- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Penfed Denial w/o successful recon (i think)

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Penfed Denial w/o successful recon (i think)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Penfed Denial w/o successful recon (i think)

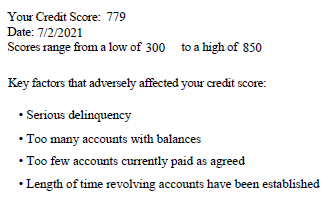

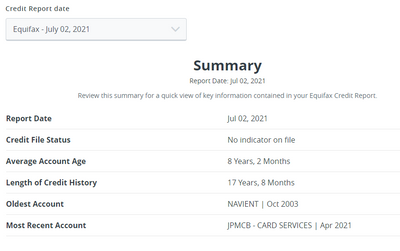

That is from the denial letter that they sent me over the weekend. I called them earlier today and spoke with the customer service rep and the underwriters couldn't do anything because there's a huge delinquincy from 2014. I have quite a bit of lates, but most of them are about 5 years old+. All my accounts have balances, but very small except for my Amex Gold.

Do you think I should call back and hopefully speak to someone else? I don't have access to EQ Fico, but according to their letter, they had me at 779. Also, if someone has the email or phone number, I may be calling the incorrect place.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed Denial w/o successful recon (i think)

What is the huge deficiency?

If you already called requesting a recon and they said no, I doubt calling again will get you a different outcome .

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed Denial w/o successful recon (i think)

Barring some kind of significant error on their part or invalid information they posess, HUCA is very unlikely to lead to a positive outcome. Sorry ![]()

FICO 8 (EX) 846 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed Denial w/o successful recon (i think)

@Jnbmom wrote:What is the huge deficiency?

If you already called requesting a recon and they said no, I doubt calling again will get you a different outcome .

It was a few late payments. I was wreckless with my credit back then, even had collections before that, but all were settled and off of my report now. The problem is, the rep didn't really recon, she mentioned that a recon would result in another hard pull (which I found strange). She just spoke to the underwriter and asked what was the reason why. I haven't had a late payment since roughly 5 years ago. Only 2 new accounts opened in April and May of this year (and one business Amex that is not showing on the report). This was also my 2nd inquiry on Equifax.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed Denial w/o successful recon (i think)

Does anyone have the telephone number that they used to recon with Penfed? I believe the number on the denial letter was just to the main regular customer service line.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed Denial w/o successful recon (i think)

IIRC, there isn't another 'backdoor' number to do so. My understanding is, and others can chime in if things have changed, PenFed would suggest you either send or fax them a letter for your reconsideration request. You can call them again to confirm, but you will not be able to speak to an UW.

In the past, they used to send surveys, which some folks had success with some denials being overturned, but I don't think they send those out anymore (or as much).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed Denial w/o successful recon (i think)

@jcooks As others have mentioned, you can try again but it may not yield a different result. As @FinStar mentioned, there used to be a survey that one could communicate their like (or distaste) for PenFed and that would at least prompt a phone call from someone within. I don' t know if those surveys still exist.

As for a backdoor number, I don't think one ever existed. In past time one would be able to get a CSR to get a UW on the phone but I think that dried up some time ago as well.

You can write a letter if you feel that you want to move forward with having your app reconsidered but I would also caution that it may lead to another inquiry. Sometimes in this hobby you have to choose between turning the page and closing the book.

Best of luck to you in whatever you decide.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed Denial w/o successful recon (i think)

I did call in a 2nd time as the previous CSR wasn't convincing that they even reconsidered. The 2nd CSR said they don't reconsider over the phone. Only way would be to send a secured message online. I pulled all 3 credit bureaus and sent them in as well as a plea for reconsideration.

Are lates worse than bankruptcies and collections? I'm seeing a lot of DPs for approvals with collections and bankruptcies very recently.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed Denial w/o successful recon (i think)

@jcooks wrote:I did call in a 2nd time as the previous CSR wasn't convincing that they even reconsidered. The 2nd CSR said they don't reconsider over the phone. Only way would be to send a secured message online. I pulled all 3 credit bureaus and sent them in as well as a plea for reconsideration.

Are lates worse than bankruptcies and collections? I'm seeing a lot of DPs for approvals with collections and bankruptcies very recently.

Did your reconsideration request have any positive outcome @jcooks?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed Denial w/o successful recon (i think)

I sent a secured upload with all 3 of my CR as well as a small message with my plea. They responded that I need to write a reconsideration letter explaining any discrepancies in the credit report. Of course there weren't any discrepancies, but rather explaining myself. Too many accounts with balances, I showed that most are very low under $100 and explained that I use all my credit cards and utilization is at 1% across all cards. The serious delinquencies, I explained that those were almost 5 years ago and have perfect payment since. They wrote a letter back still denying me. Did they change the underwriting on the cards? A lot of DPs are showing approvals with recent BKs and recent COs also. The most I have is late payments that are falling off within 2 years and only 2 new accounts with 4 new inquiries across all 3 bureaus. 2 are on EQ including the one they pulled.