- myFICO® Forums

- Types of Credit

- Credit Card Applications

- drat, let’s say a PRG holder get denied for an ED ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

drat, let’s say a PRG holder get denied for an ED @ 25K…

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

drat, let’s say a PRG holder get denied for an ED @ 25K…

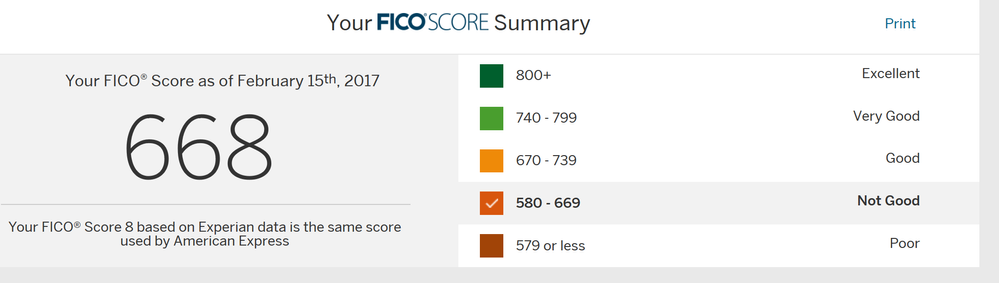

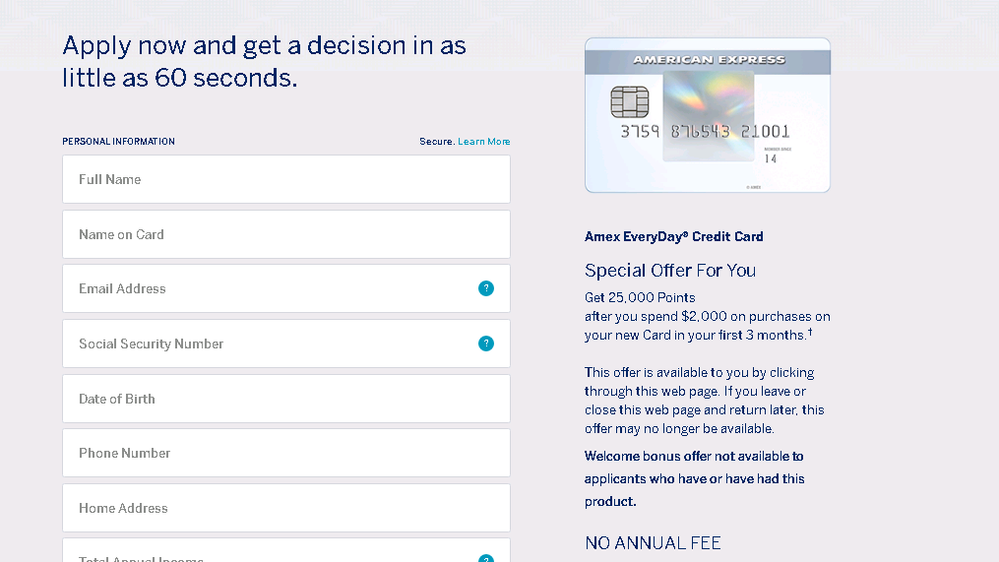

I was messing around with incognito yesterday and up popped a 25K offer. As I will probably not be keeping my PRG and wanted something to store my points with + keep the nostalgia going so I jumped without thinking. My AX fico has not refreshed to my current 685 and instead showed a 668. I got an instant denial for I am assuming that and a bunch of other stuff – see below. As a backstory, except for the C1 all my current credit is from 3/16 on and there is also a CSP app in the mix from last month that I used for bonus, cl and a sapphire/fu pc. also a $63K penfed car loan in 10/16. My PRG score from 3/17 was 674. I essentially did a quick rebuild because, well, that is just the way it turned out.

So I guess the good news is that it only cost me a SP or at least nothing has showed so far on CCT.

My questions are simple:

can I try again after my score is current, is there any max an individual can do this if they are a current cardholder? I don’t mind an hp but only if I get something in return.

Will the result probably still be a denial – a 685 more than the 674 that I had a year ago for the PRG but I have heard that AX revolvers can be something tricky to get sometimes and my personal belief is that AX basically gives away charge cards which is one reason I got the PRG.

To fill in the blanks, my EX oldest account 12.3 year(s) and my average account age 2.3 year(s). I have a single bad, a ~$16K CO that will fall off this year – I tried to PFD but Cavalry would not play ball. I also have some tax related PRs. I always PIF, never late and always report <1%. EDIT: 6 EX inquiries, 3 from a year ago - # will be 2 in 4 more days

Any thoughts on the matter would be most welcome. Thank you.

Risk score not available due to report of deceased status.

Length of time consumer finance company loans have been established

Length of time accounts have been established.

Too many inquiries in the last 12 months.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: drat, let’s say a PRG holder get denied for an ED @ 25K…

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: drat, let’s say a PRG holder get denied for an ED @ 25K…

@Aduke1122 wrote:

I have gotten those two reason lately , started my rebuild in Feb of last year and it moved fast . Guess it's time to sit in the garden for me . Sorry about the denial

hey, for what card and which reasons? not science by any means but I was looking at the credit pull db and the sl's for <700 are awful for the everyday - I know, its more than just scores but I am thinking of just waiting and asking retention to downgrade me to a green. the only thing I want is to store my MRs and ticket pre-sales to events. buyer protection & car insurance sounds nice but I will seldom if ever use an AX card to benefit from these features. then again 25K in points lol

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: drat, let’s say a PRG holder get denied for an ED @ 25K…

@bourgogne wrote:I was messing around with incognito yesterday and up popped a 25K offer. As I will probably not be keeping my PRG and wanted something to store my points with + keep the nostalgia going so I jumped without thinking. My AX fico has not refreshed to my current 685 and instead showed a 668. I got an instant denial for I am assuming that and a bunch of other stuff – see below. As a backstory, except for the C1 all my current credit is from 3/16 on and there is also a CSP app in the mix from last month that I used for bonus, cl and a sapphire/fu pc. also a $63K penfed car loan in 10/16. My PRG score from 3/17 was 674. I essentially did a quick rebuild because, well, that is just the way it turned out.

So I guess the good news is that it only cost me a SP or at least nothing has showed so far on CCT.

My questions are simple:

can I try again after my score is current, is there any max an individual can do this if they are a current cardholder? I don’t mind an hp but only if I get something in return.

Will the result probably still be a denial – a 685 more than the 674 that I had a year ago for the PRG but I have heard that AX revolvers can be something tricky to get sometimes and my personal belief is that AX basically gives away charge cards which is one reason I got the PRG.

To fill in the blanks, my EX oldest account 12.3 year(s) and my average account age 2.3 year(s). I have a single bad, a ~$16K CO that will fall off this year – I tried to PFD but Cavalry would not play ball. I also have some tax related PRs. I always PIF, never late and always report <1%. EDIT: 6 EX inquiries, 3 from a year ago - # will be 2 in 4 more days

Any thoughts on the matter would be most welcome. Thank you.

Risk score not available due to report of deceased status.

Length of time consumer finance company loans have been established

Length of time accounts have been established.

Too many inquiries in the last 12 months.

Risk score not available due to report of deceased status.

You have some work to do - My advice would be to pull a full copy of every report available to you and start disputing that. Of course you should pull the big three:

Experian

Equifax

Transunion

But you should also pull the 'Lesser bureaus' for something like this:

Chexsystems

Early Warning System

Lexis-Nexis

Innovis

Having a report of you being dead can get you denied for all sorts of things...best to start now to get rid of that

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: drat, let’s say a PRG holder get denied for an ED @ 25K…

@Anonymous wrote:

@bourgogne wrote:I was messing around with incognito yesterday and up popped a 25K offer. As I will probably not be keeping my PRG and wanted something to store my points with + keep the nostalgia going so I jumped without thinking. My AX fico has not refreshed to my current 685 and instead showed a 668. I got an instant denial for I am assuming that and a bunch of other stuff – see below. As a backstory, except for the C1 all my current credit is from 3/16 on and there is also a CSP app in the mix from last month that I used for bonus, cl and a sapphire/fu pc. also a $63K penfed car loan in 10/16. My PRG score from 3/17 was 674. I essentially did a quick rebuild because, well, that is just the way it turned out.

So I guess the good news is that it only cost me a SP or at least nothing has showed so far on CCT.

My questions are simple:

can I try again after my score is current, is there any max an individual can do this if they are a current cardholder? I don’t mind an hp but only if I get something in return.

Will the result probably still be a denial – a 685 more than the 674 that I had a year ago for the PRG but I have heard that AX revolvers can be something tricky to get sometimes and my personal belief is that AX basically gives away charge cards which is one reason I got the PRG.

To fill in the blanks, my EX oldest account 12.3 year(s) and my average account age 2.3 year(s). I have a single bad, a ~$16K CO that will fall off this year – I tried to PFD but Cavalry would not play ball. I also have some tax related PRs. I always PIF, never late and always report <1%. EDIT: 6 EX inquiries, 3 from a year ago - # will be 2 in 4 more days

Any thoughts on the matter would be most welcome. Thank you.

Risk score not available due to report of deceased status.

Length of time consumer finance company loans have been established

Length of time accounts have been established.

Too many inquiries in the last 12 months.

Risk score not available due to report of deceased status.

You have some work to do - My advice would be to pull a full copy of every report available to you and start disputing that. Of course you should pull the big three:

Experian

Equifax

Transunion

But you should also pull the 'Lesser bureaus' for something like this:

Chexsystems

Early Warning System

Lexis-Nexis

Innovis

Having a report of you being dead can get you denied for all sorts of things...best to start now to get rid of that

okay, 1st off that is an impressive catch - thank you very much. I thought it said decreased not deceased. 2nd **bleep**! I mean really, how can this be? my CCT shows that I am alive and they all keep sending me bills so I must be alive! ha-ha, I got a PRG. makes no sense, is this a glitch? I would imagine that could be a slight problem lol

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: drat, let’s say a PRG holder get denied for an ED @ 25K…

It's obviously a glitch, given the fact that you and I are having this conversation ![]()

That said, fixing said glitch can be a serious PITA - I wish you the best of luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: drat, let’s say a PRG holder get denied for an ED @ 25K…

@Anonymous wrote:It's obviously a glitch, given the fact that you and I are having this conversation

That said, fixing said glitch can be a serious PITA - I wish you the best of luck!

lol keep the day job...still amazed that you caught this. if amex only pulls ex how hard can this be? I have recent cards from the past year, am I getting lower CLs because I am dead and my spending is way down ha-ha...I mean really, what next. this has to be somehow tied to trump, i can feel it

| 9001 | XPN/FAIR ISAAC SCORE NOT AVAILABLE DUE TO REPORT OF "DECEASED" STATUS | The profile report contains a subscriber transaction with a status code of "21" or an association code of "X", indicating the consumer is deceased. |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: drat, let’s say a PRG holder get denied for an ED @ 25K…

It would seem you are not alone in your untimely and greatly exaggerated demise:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: drat, let’s say a PRG holder get denied for an ED @ 25K…

@Anonymous wrote:It would seem you are not alone in your untimely and greatly exaggerated demise:

unreal, so its not enough that I have crappy scores and credit, now I am getting denied because I am dead. you cannot make this stuff up. I will contact ex and have their db dept look into it further. sounds like a code just got mixed it my profile somewhere. I think ax pulls in a few different models which is why this might have happened but never bothered chase for example. seriously, I owe you one I would have never caught this. I can tell from your posts that you are very astute/bright. so who knows, maybe I do have a shot at this card afterall

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content