- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Penfed Denial/Other Recommendations

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Penfed Denial/Other Recommendations

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed Denial/Other Recommendations

@Anonymous Sorry about the denial with PenFed. You should definitely try for recon.

Unfortunately there are lenders that aren't comfortable with short credit histories (they probably discounted your au Cap One account).

Discover was a great suggestion made above. The underwriting on their cards are similar so if you prequal for one, you likely prequal for all of their cards. They have a great cashback match for the first year.

You should check Amex prequals. Amex doesn't mind thin files as much but in this credit environment it can be a challenge.

I do think your scores are good enough for an unsecured card.

I would have suggested Discover, a credit union card, or a secured bank card like Bank of America.

Good luck

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed Denial/Other Recommendations

@AllZero wrote:

@M_Smart007 wrote:

@AllZero wrote:

@BmoreBull wrote:

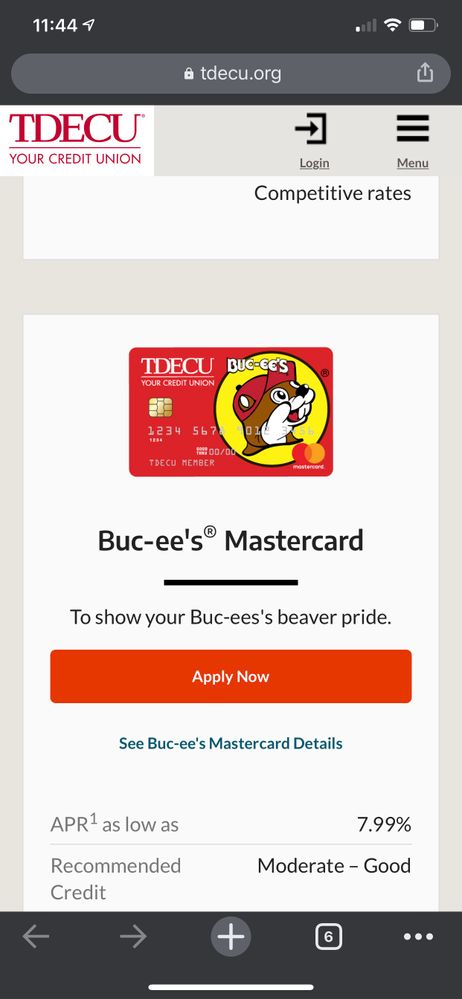

@AllZero wrote:I'm not too familair with them. If you use the search bar for TDECU, it may yield some data points.

There line up doesn't look too bad. You're building or rebuilding your credit profile so you'll have to start off slow. The starter or entry level cards will be a stepping stone to better credit products.

https://www.tdecu.org/compare-all-credit-cards/

I clicked that link that @AllZero provided I must say this image made my day.

I literally lol'd at this. I would carry this card just to see the look on people's faces when I handed it to them.

It's an awesome looking card. Has fun written all over it. 😃

I think @AllZero , should use Buc-ee's pic for His avatar

Here, all cropped and ready to go

@M_Smart007 Thanks! Let me know if this works.

I so love that you took that image!! Now I smile each time I see it!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed Denial/Other Recommendations

Glad you like it. Thanks to @M_Smart007. 😝

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed Denial/Other Recommendations

Well I just received an email back from Penfed & this was their response:

Dear Member,

Unfortunately, your loan application was declined based on the information provided. If you have additional information not provided with the application or if there is incorrect information appearing on your credit report, you may request to have the application reviewed again.

You may submit a request for reconsideration with your explanation and documentation of the incorrect information by email by replying to this email.

Whats yalls take on it?? Seems pretty generic to me considering how personal I guess you could say I made it. I touched up on my 100% payment history & no derogs along with my very decent income & low DTI as @AllZero suggested. They dont even address if they at least tried to consider me for their Gold Visa instead like I asked

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed Denial/Other Recommendations

Maybe thats why I got denied as I just applied for their card without setting up an account to not get hit with 2 inquiries in case I did get denied, which I did lol. But I went into detail about that in my letter as well letting them know I intended to become a member if approved.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed Denial/Other Recommendations

@Anonymous wrote:Maybe thats why I got denied as I just applied for their card without setting up an account to not get hit with 2 inquiries in case I did get denied, which I did lol. But I went into detail about that in my letter as well letting them know I intended to become a member if approved.

@Anonymous Not being a member may have played a part in the denial. I do not know. Current data points suggest that PenFed does not HP for membership. YEMV. Your Experience May Vary.

Moving forward, for your credit profile, I would recommend being a member of a credit union first before you apply for credit.

Have you considered being a member of PenFed?

For your reading pleasure. Pentagon Federal Credit Union Data Share

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed Denial/Other Recommendations

+1

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed Denial/Other Recommendations

If I were the OP and lived near a Buc-ee's (i.e. I might actually stop and get gas there on a regular basis) and I had a membership with the very credit union that sponsors the card, I would probably get the card. No AF and good chance for approval seems like a way to go. It's a unique card, too.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed Denial/Other Recommendations

I actually am a member of a credit union. Ive been banking with TDECU (Texas Dow Employees Credit Union) for 5+ years but the only reason I havent applied for a card with them is because none of their cards offer rewards or cash back other than the now infamous Bucees card that gives you 10 cents off per gallon of gas when you use it to fill up. And yes @sxa001 I have a Bucees literally 2 minutes from my house. Guess that going to be my next card after all lol