- myFICO® Forums

- Types of Credit

- Credit Card Applications

- UMB VISA APP DENIED (TOO MUCH CREDIT) EXPERT PLZ C...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

UMB VISA APP DENIED (TOO MUCH CREDIT) EXPERT PLZ COMMENT

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UMB VISA APP DENIED (TOO MUCH CREDIT) EXPERT PLZ COMMENT

Hi All

8/15 -- App Spree UMB Visa was one of my target , received 7-10days msg.

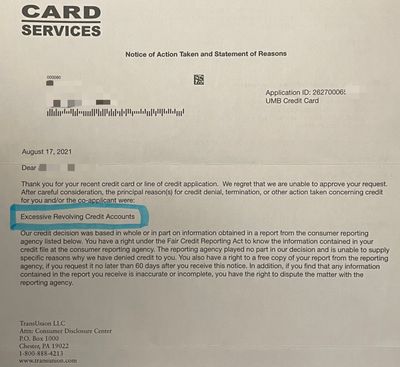

8/17 -- Denied me due to " Excessive Revolving Credit Accounts" as a reason.

(Please see below letter attached)

And I would like to share my personal experience, back to the old days when I had 10-15 cards with $200k TL , during those years every new cards I applied must be $20k $30k starting limit with zero denied.

And once I got up to 23-25 cards with $400TL , I start getting denied or only approved with $3k $6k

Please note for all these times my income , my inquires , my score was nearly the same level nothing changed but just when my cards increasing, TL increasing, it seem more harder and harder to get approved.

I have seen many many many big credit players on this forum have over 30 40 maybe even 50 cards with over $500k $700k and I even saw ppl here have over $1 mil TL , Incase if you are one of the big credit players here May I ask do you have this issue ? the more credit you have the harder to get approved ? Now I even got denied for " Excessive Revolving Credit Accounts"

Some of you might think why do I need that many, Yes I admit Im a credit freak, very addicted with credit cards, from searching for the good one to pull the triger, heart beat for denied or approve , received them in the mail opened them put them in wallet, spend them earn reward and online expereience with the lenders, I just love the whole experience. And slowly it become my hobby. I do use most of them pretty often since I have big family and Im a big spender. Only a few sock drawers.

Any big credit holders please comment, do you also have the downhill period ? And what should we do ? cancel some before apply more ?

Thank you so much for all your comments and help

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: UMB VISA APP DENIED (TOO MUCH CREDIT) EXPERT PLZ COMMENT

This is a common and fairly well-known rejection type from UMB and that has been kind of an underground running joke here on the site.

To give an example there's a thread in the CC forum here going back a couple of years where a number of members who appled were rejected for the DC Power Visa due to "Excessive Revolving Credit Accounts".

When the card was discontinued there were jokes made here along the lines about how all 4 of the people in the world who were approved for it would be disappointed.

FICO 8 (EX) 846 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: UMB VISA APP DENIED (TOO MUCH CREDIT) EXPERT PLZ COMMENT

I have been denied credit by a few lenders for excessive revolving credit. Applied with AOD last year and was approved for only $5k because of the same reason.

INQs: EQ(7) EX(16) TU(8)

Last INQ: 13 Jul 23

Total Credit Limit - $2.0M

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: UMB VISA APP DENIED (TOO MUCH CREDIT) EXPERT PLZ COMMENT

Credit limits have been a topic of interest for me, @Anonymous, so I'll comment. This is based on my personal history over a few decades of credit history along with observing data points on My Fico and comments from other forum members more experienced than myself.

Yes, with the exception of some of our really BIG ($$$) players I've seen, given enough credit-seeking most of us will eventually experience a "downhill period."

- If someone has been applying for a lot of new credit, it can be a short-term problem due to recent new accounts or inquiries. I had high FICO and income but that happened to me last year. If you get low-limit approvals or denials with everything else in order, the problem is probably just excessive recent credit-seeking. The solution for that is just gardening for at least six months to a year if not more, letting everything age.

- However, it can also be a longer-term problem independent of other recent accounts. IMO, that normally boils down to wealth, income, level of spending, debt, and financial stability. Basically, $$$. You could even get that reason with an 850 FICO since FICO scores only go so far in getting approval for new credit or higher limits. Unless you have significant investments with a bank (often somewhere in the six-to-seven figure ranges) or have really large levels of spend-and-pay (reimbursed business expenses for example), your credit limits are usually dictated by your income. And they can also be influenced somewhat by the credit limits you've demonstrated that you can manage successfully. I've seen my credit limits rise substantially in the last decade as my income has also risen. With some lenders (in particular credit unions or smaller more conservative banks), Debt-to-Income can become a major consideration. If your income is high but so are debts, it may detract from your ability to obtain large limits or even approvals.

One of the problems with comparing yourself to others on My Fico is that there is a LOT of secondary information about that person's profile, income, or circumstances that we do not see, even if they post some details in their signature. Some of those on My Fico who have $750K to $1.5M+ credit limits may have very large six-or-seven figure incomes that back that up. And maybe even eight-figure or higher balances in investments. Even with $500K or $1M limits, those members may be at a multiple of less than 1x annual income in credit limits. Meanwhile, someone who makes a median income of around $65K would be at 8x a multiple of income with $500K in credit limits. Add in the debt load and you can see the underwriter raise his eyebrows. ![]() Credit limits are about risk and ability to repay.

Credit limits are about risk and ability to repay.

As @coldfusion, another consideration is that lenders have individual risk tolerance so someone could run into a conservative lender who uses the "excessive credit limits" reason when they might be easily approved by other lenders. So it's not only profile dependent but also lender dependent.

So yes, the "solution" if you run into the longer term problem would be to either go to a different lender, close some cards, and/or voluntarily Credit Limit Decrease (CLD) your existing accounts.

Based on your signature, I show you've got about $469K in TCL on 28 cards for an average of $16,751. I used that metric in the list below. If your income supports those limits with a safe margin and if you share my goal of higher total limits, you might consider focusing on growing your best and most promising cards instead of adding new accounts. If I may make some suggestions, I listed your cards from your signature from lowest-to-highest limit. While you may make a point of using all those cards regularly, consider how much value-added they deliver versus the time cost of using and managing them and whether you could comfortably slim your list. And if you did, which cards would you cut first based on age, credit limit, rewards, APR, fees, lender diversity, payment network diversity, perks or other factors? I purposefully chose to close my lower limit cards and store cards to raise my average limits, simplify my finances, and to leverage my limits between lenders. As part of an overall strategy, it seems to have helped me. My limits are $579K not counting one unlisted AU card, over 20 cards for a current average of $28,950 per card. I like to consider my ACL as well as TCL. Long term, I'd like to raise my average CL even higher and have fewer overall cards to manage, but that's just my preference.

If you were to rank your cards and you have multiple cards earning the same rewards (for example 2% on CITI DC, FNBO Evergreen, PayPal MC, SoFi MC, Apple card, AMEX BBC, Citizens Cash Back Plus 1.8%), consider if some of the overlapping programs could be safely trimmed. In the case of the 2% cards, your Alliant Visa Signature earns up to 2.5% so if you made it your primary card, keeping one or two other 2% cards as a backup might be sufficient.

A few cards stand out on both the high and low ends of your signature. You have some very nice high limit cards of $25K to $40K. ![]() And your low limit cards also stand out, especially on the same list as the better cards.

And your low limit cards also stand out, especially on the same list as the better cards. ![]() I see several cards that appear to be starter cards that, with your profile, you could easily shed such as the "Crab One" secured or the Mercury Mastercard. I see cards that appear to be basic VS/MC credit cards that may not offer rewards and may not be a really good APR. (With your credit scores of 821-830, you should be able to find and qualify for low-APR cards for carrying a balance if needed with rates of well under 10%. If your basic non-rewards VS/MC cards charge more, it may be helpful to close them and replace them with a more competitive card.) That high-limit Bankamericard $40K CL might be able to be converted to a BofA Cash Rewards and combined with your other CR $21.6K card for a $61.6K CL.

I see several cards that appear to be starter cards that, with your profile, you could easily shed such as the "Crab One" secured or the Mercury Mastercard. I see cards that appear to be basic VS/MC credit cards that may not offer rewards and may not be a really good APR. (With your credit scores of 821-830, you should be able to find and qualify for low-APR cards for carrying a balance if needed with rates of well under 10%. If your basic non-rewards VS/MC cards charge more, it may be helpful to close them and replace them with a more competitive card.) That high-limit Bankamericard $40K CL might be able to be converted to a BofA Cash Rewards and combined with your other CR $21.6K card for a $61.6K CL.

Another point about getting CLI approvals on many cards is that they may be slightly (or even heavily) dependent on how heavily you've spent the current CL. As you add more cards and dilute your spending, it's hard to get them to grow. For example, if you have a $25K limit and only put $100 a month on it, that's $1200 a year or less than 5% of the CL. That's another reason that selecting your most valuable cards, pruning as you go, and not overdiluting rewards and spending can help your cards to grow. It's all another manner of the 'gardening' of your cards. The other suggestion is to make sure you're aware of CLI policies with different lenders and that you're taking full advantage of growing your limits. If you focus some heavy spending on that Alliant Signature and Apple Mastercard, there's a good chance they will grow much larger than the current $30K limits. Your American Express cards could also grow very well with heavier spending and CLI requests. Sometimes, I've used a short-term PUSH to get a card to grow with temporary heavier usage for a few months (regardless of rewards) . That worked well with my Capital One Quicksilver and Apple cards, for example.

If your goal is, instead, the sheer number of card accounts instead of high credit limits, I would suggest decreasing the limits substantially on the less valuable cards in your collection so that you have comfortable room to add new accounts. If you're up against the approval limit for new credit based on your finances, that's about all you can do unless you either raise your income or outright close some accounts.

I hope this is all helpful and good luck in whatever direction you choose to take your credit profile!

USB Platium = $2,000

Bank Of The West MC =$3,000

Crab One secured platinum MC= $4500

- - - - - - - - - - - - - - - -

Mercury MC = $6,750

Paypal MC =$8,000

AMEX BCE = $8,800

Ikea Visa =$9,000

BBVA ClearPoints = $10,000

SoFi MC =$10,000

Banc Of California Max Cash =$10,000

- - - - - - - - - - - - - - - -

Citi Thank You = $11,000

Citizen Cash Back+ =$14,400

Synchrony MC =$15,000

FNBO Evergreen =$15,000

* * * AVERAGE CREDIT LIMIT $16,751 * * *

AMEX Blue Business Cash =$17,800

Citizen Clear Value =$18,000

WellsFargo Wise = $20,000

Sams Club MC = $20,000

BoA CashReward = $21,600

Citi DC = $21,000

Total Rewards Visa = $23,000

Discover IT = $24,700

- - - - - - - - - - - - - - - -

USB Cash+ = $25,000

BlockFi Visa =$25,000

Citi Rewards+ = $25,500

Alliant Signature = $30,000

Apple Card = $30,000

BoA Americard = $40,000

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: UMB VISA APP DENIED (TOO MUCH CREDIT) EXPERT PLZ COMMENT

@Aim_High wrote:Credit limits have been a topic of interest for me, @Anonymous, so I'll comment. This is based on my personal history over a few decades of credit history along with observing data points on My Fico and comments from other forum members more experienced than myself.

Yes, with the exception of some of our really BIG ($$$) players I've seen, given enough credit-seeking most of us will eventually experience a "downhill period."

- If someone has been applying for a lot of new credit, it can be a short-term problem due to recent new accounts or inquiries. I had high FICO and income but that happened to me last year. If you get low-limit approvals or denials with everything else in order, the problem is probably just excessive recent credit-seeking. The solution for that is just gardening for at least six months to a year if not more, letting everything age.

- However, it can also be a longer-term problem independent of other recent accounts. IMO, that normally boils down to wealth, income, level of spending, debt, and financial stability. Basically, $$$. You could even get that reason with an 850 FICO since FICO scores only go so far in getting approval for new credit or higher limits. Unless you have significant investments with a bank (often somewhere in the six-to-seven figure ranges) or have really large levels of spend-and-pay (reimbursed business expenses for example), your credit limits are usually dictated by your income. And they can also be influenced somewhat by the credit limits you've demonstrated that you can manage successfully. I've seen my credit limits rise substantially in the last decade as my income has also risen. With some lenders (in particular credit unions or smaller more conservative banks), Debt-to-Income can become a major consideration. If your income is high but so are debts, it may detract from your ability to obtain large limits or even approvals.

One of the problems with comparing yourself to others on My Fico is that there is a LOT of secondary information about that person's profile, income, or circumstances that we do not see, even if they post some details in their signature. Some of those on My Fico who have $750K to $1.5M+ credit limits may have very large six-or-seven figure incomes that back that up. And maybe even eight-figure or higher balances in investments. Even with $500K or $1M limits, those members may be at a multiple of less than 1x annual income in credit limits. Meanwhile, someone who makes a median income of around $65K would be at 8x a multiple of income with $500K in credit limits. Add in the debt load and you can see the underwriter raise his eyebrows.

Credit limits are about risk and ability to repay.

As @coldfusion, another consideration is that lenders have individual risk tolerance so someone could run into a conservative lender who uses the "excessive credit limits" reason when they might be easily approved by other lenders. So it's not only profile dependent but also lender dependent.

So yes, the "solution" if you run into the longer term problem would be to either go to a different lender, close some cards, and/or voluntarily Credit Limit Decrease (CLD) your existing accounts.

Based on your signature, I show you've got about $469K in TCL on 28 cards for an average of $16,751. I used that metric in the list below. If your income supports those limits with a safe margin and if you share my goal of higher total limits, you might consider focusing on growing your best and most promising cards instead of adding new accounts. If I may make some suggestions, I listed your cards from your signature from lowest-to-highest limit. While you may make a point of using all those cards regularly, consider how much value-added they deliver versus the time cost of using and managing them and whether you could comfortably slim your list. And if you did, which cards would you cut first based on age, credit limit, rewards, APR, fees, lender diversity, payment network diversity, perks or other factors? I purposefully chose to close my lower limit cards and store cards to raise my average limits, simplify my finances, and to leverage my limits between lenders. As part of an overall strategy, it seems to have helped me. My limits are $579K not counting one unlisted AU card, over 20 cards for a current average of $28,950 per card. I like to consider my ACL as well as TCL. Long term, I'd like to raise my average CL even higher and have fewer overall cards to manage, but that's just my preference.

If you were to rank your cards and you have multiple cards earning the same rewards (for example 2% on CITI DC, FNBO Evergreen, PayPal MC, SoFi MC, Apple card, AMEX BBC, Citizens Cash Back Plus 1.8%), consider if some of the overlapping programs could be safely trimmed. In the case of the 2% cards, your Alliant Visa Signature earns up to 2.5% so if you made it your primary card, keeping one or two other 2% cards as a backup might be sufficient.

A few cards stand out on both the high and low ends of your signature. You have some very nice high limit cards of $25K to $40K.

And your low limit cards also stand out, especially on the same list as the better cards.

I see several cards that appear to be starter cards that, with your profile, you could easily shed such as the "Crab One" secured or the Mercury Mastercard. I see cards that appear to be basic VS/MC credit cards that may not offer rewards and may not be a really good APR. (With your credit scores of 821-830, you should be able to find and qualify for low-APR cards for carrying a balance if needed with rates of well under 10%. If your basic non-rewards VS/MC cards charge more, it may be helpful to close them and replace them with a more competitive card.) That high-limit Bankamericard $40K CL might be able to be converted to a BofA Cash Rewards and combined with your other CR $21.6K card for a $61.6K CL.

Another point about getting CLI approvals on many cards is that they may be slightly (or even heavily) dependent on how heavily you've spent the current CL. As you add more cards and dilute your spending, it's hard to get them to grow. For example, if you have a $25K limit and only put $100 a month on it, that's $1200 a year or less than 5% of the CL. That's another reason that selecting your most valuable cards, pruning as you go, and not overdiluting rewards and spending can help your cards to grow. It's all another manner of the 'gardening' of your cards. The other suggestion is to make sure you're aware of CLI policies with different lenders and that you're taking full advantage of growing your limits. If you focus some heavy spending on that Alliant Signature and Apple Mastercard, there's a good chance they will grow much larger than the current $30K limits. Your American Express cards could also grow very well with heavier spending and CLI requests. Sometimes, I've used a short-term PUSH to get a card to grow with temporary heavier usage for a few months (regardless of rewards) . That worked well with my Capital One Quicksilver and Apple cards, for example.

If your goal is, instead, the sheer number of card accounts instead of high credit limits, I would suggest decreasing the limits substantially on the less valuable cards in your collection so that you have comfortable room to add new accounts. If you're up against the approval limit for new credit based on your finances, that's about all you can do unless you either raise your income or outright close some accounts.

I hope this is all helpful and good luck in whatever direction you choose to take your credit profile!

USB Platium = $2,000

Bank Of The West MC =$3,000

Crab One secured platinum MC= $4500

- - - - - - - - - - - - - - - -

Mercury MC = $6,750

Paypal MC =$8,000

AMEX BCE = $8,800

Ikea Visa =$9,000

BBVA ClearPoints = $10,000

SoFi MC =$10,000

Banc Of California Max Cash =$10,000

- - - - - - - - - - - - - - - -

Citi Thank You = $11,000Citizen Cash Back+ =$14,400

Synchrony MC =$15,000

FNBO Evergreen =$15,000

* * * AVERAGE CREDIT LIMIT $16,751 * * *

AMEX Blue Business Cash =$17,800

Citizen Clear Value =$18,000

WellsFargo Wise = $20,000

Sams Club MC = $20,000

BoA CashReward = $21,600Citi DC = $21,000

Total Rewards Visa = $23,000

Discover IT = $24,700

- - - - - - - - - - - - - - - -

USB Cash+ = $25,000

BlockFi Visa =$25,000

Citi Rewards+ = $25,500

Alliant Signature = $30,000Apple Card = $30,000

BoA Americard = $40,000

Hi there,

Good Day ! So sorry for such late reply, the day after I posted this thread I left my town for a business trip and just come back home for the long weekend holiday. When I was at the hotel I dont have my fico logon which saved in my computer at home.

I want to say BIG BIG BIG THANKS for your time spent on such detail detail in comment !! And BIG BIG BIG Thanks to you from the bottom of my heart to share the valuable tips especially a deep dive analysis of my current credit accounts. So touching !! Thank you so much so much !!

Yes, I want to have Less cards with higher limit on each because I found once I passed 17 or 18 cards , i started getting denied very often, my last app spree on 8/15 I applied 9 and 5 was approved with 4 Denied. Denied reasons was (Excessive revolving accounts) and (Too Much Available Credit) and Thank you so much so much for your advise I will definitley consider close all the low limit cards. My current Age Of Avg Accounts is 3yrs 9 months, For below Mercury 15yrs history and Crab One 13yrs history, If I close them do you think it will big impact on my age of history ? Thank you once again , Talk to you soon ![]() Have A Great Labor Day Long Weekend !

Have A Great Labor Day Long Weekend !

USB Platium = $2,000 <-------------------------------- I can close it immediately since no perks and I never use it, Disappointed SL only $2K

Bank Of The West MC =$3,000 <--------------------- I can close it immediately very disappointed SL only $3K

Crab One secured platinum MC= $4500 <----------- This one opened 13 yrs ago and Im even paying $5 per monthly fee ( $65 AF)

Mercury MC = $6,750 < -------------------------------- This one opened 15yrs ago originally Juniper Bank transfered to Mercury few yrs back

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: UMB VISA APP DENIED (TOO MUCH CREDIT) EXPERT PLZ COMMENT

@Anonymous wrote:

@Aim_High wrote:Credit limits have been a topic of interest for me, @Anonymous, so I'll comment ...

Hi there,

Good Day ! So sorry for such late reply, the day after I posted this thread I left my town for a business trip and just come back home for the long weekend holiday. When I was at the hotel I dont have my fico logon which saved in my computer at home.

I want to say BIG BIG BIG THANKS for your time spent on such detail detail in comment !! And BIG BIG BIG Thanks to you from the bottom of my heart to share the valuable tips especially a deep dive analysis of my current credit accounts. So touching !! Thank you so much so much !!

Yes, I want to have Less cards with higher limit on each because I found once I passed 17 or 18 cards , i started getting denied very often, my last app spree on 8/15 I applied 9 and 5 was approved with 4 Denied. Denied reasons was (Excessive revolving accounts) and (Too Much Available Credit) and Thank you so much so much for your advise I will definitley consider close all the low limit cards. My current Age Of Avg Accounts is 3yrs 9 months, For below Mercury 15yrs history and Crab One 13yrs history, If I close them do you think it will big impact on my age of history ? Thank you once again , Talk to you soon

Have A Great Labor Day Long Weekend !

USB Platium = $2,000

<- I can close it immediately since no perks

and I never use it, Disappointed SL only $2K

Bank Of The West MC =$3,000

<- I can close it immediately very disappointed

SL only $3K

Crab One secured platinum MC= $4500

<- This one opened 13 yrs ago and Im even

paying $5 per monthly fee ( $65 AF)

Mercury MC = $6,750

<-- This one opened 15yrs ago originally Juniper

Bank transfered to Mercury few yrs back

Glad to hear back, @Anonymous, and that my analysis was helpful.

Typically, when an account is closed it will often still report for up to about ten years so the impact on your age of accounts will be minimized. (*There is not a guarantee, though. There isn't a universal standard so a closed account may stop reporting quickly, may report for five years, ten years or even longer.)

Yes, closing cards of little value due to those factors I mentioned (age, credit limit, rewards, APR, fees, lender diversity, payment network diversity, perks etc) is a great place to start! I would definitely close that "Crab One" card since (1) it has an Monthly/Annual Fee (2) not useful except for age and (3) it's a secured card whose presence detracts from a stronger credit profile. The only caveat I would add is that if the Mercury MC is by-far your oldest card at 15 years, I might consider just sock-drawering it to keep it open for account age a little longer until your other accounts mature since your AAoA is still on the lower side at 3 years 9 months.

Beyond the obvious "low hanging fruit" that we've identified, I think I would take a serious look at anything below the Average CL. Since they have lower limits, what are they contributing to your credit profile in terms of age, rewards, APR, etc? For example, I heard that the BBVA Clear Points was being converted to a less-desirable card for some of members in the merger with PNC. Will it still be a worthwhile card for you after the conversion? Do you shop at IKEA enough to have a dedicated IKEA card? (Store cards can be great if you get enough rewards or organic usage at a chain but may be a poor fit for longer-term usage patterns. In recent years, I've closed many of mine to focus on more general-use cards. I opened some to get special financing on larger purchases, such as furniture, but I closed the accounts after the balance was paid.) I've found that focusing on my most valuable cards has helped them to grow. ![]()

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.