- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Sync car care CLI

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Sync car care CLI

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sync car care CLI

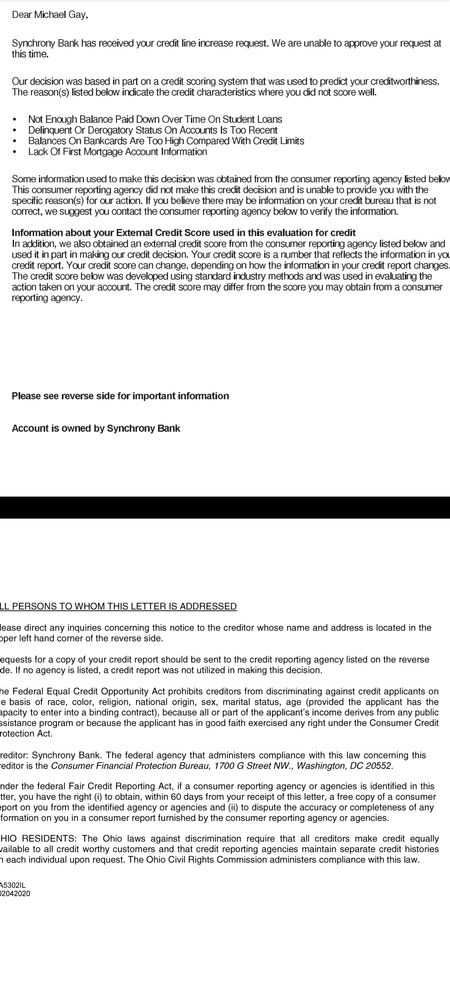

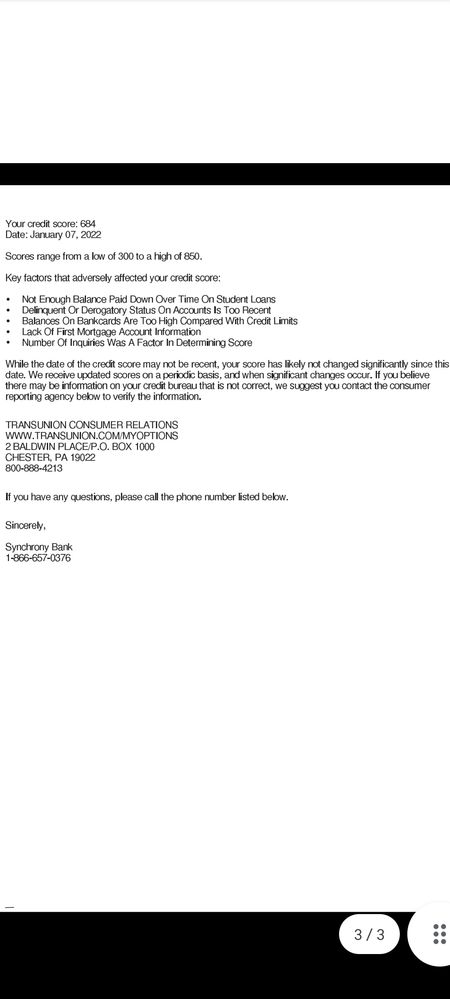

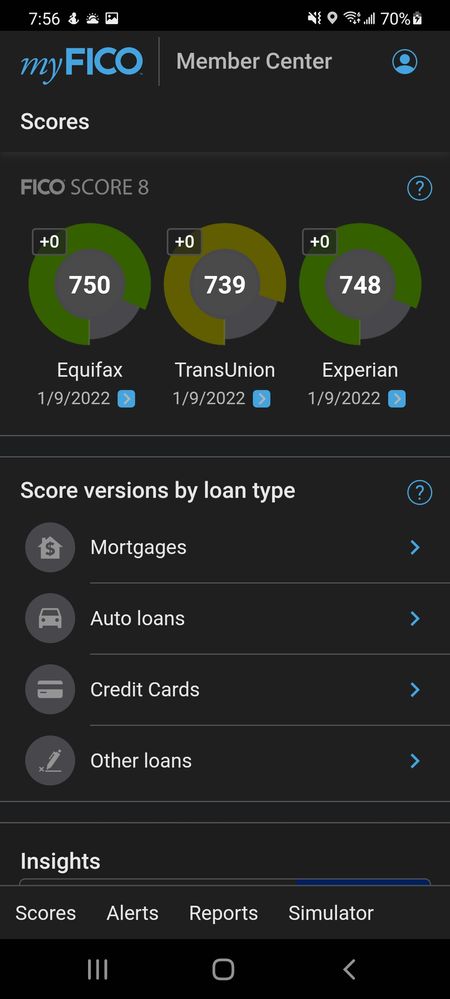

Can someone enlighten me as to what's going on here? What score do they use? Even my vantage score isn't that low... it's at 695. I have 1% util, my student loans are 6k total out of which 2k are paid off, my 1 30 day late is from 2018. I'm pretty sure these are just bs reasons, but why are they claiming my score is low? Only thing that is different is my 2 charge cards reporting a balance of around 13k between the two of them but that hasn't affected my scores at all (I just pulled the scores now and the balanced were reported on the 26th of December)

Edit: I think I answered my question doesn't sync use sagestream or some weird score? I guess they care about my charge cards lol

Discover it cashback: $10900

Citi DC: $13000

WF Propel: closed 2k

Amex BCED: $3000

Amex Gold: $NPSL

Amex Plat: NPSL

Cap1 QS: $3200

Cap1 VX $50k

VS CC: $2900

Kohls: $3000

Synchrony car care: $3000

citi best buy visa: $8500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sync car care CLI

I am sorry about your denial.

With Synchrony and a CLI they do not want to see any recent lates. Your 2018 late is enough for them to do this. If you applied for a NEW card instead it probably would have been approved. It is just how they are. I would wait until that late is at least 4 years old and even then this could happen. As I said, a new credit card with them would be a better option for you.

The UW has a list to choose from, they just pick reasons from that list. They dont have to actually apply to you LOL they just need to pick anything.

Also beware of "poking the bear" it is a term used for Synchrony. Too many CLI requests and they may close all of your accounts. There are many long threads about this being a common practice with them.

Thanks

Mark

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sync car care CLI

@Anonymous wrote:I am sorry about your denial.

With Synchrony and a CLI they do not want to see any recent lates. Your 2018 late is enough for them to do this. If you applied for a NEW card instead it probably would have been approved. It is just how they are. I would wait until that late is at least 4 years old and even then this could happen. As I said, a new credit card with them would be a better option for you.

The UW has a list to choose from, they just pick reasons from that list. They dont have to actually apply to you LOL they just need to pick anything.

Also beware of "poking the bear" it is a term used for Synchrony. Too many CLI requests and they may close all of your accounts. There are many long threads about this being a common practice with them.

Thanks

Mark

It's just funny that I got 2 clis from them last year... when the late was more recent🤣🤣 and if they close it so be it, it's my only account with them and it's pretty useless to me in this day and age. Doesn't earn rewards and I do all the car fixing at the mechanic shop I now own lol.

Discover it cashback: $10900

Citi DC: $13000

WF Propel: closed 2k

Amex BCED: $3000

Amex Gold: $NPSL

Amex Plat: NPSL

Cap1 QS: $3200

Cap1 VX $50k

VS CC: $2900

Kohls: $3000

Synchrony car care: $3000

citi best buy visa: $8500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sync car care CLI

They use vantage score 4.0

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sync car care CLI

Yes they use Vantage score 4.0. Do you have other Synchrony cards and have you bought and made payments on anything since your last CLI request?

3/3/24

3/3/24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sync car care CLI

@Lou-natic wrote:Yes they use Vantage score 4.0. Do you have other Synchrony cards and have you bought and made payments on anything since your last CLI request?

Nope it's my only sync card, if they use vantage that explains why the score is so low, my charge cards reporting tanked my CK scores lol

Discover it cashback: $10900

Citi DC: $13000

WF Propel: closed 2k

Amex BCED: $3000

Amex Gold: $NPSL

Amex Plat: NPSL

Cap1 QS: $3200

Cap1 VX $50k

VS CC: $2900

Kohls: $3000

Synchrony car care: $3000

citi best buy visa: $8500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sync car care CLI

I see, I think at this point you'd be better off closing it anyway to be honest. It served your purpose so time to move on.

3/3/24

3/3/24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sync car care CLI

@Anonymous wrote:I am sorry about your denial.

With Synchrony and a CLI they do not want to see any recent lates. Your 2018 late is enough for them to do this. If you applied for a NEW card instead it probably would have been approved. It is just how they are. I would wait until that late is at least 4 years old and even then this could happen. As I said, a new credit card with them would be a better option for you.

The UW has a list to choose from, they just pick reasons from that list. They dont have to actually apply to you LOL they just need to pick anything.

Also beware of "poking the bear" it is a term used for Synchrony. Too many CLI requests and they may close all of your accounts. There are many long threads about this being a common practice with them.

Thanks

Mark

>/ nfcu platinum 15k, BABY NEEDS NEW SHOES !!!!!

closed-- reflex, applied bank, first digital, mission lane, ikea, fingerhut, big lots, valero gasoline, ollo, more to come

Rebuilding since September 2020

who i burned - chase, cap 1, TD bank, Sync, were the biggies

Income 40k

Total utilization around 20 pct depending on my current usage/needs

Ficos in the 680 - 690 range, the 9's slightly higher than the 8's

My vantage scores 708 - 711

TCL - about 110k

Retired since 2017

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sync car care CLI

@SUPERSQUID wrote:

@Anonymous wrote:I am sorry about your denial.

With Synchrony and a CLI they do not want to see any recent lates. Your 2018 late is enough for them to do this. If you applied for a NEW card instead it probably would have been approved. It is just how they are. I would wait until that late is at least 4 years old and even then this could happen. As I said, a new credit card with them would be a better option for you.

The UW has a list to choose from, they just pick reasons from that list. They dont have to actually apply to you LOL they just need to pick anything.

Also beware of "poking the bear" it is a term used for Synchrony. Too many CLI requests and they may close all of your accounts. There are many long threads about this being a common practice with them.

Thanks

Mark

Well, turns out they didn't like the fact that I put 0 spend on it in the last 6 months lol. put 100$ through the card paid it off and asked for $7500, they told me they could only approve 5k so I'll take what I can get. Not sure if having higher limits really helps anything but hey might as well keep it around for as long as they'll let me and I guess I'll just put some random gas on it from time to time. (sadly no rewards since I applied for the reg car care and not the gas version, is there any way to switch?)

Discover it cashback: $10900

Citi DC: $13000

WF Propel: closed 2k

Amex BCED: $3000

Amex Gold: $NPSL

Amex Plat: NPSL

Cap1 QS: $3200

Cap1 VX $50k

VS CC: $2900

Kohls: $3000

Synchrony car care: $3000

citi best buy visa: $8500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sync car care CLI

@micvite wrote:Well, turns out they didn't like the fact that I put 0 spend on it in the last 6 months lol. put 100$ through the card paid it off and asked for $7500, they told me they could only approve 5k so I'll take what I can get. Not sure if having higher limits really helps anything but hey might as well keep it around for as long as they'll let me and I guess I'll just put some random gas on it from time to time. (sadly no rewards since I applied for the reg car care and not the gas version, is there any way to switch?)

Unfortunately, SYNCB doesn't PC between products.