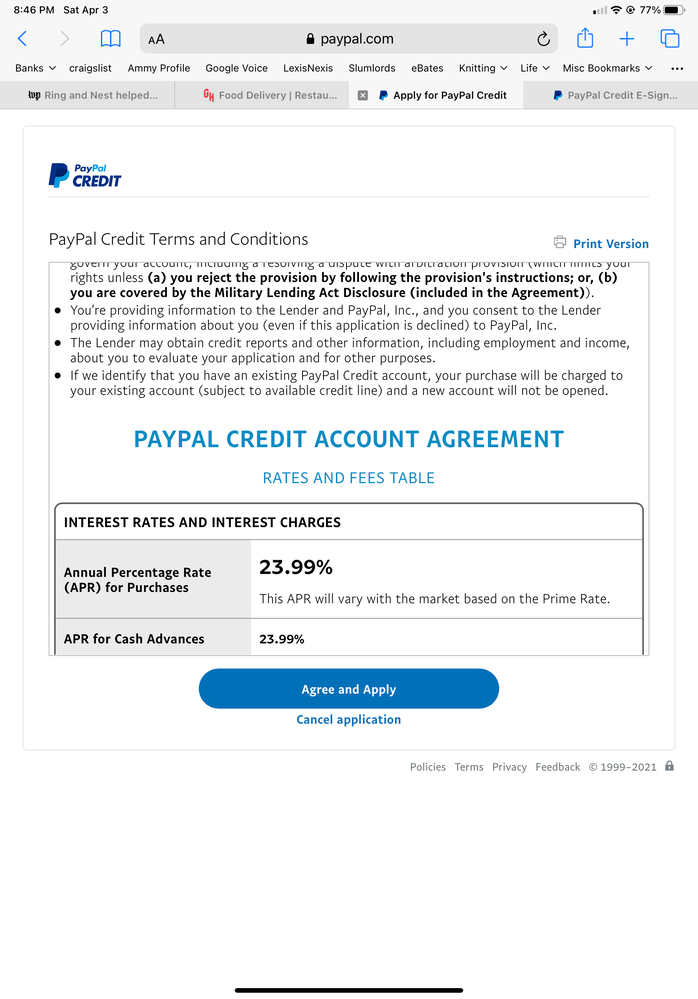

However, the application clearly indicates that you consent to allow PayPal to check credit reports.

Nowhere do they imply it will be a soft pull.

Companies can do a hard pull of your credit reports without having any information about your SSN. All they need is your Name, DOB, and consent. When you clicked the "agree", you gave them consent.

In the grand scheme of things, a hard pull will not impact your credit scores nearly as much as your utilization. If you can get util down to below 50 percent, that will make a much bigger difference on your scores. Likewise, if you let util climb just 9 points, you will see a much larger decline than a single hard pull.

Good luck!

06/15/2019:

03/02/2021:

04/06/2021:

05/28/2021:

Lesson Learned: DON'T POKE THE BEAR!!! THE BEAR WILL WIN!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PayPal Credit Denied

@Chala wrote:I was denied for PayPal Credit, they pulled from Equifax, my Equifax Fico 8 is 645 Utilization 61% with one collection. There was only one inquiry on my Equifax profile in the past year. The thing is they did not ask for full social security number only the last 4, i thought this was a soft pull, as it turns out it is a hard pull and i was denied. Isn't this a FCRA violation or something? This can't be right. No reconsideration line to try and reevaluate , they would not even talk to me about t. Any options? I will definitely dispute, but this does not seem right!

You cannot dispure a valid credit application.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PayPal Credit Denied

@designated_knitter wrote:I'm sorry you were declined!

However, the application clearly indicates that you consent to allow PayPal to check credit reports.

Nowhere do they imply it will be a soft pull.

Compamies can do a hard pull of your credit reports without having any information about your SSN. All they need is your Name, DOB, and consent. When you clicked the "agree", you gave them consent.

In the grand scheme of things, a hard pull will not impact your credit scores nearly as much as your utilization. If you can get util down to below 50 percent, that will make a much bigger difference on your scores. Likewise, if you let util climb just 9 points, you will see a much larger decline than a single hard pull.

Good luck!

You are right DK i did consent. I thank you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PayPal Credit Denied

@Chala wrote:

@FinStar wrote:Unfortunately, it is not a FCRA violation. So disputing is going to yield a fruitless effort.

When applying, regardless if the lender prompts for the last 4 digits of your SS# or the full string, you are providing permissible purpose for access to your credit file.

Most soft pulls ask for the last 4 digits so i am somewhat confused, thanks for responding however!

Not necessarily.

If a lender promtped with a pre-approval or pre-qualified offer and explicitly stated that it will not impact your credit score, then yes. They have to provide that disclaimer. If you accept the offer, then it's usually a HP once you submit the application. SYNCB doesn't operate that way, especially with PayPal Credit. They can match the last 4 of SS# with internal information you've alredy provided in your PayPal account and other particulars such as your DOB, address, etc., with the rest of your credit profile without the need of asking for the full SS# on the application.

There are lenders like Comenity, for instance, who can yield SP on some of their [SCT] credit cards, but outcomes will vary since (a) there is no disclaimer of HP/SP, and (b) data points have shown that even if 4-digits of a SS# was input, individuals have reported a HP after the fact, which is non-disputable.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PayPal Credit Denied

@AverageJoesCredit wrote:You cannot dispure a valid credit application.

You mean your not suposed to :-)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PayPal Credit Denied

@FinStar wrote:

@Chala wrote:

@FinStar wrote:Unfortunately, it is not a FCRA violation. So disputing is going to yield a fruitless effort.

When applying, regardless if the lender prompts for the last 4 digits of your SS# or the full string, you are providing permissible purpose for access to your credit file.

Most soft pulls ask for the last 4 digits so i am somewhat confused, thanks for responding however!

Not necessarily.

If a lender promtped with a pre-approval or pre-qualified offer and explicitly stated that it will not impact your credit score, then yes. They have to provide that disclaimer. If you accept the offer, then it's usually a HP once you submit the application. SYNCB doesn't operate that way, especially with PayPal Credit. They can match the last 4 of SS# with internal information you've alredy provided in your PayPal account and other particulars such as your DOB, address, etc., with the rest of your credit profile without the need of asking for the full SS# on the application.

There are lenders like Comenity, for instance, who can yield SP on some of their [SCT] credit cards, but outcomes will vary since (a) there is no disclaimer of HP/SP, and (b) data points have shown that even if 4-digits of a SS# was input, individuals have reported a HP after the fact, which is non-disputable.

Understood and thank you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PayPal Credit Denied

@Chala wrote:

@AverageJoesCredit wrote:You cannot dispure a valid credit application.

You mean your not suposed to :-)

True! You can dispute anything! I've learned the hard way, though, that they seldom end well! I can't think of one instance where a dispute did me any good!

06/15/2019:

03/02/2021:

04/06/2021:

05/28/2021:

Lesson Learned: DON'T POKE THE BEAR!!! THE BEAR WILL WIN!!!