- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: cap 1 prequal good or fake?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

cap 1 prequal good or fake?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

cap 1 prequal good or fake?

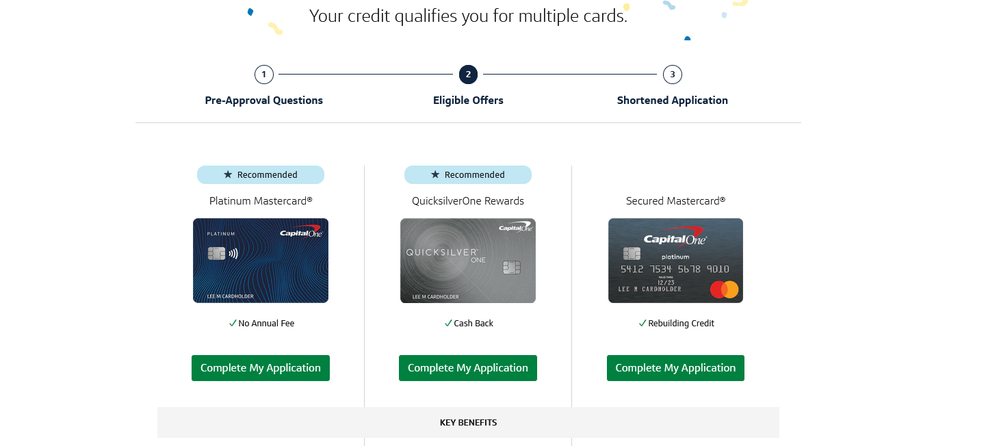

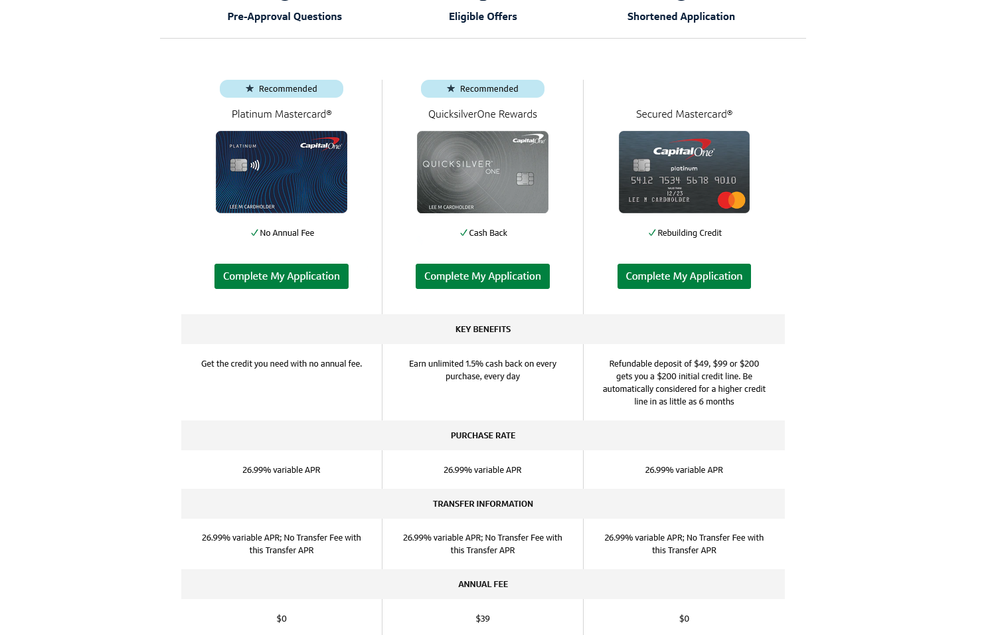

Look at what i was offered. 26.99 percent that is like wow they do not like me.

Is this a good prequal LOL it does not say pre-approved.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: cap 1 prequal good or fake?

Cap1 pre-approvals are fairly solid. 26.99% APR is the single, and only option offered for the cards you are viewing. It would not matter what your profile looked like. If you decide to pull the trigger, expect a HP to all 3 CBs.

FICO 8 Sep '23 EX 755 EQ 765 TU 739

TCL $199,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: cap 1 prequal good or fake?

@Ficoproblems247 wrote:Cap1 pre-approvals are fairly solid. 26.99% APR is the single, and only option offered for the cards you are viewing. It would not matter what your profile looked like. If you decide to pull the trigger, expect a HP to all 3 CBs.

Thanks for the info, is that the only way in the door with cap1? That is a very expensive entry.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: cap 1 prequal good or fake?

@Anonymous wrote:

@Ficoproblems247 wrote:Cap1 pre-approvals are fairly solid. 26.99% APR is the single, and only option offered for the cards you are viewing. It would not matter what your profile looked like. If you decide to pull the trigger, expect a HP to all 3 CBs.

Thanks for the info, is that the only way in the door with cap1? That is a very expensive entry.

As far as "the only way in the door," I am assuming you mean the 3 HPs, rather than only through those cards they offered. If that is the case, then yes, Cap1 will HP all 3 bureaus for any card you apply for almost 100% of the time. If you are referring to the cards that they offered, you could always apply for one of their other offerings if you feel that a different reward structure better suits your spend. If it were me, and I were set on applying for a Cap1 card I would apply for the Platinum. There have been a good number of decent approvals for that card rolling through lately, and you will almost certainly be able to PC it to a no AF Quicksilver that will earn cash back after having the card for 100-180 days. The QS1 they offered you has an AF, and is notoriously hard to change to any card of theirs that does not have one. Just my 2 pennies. Good luck should you chose to apply and keep us posted as to the outcome.

FICO 8 Sep '23 EX 755 EQ 765 TU 739

TCL $199,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: cap 1 prequal good or fake?

@Ficoproblems247 wrote:

@Anonymous wrote:

@Ficoproblems247 wrote:Cap1 pre-approvals are fairly solid. 26.99% APR is the single, and only option offered for the cards you are viewing. It would not matter what your profile looked like. If you decide to pull the trigger, expect a HP to all 3 CBs.

Thanks for the info, is that the only way in the door with cap1? That is a very expensive entry.

As far as "the only way in the door," I am assuming you mean the 3 HPs, rather than only through those cards they offered. If that is the case, then yes, Cap1 will HP all 3 bureaus for any card you apply for almost 100% of the time. If you are referring to the cards that they offered, you could always apply for one of their other offerings if you feel that a different reward structure better suits your spend. If it were me, and I were set on applying for a Cap1 card I would apply for the Platinum. There have been a good number of decent approvals for that card rolling through lately, and you will almost certainly be able to PC it to a no AF Quicksilver that will earn cash back after having the card for 100-180 days. The QS1 they offered you has an AF, and is notoriously hard to change to any card of theirs that does not have one. Just my 2 pennies. Good luck should you chose to apply and keep us posted as to the outcome.

Them some good valued pennies. The interest rate on the card appeared to be to high for my blood. I was wondering how to get a lower starting interest rate. Even though I never really carry a balance, I am just concerned of how high that pre qualification came in at. Thank you for the DP's I would have never known which card is best.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: cap 1 prequal good or fake?

@Anonymous wrote:

@Ficoproblems247 wrote:

@Anonymous wrote:

@Ficoproblems247 wrote:Cap1 pre-approvals are fairly solid. 26.99% APR is the single, and only option offered for the cards you are viewing. It would not matter what your profile looked like. If you decide to pull the trigger, expect a HP to all 3 CBs.

Thanks for the info, is that the only way in the door with cap1? That is a very expensive entry.

As far as "the only way in the door," I am assuming you mean the 3 HPs, rather than only through those cards they offered. If that is the case, then yes, Cap1 will HP all 3 bureaus for any card you apply for almost 100% of the time. If you are referring to the cards that they offered, you could always apply for one of their other offerings if you feel that a different reward structure better suits your spend. If it were me, and I were set on applying for a Cap1 card I would apply for the Platinum. There have been a good number of decent approvals for that card rolling through lately, and you will almost certainly be able to PC it to a no AF Quicksilver that will earn cash back after having the card for 100-180 days. The QS1 they offered you has an AF, and is notoriously hard to change to any card of theirs that does not have one. Just my 2 pennies. Good luck should you chose to apply and keep us posted as to the outcome.

Them some good valued pennies. The interest rate on the card appeared to be to high for my blood. I was wondering how to get a lower starting interest rate. Even though I never really carry a balance, I am just concerned of how high that pre qualification came in at. Thank you for the DP's I would have never known which card is best.

If you don't carry a balance, interest rate shouldn't matter. That would negate any rewards earned anyway. Also, as @Ficoproblems247 said, the 26.99% interest rate isn't a reflection of your creditworthiness by any means - it's literally the *only* rate they offer on their subprime cards.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: cap 1 prequal good or fake?

@OmarGB9 wrote:

@Anonymous wrote:

@Ficoproblems247 wrote:

@Anonymous wrote:

@Ficoproblems247 wrote:Cap1 pre-approvals are fairly solid. 26.99% APR is the single, and only option offered for the cards you are viewing. It would not matter what your profile looked like. If you decide to pull the trigger, expect a HP to all 3 CBs.

Thanks for the info, is that the only way in the door with cap1? That is a very expensive entry.

As far as "the only way in the door," I am assuming you mean the 3 HPs, rather than only through those cards they offered. If that is the case, then yes, Cap1 will HP all 3 bureaus for any card you apply for almost 100% of the time. If you are referring to the cards that they offered, you could always apply for one of their other offerings if you feel that a different reward structure better suits your spend. If it were me, and I were set on applying for a Cap1 card I would apply for the Platinum. There have been a good number of decent approvals for that card rolling through lately, and you will almost certainly be able to PC it to a no AF Quicksilver that will earn cash back after having the card for 100-180 days. The QS1 they offered you has an AF, and is notoriously hard to change to any card of theirs that does not have one. Just my 2 pennies. Good luck should you chose to apply and keep us posted as to the outcome.

Them some good valued pennies. The interest rate on the card appeared to be to high for my blood. I was wondering how to get a lower starting interest rate. Even though I never really carry a balance, I am just concerned of how high that pre qualification came in at. Thank you for the DP's I would have never known which card is best.

If you don't carry a balance, interest rate shouldn't matter. That would negate any rewards earned anyway. Also, as @Ficoproblems247 said, the 26.99% interest rate isn't a reflection of your creditworthiness by any means - it's literally the *only* rate they offer on their subprime cards.

That is good to know. I do not carry balances so you are right it would not matter. I hope that I could PC in the future and it would provide me a lower rate. I do not want cards that do not grow. They are pretty much a waste of time and my financial resources.